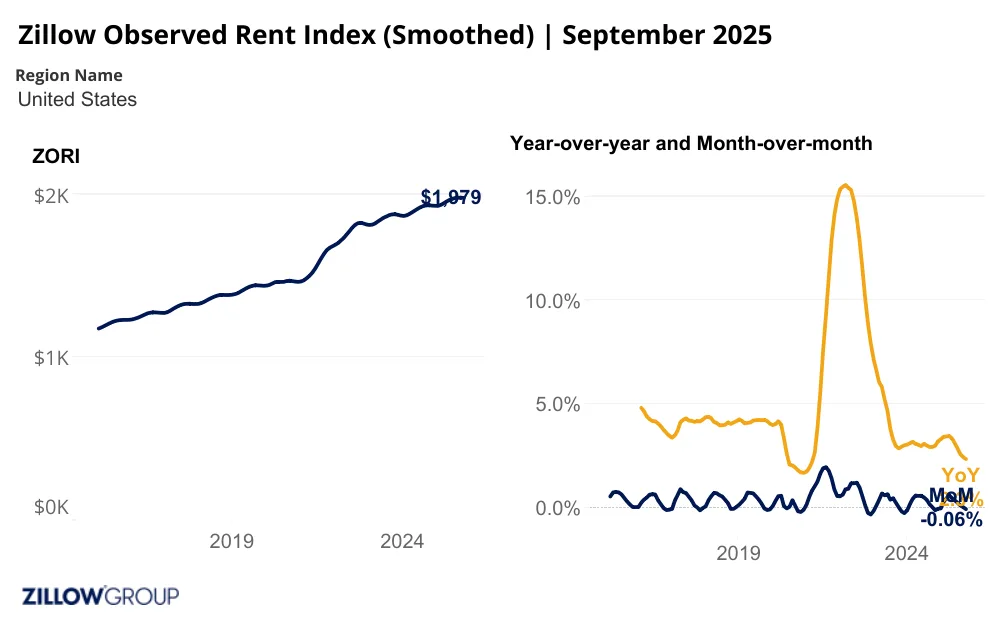

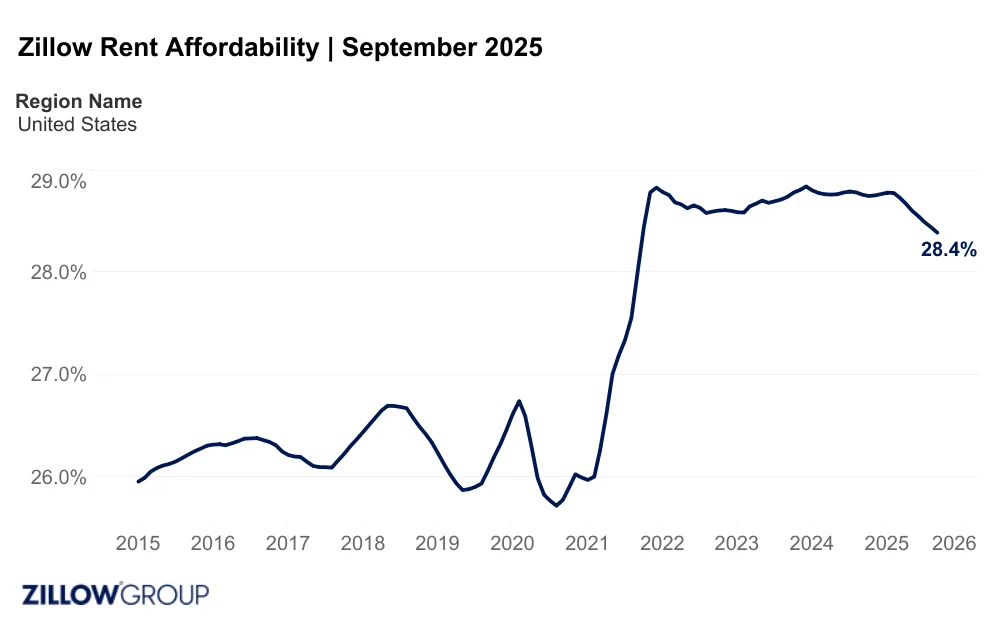

- Rental affordability improved to 28.4% of median household income nationally — the lowest level since 2021.

