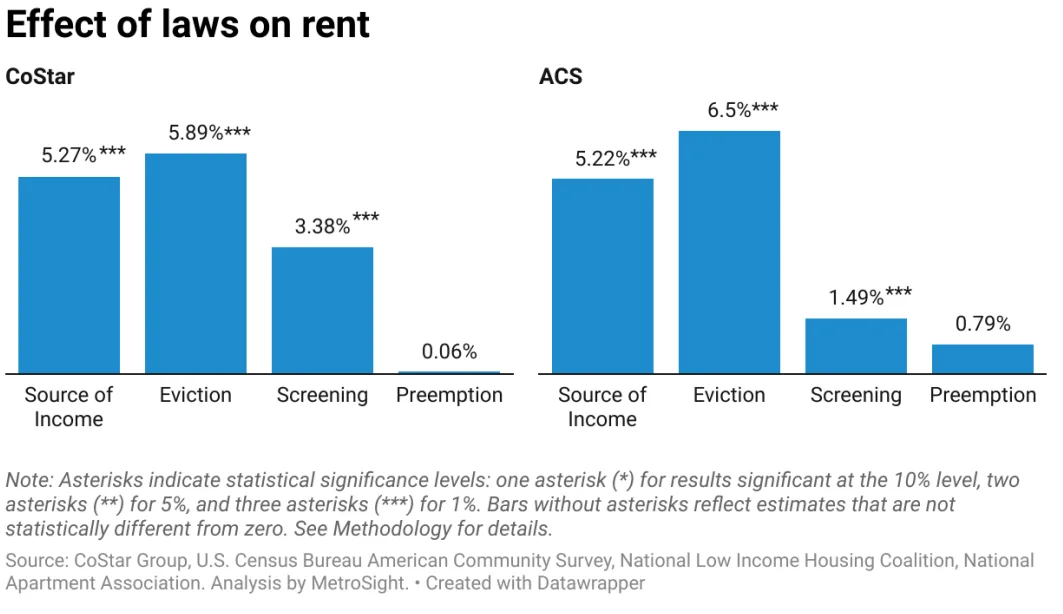

- Source-of-income protections, eviction regulations, and resident screening restrictions each drove statistically significant rent increases.

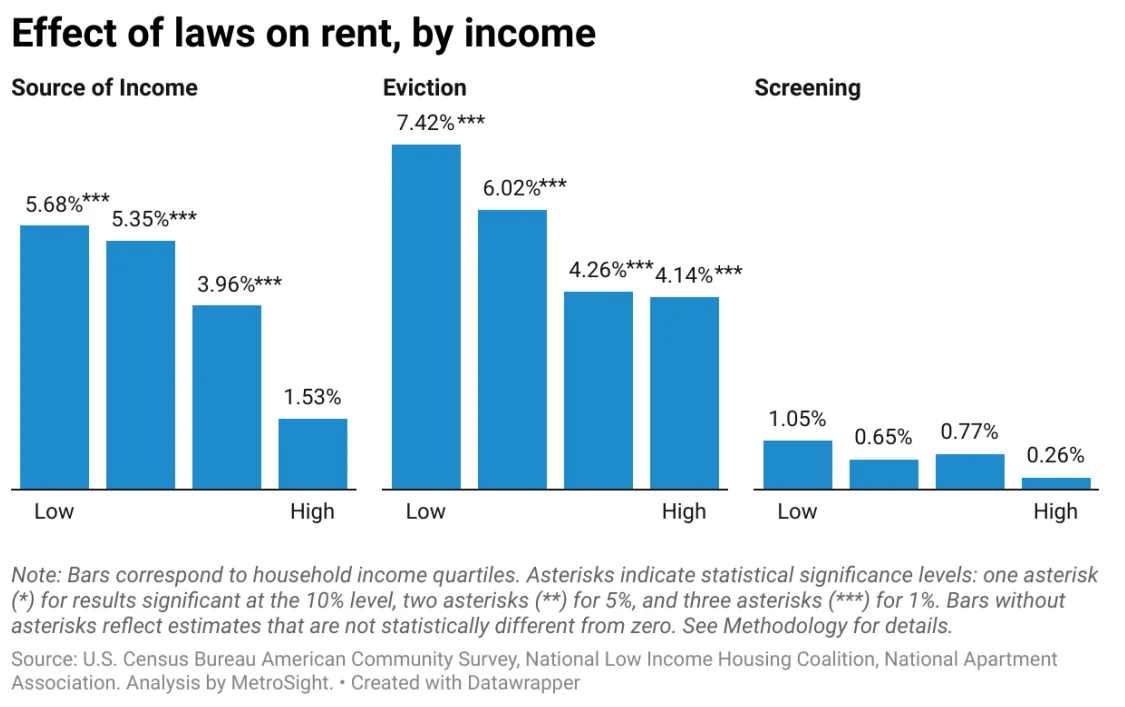

- Lower-income renters and households in two- to four-unit buildings faced the steepest hikes.

