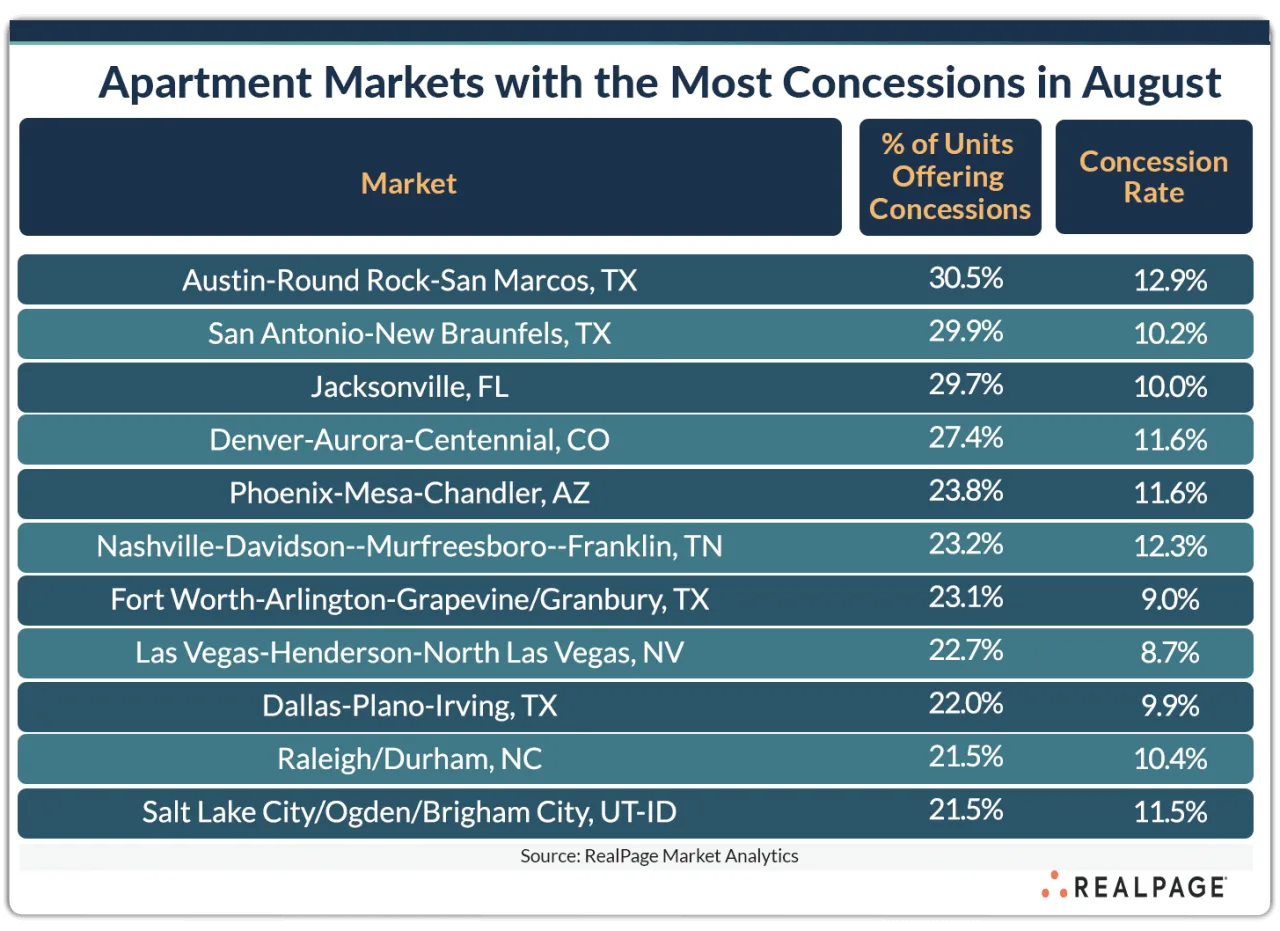

- Austin leads nationally with 30.5% of apartments offering concessions in August and an average discount of 12.9%, the highest among large US markets.

- Texas dominates the list, with San Antonio, Fort Worth, and Dallas also among the top markets for rental discounts. Heavy new supply is fueling competition.

- Sun Belt metros such as Jacksonville, Phoenix, and Las Vegas are turning to concessions as demand cools from earlier migration-driven spikes.

Supply-Driven Discounts

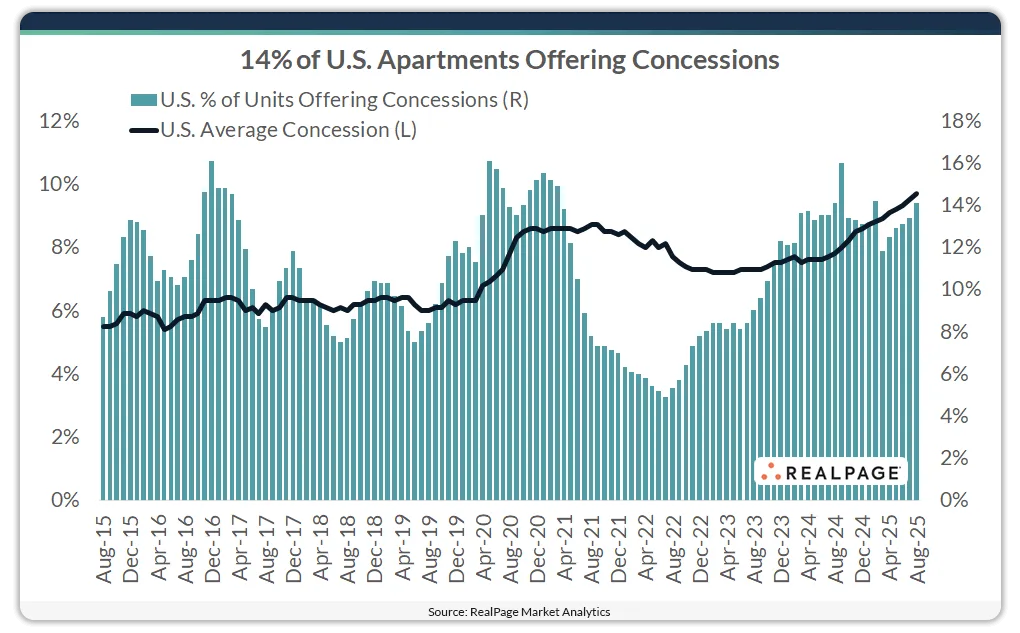

New construction is driving more operators to use concessions to attract renters. Nationwide, just over 14% of apartments offered discounts in August 2025. The average rental concession rate was 9.7%, according to RealPage Market Analytics.

Texas Markets Take the Lead

Austin topped all major markets with the largest share of apartments offering concessions (30.5%). It also posted the steepest average discount at 12.9%. Despite these offers, renter demand has been strong enough to absorb much of the new supply.

In San Antonio, nearly 30% of apartments offered concessions in August. Fort Worth and Dallas followed with about 22–23% of stock discounted as developers compete to lease up new units across the Metroplex.

Beyond Texas

Other Sun Belt markets are also seeing high concession use. Jacksonville, Phoenix, and Las Vegas reported elevated discounts as renter demand has cooled from pandemic-era peaks.

Why It Matters

Rental concessions highlight the intense competition in oversupplied markets. The discounts are attractive to renters but show how operators are struggling to balance supply growth with stable rent performance.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes