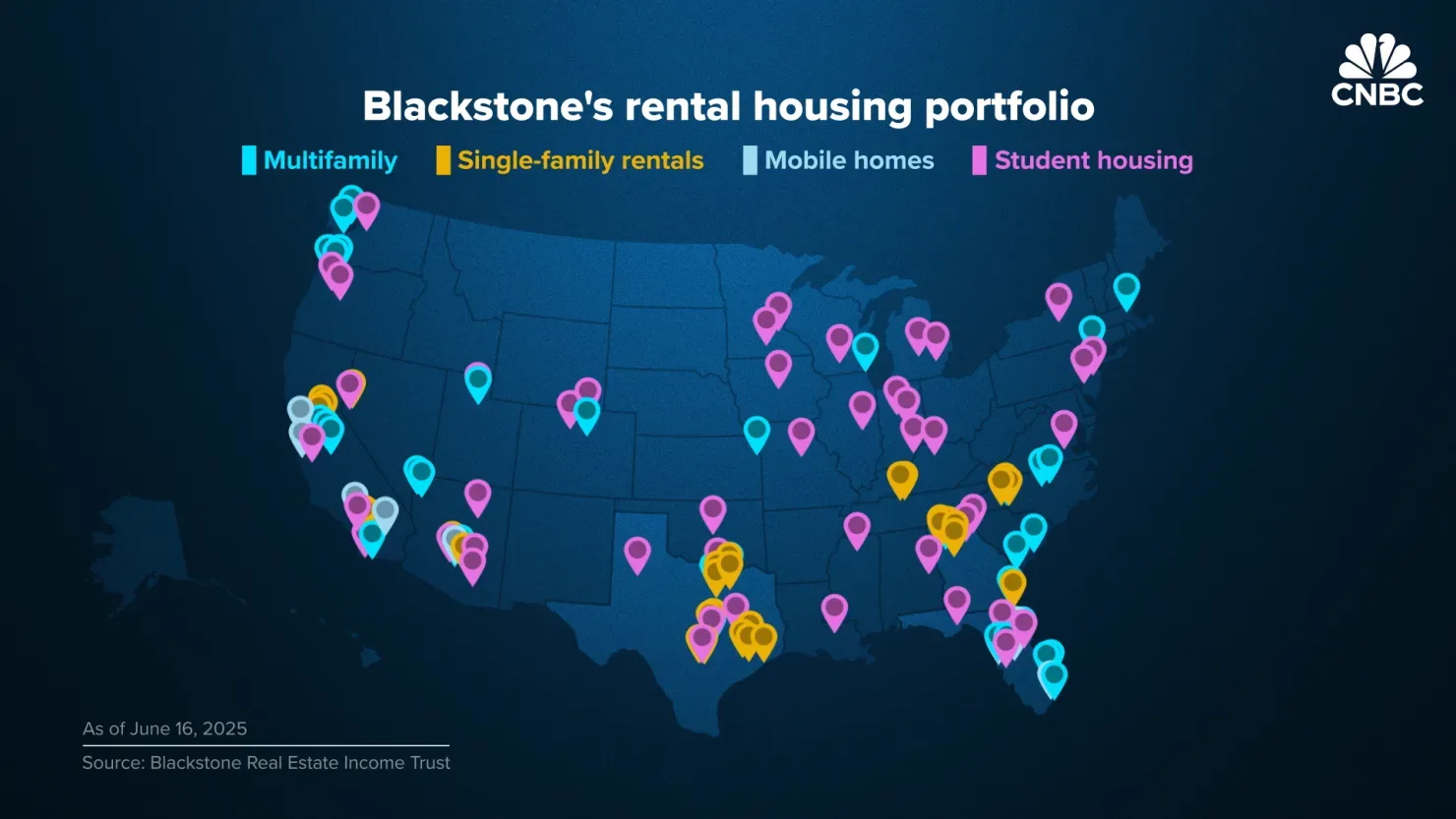

- Blackstone is expanding its rental housing portfolio across multifamily, student housing, mobile homes, and single-family rentals.

- The firm owns less than 1% of the US’s 46M rental homes but holds over 274,000 units nationwide.

- High construction costs and limited supply make buying more profitable than building, driving Blackstone’s acquisition strategy.

Blackstone Bets on Rentals Again

According to CNBC, Blackstone is buying rental homes in the US once more. The company sees strong potential in growing job markets and population hubs. It has recently acquired major rental housing operators like Tricon Residential, American Campus Communities, and AIR Communities.

Focus on Sun Belt and Urban Centers

Many of Blackstone’s properties are in fast-growing areas. These include cities in Texas, Florida, and Georgia, as well as New York. The firm follows migration and job creation trends to guide its investment decisions.

How Big Is the Portfolio

Through the Blackstone Real Estate Income Trust (BREIT), the firm owns over 274,000 rental housing units. BREIT makes up about $55B of Blackstone’s $315B real estate holdings. While large, these units account for less than 1% of all US rental homes.

Why Buy Now

Building new housing is expensive. In many areas, buying is still cheaper than building. That’s keeping new construction low and pushing rents up. Will Pattison of MetLife Investment Management says this trend supports buying over building early in the cycle.

What It Means for the Market

Blackstone’s buying spree signals growing institutional interest in US housing. Though the firm owns a small slice of the national rental stock, its influence is rising. More institutional capital is flowing into the rental housing sector, reshaping who owns American housing.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes