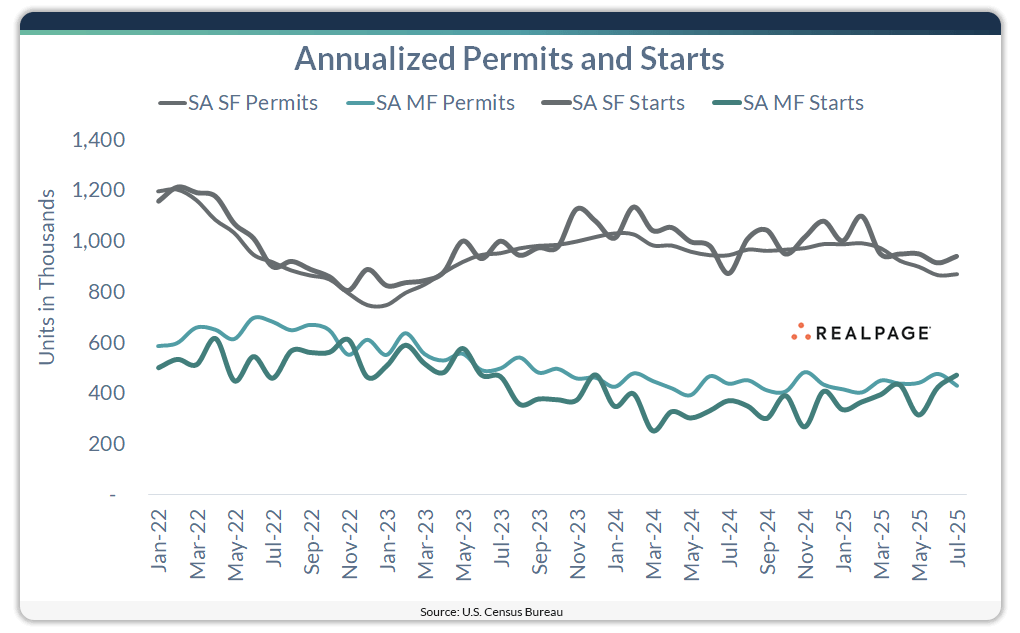

- Multifamily construction is gaining momentum, with July’s SAAR jumping 11.6% month-over-month and 27.4% year-over-year—the highest level since December 2023.

- Single-family starts increased modestly, but have averaged a plateau of about 940K units over the past five months, below early 2024 levels.

- Permitting trends point to a slowdown ahead, particularly for multifamily, where July’s permitting rate dropped 9.9% from June.

- Completions and units under construction declined, indicating potential future supply constraints amid rising demand.

A Mixed Picture For Residential Construction

In July, the seasonally adjusted annual rate (SAAR) for total residential starts rose 5.2% from the previous month, reports RealPage. Compared to July of last year, the rate increased by 12.9%. The total SAAR reached 1.428M units. But under the surface, the dynamics between multifamily and single-family construction are shifting.

Multifamily Starts Surge—But Permits Lag

Multifamily starts increased to 470K units in July—up 11.6% month-over-month and 27.4% year-over-year. It’s the strongest pace since December 2023, and a significant improvement over the 14-month average of 338K units from January 2024 to February 2025.

However, the forward-looking data tells a different story. Multifamily permitting dropped nearly 10% from June and is down 1.8% annually to 430K units. The July starts surge likely reflects the elevated permitting activity seen in June, which hit 477K units.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Single-Family Construction Levels Off

Single-family starts rose 2.8% month-over-month and 7.8% year-over-year to a SAAR of 939K units. But recent trends suggest stagnation. Starts have hovered around this level for five consecutive months, down from a 1M unit average earlier this year.

Permitting tells a similar story: Single-family permits fell to 870K units in July, down 8% from a year ago and flat compared to June. Developers continue to face headwinds including economic uncertainty, elevated mortgage rates, and construction cost pressures tied to tariffs.

Construction Pipeline Shows Signs Of Cooling

Despite the uptick in starts, the number of units under construction is falling. Multifamily units under construction fell 19.4% year-over-year to 716K, while single-family units declined 3.7% to 621K.

Completions also trended downward: Multifamily completions fell 29% year-over-year to 385K units. Single-family completions dropped 6.1% to 1.022M units. However, single-family completions were up 11.6% compared to June.

Regional Trends: Midwest Leads Multifamily Growth

Multifamily activity was strongest in the Midwest, where annualized starts surged 173.2% to 122K units. The South also saw a robust 54% increase. In contrast, starts fell 52.4% in the Northeast and 16.1% in the West.

Permitting trends were more subdued. Year-over-year, only the Midwest posted an increase in multifamily permits (up 33.1%), while the West, Northeast, and South all declined.

Why It Matters

As affordability challenges mount, developers are increasingly turning to multifamily projects—particularly in regions with growing renter demand. However, the dip in new permits suggests this momentum may be short-lived unless macroeconomic and policy conditions improve.

What’s Next

Expect single-family construction to remain flat or soften further unless mortgage rates ease significantly. Multifamily may see near-term gains from recent permitting surges but could taper off if new permits remain subdued. The direction of future residential supply will hinge on economic confidence, rate stability, and local permitting conditions.