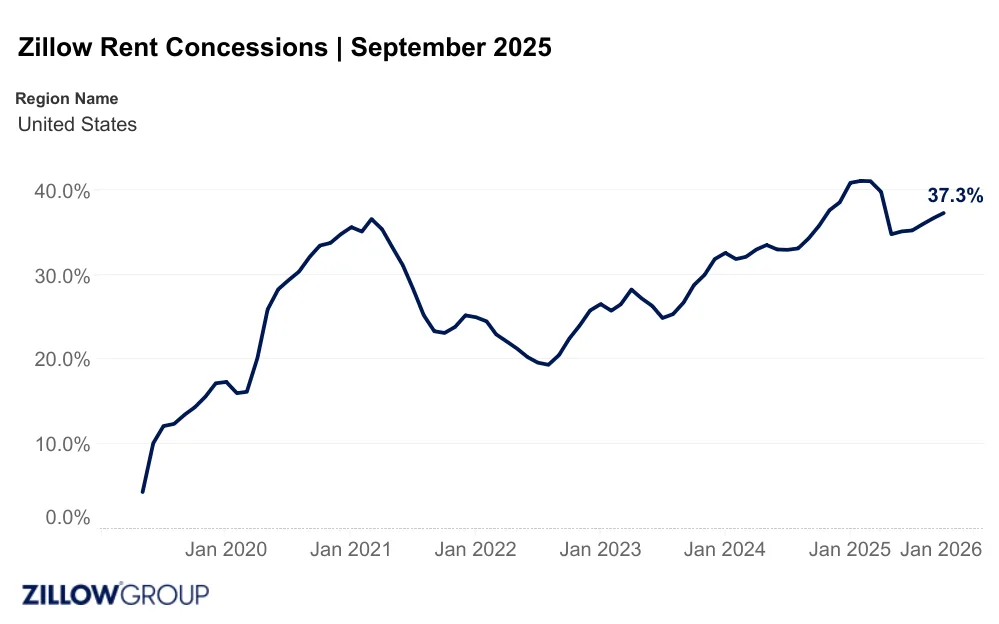

- Nearly 4 in 10 rentals on Zillow now offer concessions, such as free rent or parking, a record high for September.

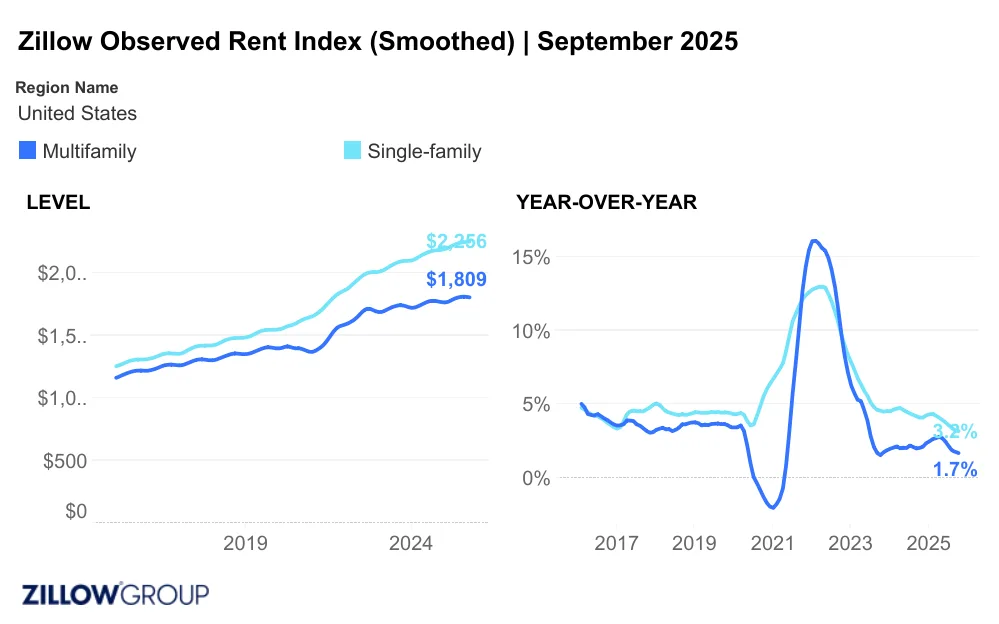

- Annual rent growth in single-family homes slowed to 3.2%, the lowest pace since 2016.

A Shift In Rent Dynamics

After years of rapid rent growth, construction is finally catching up to demand, reports Zillow. The US rental market is showing signs of cooling. Affordability is improving in most major metros. A key driver is the surge in new apartment completions in 2024 — the highest in any year since 1974.

The result? Renters are seeing relief not just in prices but in perks. In September, 37.3% of listings on Zillow included concessions like free rent or parking — the highest share ever recorded for the month.

