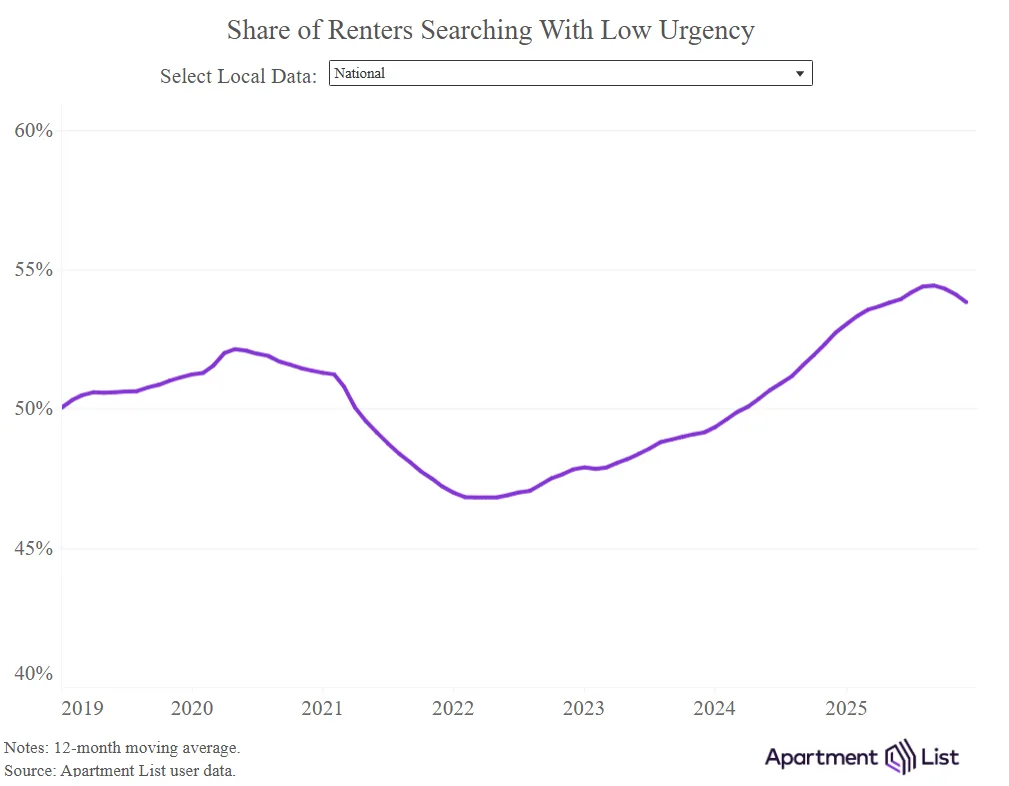

- Renter urgency hit a post-pandemic low in 2025 but showed signs of rebounding in late 2025.

- Low urgency renters peaked at 54.4% nationally, reflecting soft market conditions and high vacancy.