- State preemption laws, which limit local housing rules, showed no significant effect on rent levels.

- Source-of-income laws add roughly $876–$1,104 annually per unit, eviction protections $1,092–$1,224, and screening laws $252–$708.

The Big Picture

As reported by the NMHC, the US housing market continues to face severe affordability challenges. To understand how regulations shape these pressures, MetroSight researchers Daniel Shoag, Ph.D., and Issi Romem, Ph.D., examined whether rental housing laws influence rents.

In February 2025, their earlier study demonstrated that such laws raise landlord operating costs. Now, they extend that analysis and conclude that many of those costs flow directly to renters in the form of higher rents.

Because the researchers drew on two independent datasets—CoStar’s rent data from 391 metros (2000–2024) and the US Census Bureau’s American Community Survey covering 307 metros (2005–2023)—the findings remain consistent across sources.

Source-of-Income Protections

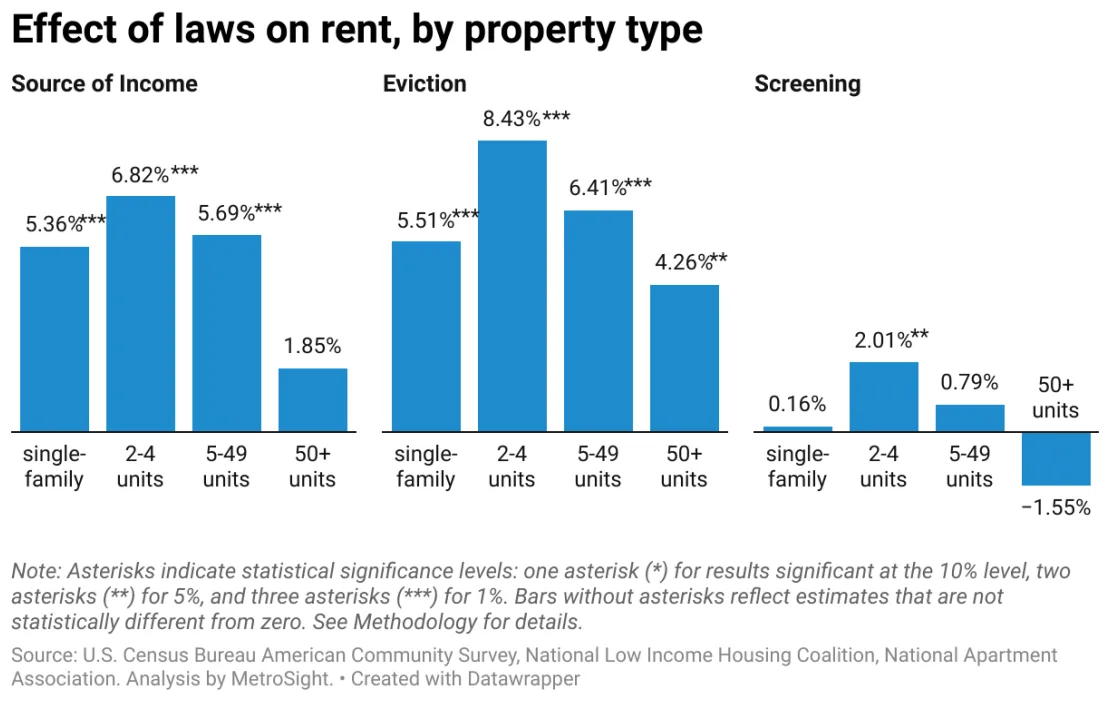

These laws raised rents about 5.2–5.3% on average. Lower-income renters and those in two- to four-unit buildings felt the biggest impact, while large complexes showed little change.

Eviction Regulations

Just-cause eviction rules led to the steepest increases, pushing rents up 5.9–6.5%. Small multifamily properties and bottom-quartile earners faced the highest jumps.

Resident Screening Laws

Restrictions on using credit or criminal histories lifted rents by 1.5–3.4%. The effect was modest overall but more noticeable in smaller properties.

State Preemption Statutes

Preemption laws showed no significant rent effect, though they may create more stability for property owners and developers.

Why It Matters

On the one hand, tenant protection laws aim to strengthen housing stability and shield vulnerable households. On the other hand, they can unintentionally make housing more expensive for the same renters they seek to help.

Because smaller landlords often lack financial buffers, they pass compliance costs directly onto tenants. As a result, residents in modest two- to four-unit properties face rent pressures that outpace those in larger complexes.

At the same time, not every regulation produces these side effects. Preemption laws, for example, did not lead to higher rents and may create a more predictable environment for investors.

Looking Ahead

If costs keep rising, fewer developers may choose to build multifamily housing, which could worsen supply shortages. For this reason, Shoag and Romem plan to examine how regulations affect long-term housing construction in their next study.

Ultimately, policymakers must strike a balance. While renter protections provide vital safeguards, poorly calibrated rules risk backfiring by raising costs and discouraging new housing supply. Consequently, future policies should aim to both protect renters and preserve affordability.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes