- National rent growth is stalling, with average rents declining 0.3% in September — the steepest drop for that month in over 15 years.

- Oversupply of new apartments is weighing on landlord pricing power, particularly in markets like Austin, Denver, and Phoenix.

- Tenant concessions are at record highs, with 37% of September leases offering perks like months of free rent or paid move-in costs.

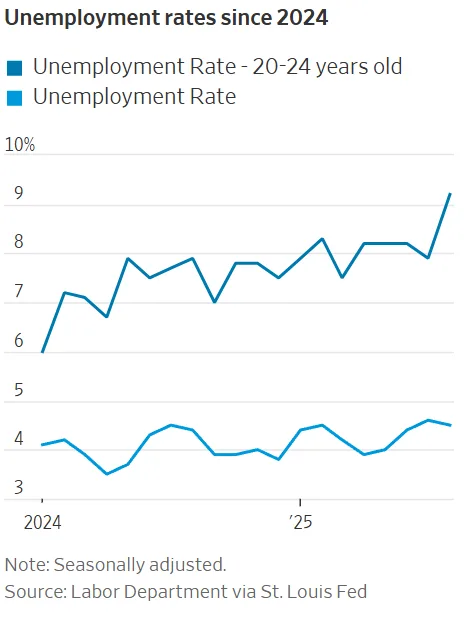

- Young renters are feeling job market strain, with unemployment for those aged 20–24 at 9.2%, pushing some to delay moving out or seek roommates.

Slowdown Continues

The WSJ reports that US renters are in an unusually strong position, with rents either flattening or falling across much of the country. The trend stems from a wave of new apartment construction that continues to outpace demand — a dynamic developers didn’t anticipate lasting into late 2025.

Landlords, especially in fast-growing metros like Phoenix and Denver, are now offering deep rent discounts and generous perks just to fill units. Nationwide, rent concessions hit a record for the month of September, according to Zillow.

Young Renters Hit Pause

Labor market pressures are compounding the slowdown. Entry-level job growth is softening in many cities, and unemployment among 20–24-year-olds is now more than twice the national average. Many in this group are delaying independent living altogether.

In Denver, 22-year-old Anika Nelson recently moved into a new building offering 12 weeks of free rent — but only after a months-long, unsuccessful job search. “A lot of people my age are doing that right now,” she said.

Developers’ Timeline Gets Pushed

Apartment owners had expected 2025 to mark a turning point — the year when excess supply would finally be absorbed and rents could rebound. That outlook has shifted.

Industry analysts are now targeting 2026 or even 2027 for meaningful rent increases. And even then, expectations are tempered. Yardi Matrix recently cut its 2027 growth projections, citing ongoing construction and softening demand.

Waterton CEO David Schwartz summed it up: “We’re in the camp, ‘We’ll be in heaven in 2027.’”

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Market Dynamics Shift

The Sunbelt, once red-hot with pandemic-era migration, has cooled significantly. Cities that benefited from remote work are now seeing reverse movement as employers call workers back to offices. And as immigration slows, another key demand driver is weakening.

Despite record-high leasing activity, landlords are largely filling units by cutting rents or piling on incentives like shopping gift cards, free parking, or covered moving costs.

Even seasoned tenants are feeling the benefit. In Denver, programmer Spencer McKean has been paying around $1,575 a month for years — well below what many new renters faced just a few years ago. This year, he’s paying for only nine months on an 11-month lease. “I just got two months off,” he said.

Why It Matters

A renter-friendly market is easing inflation pressures, as housing is the largest component of the consumer-price index. With leasing demand likely to remain tepid and supply still climbing, landlords may have to keep adjusting expectations.

What was once “stay alive until 2025” is now increasingly looking like “wait it out until 2027.”