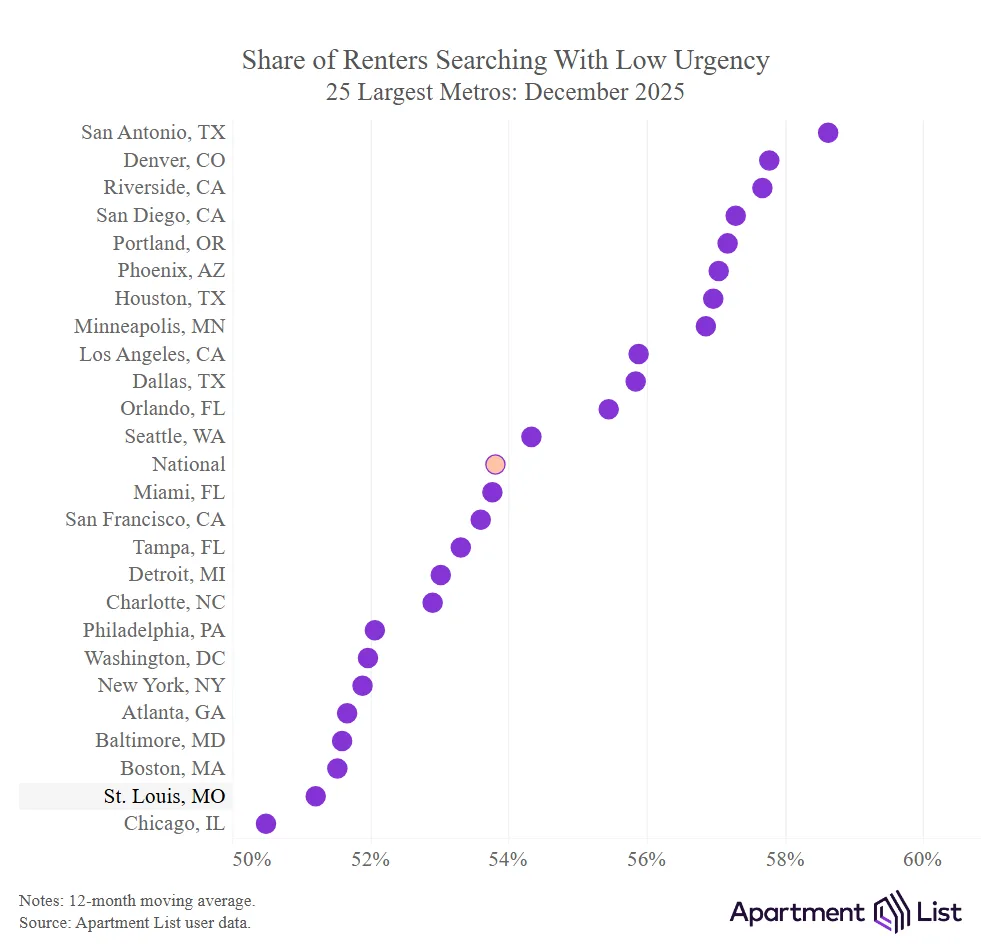

- Sun Belt markets saw the least urgency due to abundant new supply, while Northeast and Midwest metros like Chicago showed higher urgency.

- An uptick in renter urgency may signal a future tightening of rental market conditions.

Renter Urgency at a Turning Point

The US rental market has seen a notable decline in renter urgency over the past three years, driven by rising multifamily vacancies and falling rents. According to Apartment List survey data, the share of ‘low urgency’ renters—those in no hurry to move—reached a high of 54.4% in September 2025. However, this trend reversed in the last quarter of 2025, offering a potential early signal that renter urgency could be recovering.

Soft Markets See Least Urgency

Market-level data reveal clear geographic patterns. Sun Belt cities such as San Antonio, Phoenix, and Denver reported the highest share of low urgency renters, correlating with elevated vacancy rates and significant rent declines. These trends reflect broader national conditions, where an oversupply of units has continued to push vacancies to record highs and rents further downward. For example, San Antonio posted a 4.7% rent drop and a 9.5% vacancy rate, with 58.6% of renters in no rush to move. In contrast, tighter markets in the Northeast and Midwest, such as Chicago and Boston, showed more urgency among renters and stronger rent growth.

Link to Market Fundamentals

Apartment List’s data shows that renter urgency moves with both local supply and seasonal patterns. Renters tend to be more urgent during peak summer months and in metros with less new construction. In soft markets, property owners compete for tenants, granting renters more time to decide. Conversely, tighter supply leads to more urgent searches and higher budgets among renters seeking faster move-ins.

Possible Market Shift Ahead

Although rents continue to fall nationally and vacancies remain historically high, the supply surge is tapering. If the uptick in renter urgency persists, it could foreshadow rising demand and tighter conditions later in 2026 as the wave of new deliveries slows. The next few quarters will be critical for assessing whether this shift in renter urgency marks the start of a new cycle in the US rental market.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes