- For 10 consecutive years, Rent Guidelines Board (RGB) increases have lagged behind inflation, effectively lowering real rents for stabilized units.

- Operating costs for rent-stabilized buildings have soared—up 21% since 2020—while rent collections remain below pre-pandemic levels.

- Financial strain is hitting nonprofits and private landlords alike, raising concerns about the long-term viability of the city’s affordable housing stock.

A Decade of Decline

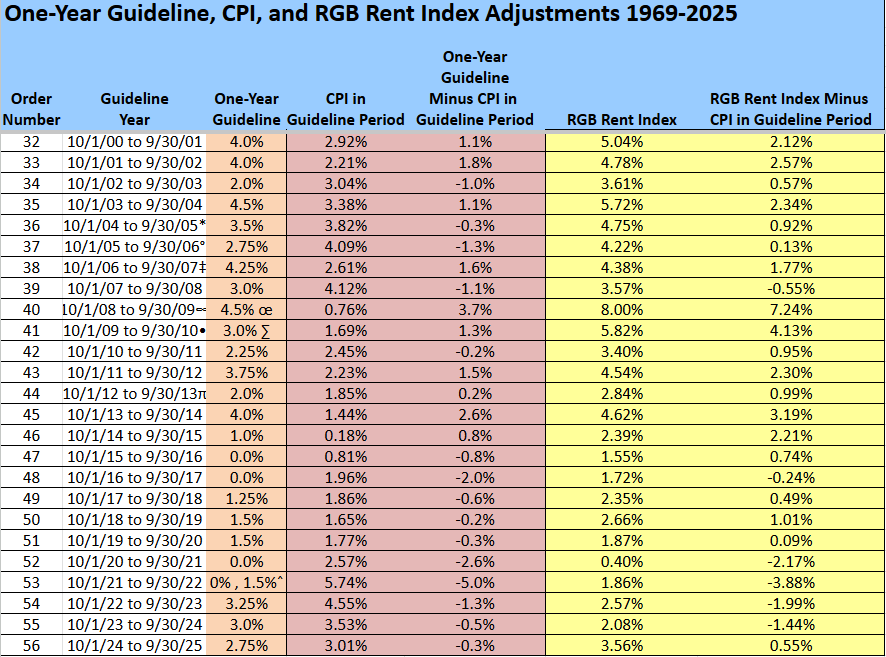

While tenant advocates continue to push for rent freezes, the economic reality of rent stabilization paints a more complicated picture, per The Real Deal. According to Alex Armlovich, a newly appointed Rent Guidelines Board member and housing analyst at the Niskanen Center, rent-stabilized units have seen inflation-adjusted rent declines for the past decade.

His analysis, shared publicly, reveals that the last time RGB increases outpaced inflation was under early de Blasio-era leadership. Since then, sub-inflation adjustments have eroded landlord revenues annually.

Beyond the Politics

Calls for rent freezes often gain traction with voters, but rarely do political campaigns or media reports highlight the quiet decline in real rents under rent stabilization. The implications go beyond private landlords—thousands of rent-stabilized units in buildings benefiting from tax abatements like 421a and J-51 are similarly impacted. Many of these buildings are now financially underwater because their financing assumed rents would rise, not shrink, in real terms.

A Warning from the Inside

Rafael Cestero, CEO of the nonprofit Community Preservation Corporation and a former city housing commissioner, warns that the city’s stabilized housing stock is in “deep, growing financial and physical distress.” In a recent op-ed, he shared that CPC’s operating expenses rose 6% in the past year alone and 21% since 2020—while rent collections average just 92%, down from pre-pandemic norms of 97%.

“Margins were razor-thin to begin with,” Cestero wrote. “Now we’re in a crisis.”

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters

This data challenges the prevailing narrative that landlords are profiting at the expense of tenants. In reality, even mission-driven operators like CPC are struggling. If these trends persist, New York’s affordable housing infrastructure—already strained—could deteriorate further, risking both livability for tenants and financial solvency for owners.

What’s Next

With the Rent Guidelines Board poised to vote on rent adjustments for the coming year, the pressure is on to balance tenant protections with housing sustainability. As the data shows, failing to acknowledge inflation’s impact on stabilized rents may ultimately jeopardize the very housing the city aims to preserve.