Rent Growth Slows, Especially In The South And West

Multifamily rent growth has slowed to just 1.7% annually, with asking rents in cities like Austin (-4.7%), Denver (-3.4%), and Phoenix (-2.2%) declining year-over-year. These drops are most pronounced in regions with looser construction regulations. Areas like the South and Mountain West saw faster responses from developers, who were quicker to meet demand.

In contrast, cities with tighter building constraints, such as Chicago (6%), San Francisco (5.6%), and New York (5.3%), saw the largest rent increases.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Concessions Now Commonplace

With elevated vacancy rates and cooling demand, property owners are turning to incentives instead of cutting rents. Nearly 4 in 10 rentals on Zillow offered some type of concession in September. That’s up from 14.4% in 2019 and 35.8% in September 2024.

Cities seeing the biggest year-over-year jump in concessions include Memphis (+10.9 percentage points), Denver (+10.6 pts), and Houston (+9.4 pts). However, as competition for tenants continues to slow into winter, experts suggest price cuts could soon follow.

Single-Family Rentals Feel The Slowdown Too

Even single-family homes — a segment that had been more insulated from market shifts — are showing signs of deceleration. Annual rent growth for single-family homes slowed to 3.2% in September, the weakest since 2016. Monthly rent declines were recorded in 22 of the largest 50 metros, led by Providence (-1.2%) and Seattle (-0.7%).

Affordability At A Four-Year High

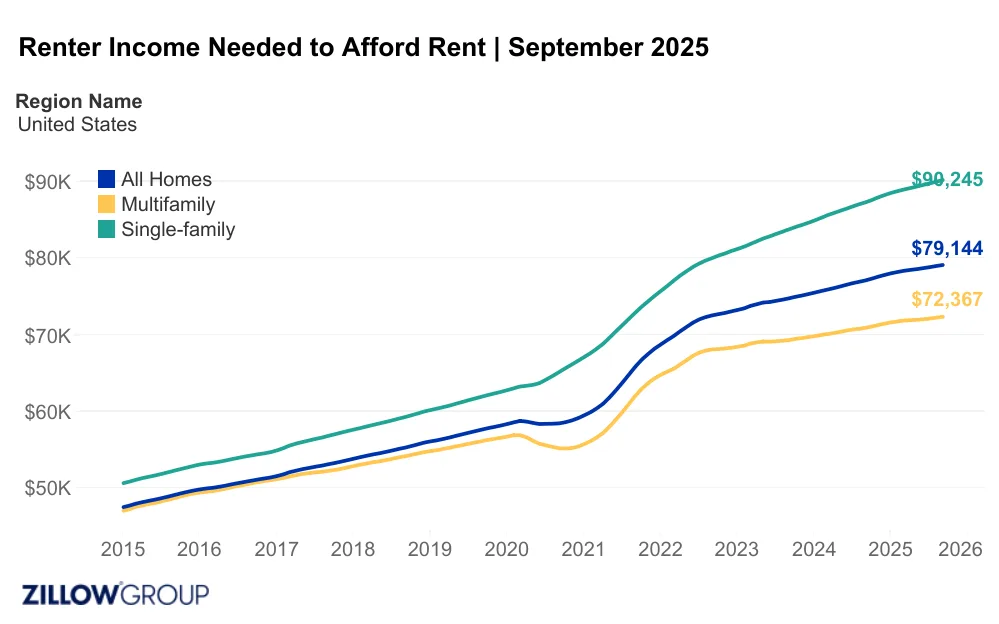

Nationally, a new lease now requires 28.4% of the median household income, down from 28.8% a year ago. That’s the most affordable reading since 2021 and below the 30% threshold often used to define a housing cost burden.

Rent affordability improved year-over-year in 38 of the 50 largest US metros. The biggest gains were seen in Denver, Austin, Miami, San Antonio, and Phoenix — all cities that have added substantial rental supply.

The most affordable large metros in September included Austin (18.2% of income), Salt Lake City (19.5%), and Raleigh (19.7%). On the flip side, New York (40.6%), Miami (38.6%), and Los Angeles (35.5%) remained the least affordable.

What’s Next

More inventory is still set to hit the market, and the labor market remains soft. As a result, rent growth is expected to stay subdued through the rest of 2025. Concessions will likely remain high through the winter. If demand doesn’t pick up by spring, landlords may start offering broader rent reductions.

Despite a 2.6% annual increase in the income needed to afford the typical rent, the surge in supply is beginning to chip away at the rental affordability crisis — at least for now.