- Florida will eliminate its 2% commercial rent sales tax in October 2025, ending a 55-year-old policy that only existed in the Sunshine State.rn

- The repeal is expected to reduce tenant occupancy costs, sharpen Florida’s appeal to relocating businesses, and influence lease negotiations across office, industrial, and retail sectors.rn

- With nearly $19B in securitized CRE debt impacted, the change could modestly support leasing velocity, improve refinancing outcomes, and put slight downward pressure on cap rates over time.rnrnrn

A Long-Awaited Repeal

As reported by Trepp, Florida’s decision to eliminate its commercial rent sales tax marks the end of a decades-old outlier policy. The tax, once as high as 6%, has steadily declined in recent years—down to 2% in 2024. When it disappears completely this October, tenants will see immediate savings: a business paying $100,000/month in rent will retain an extra $24,000 annually.

Winners and Negotiators

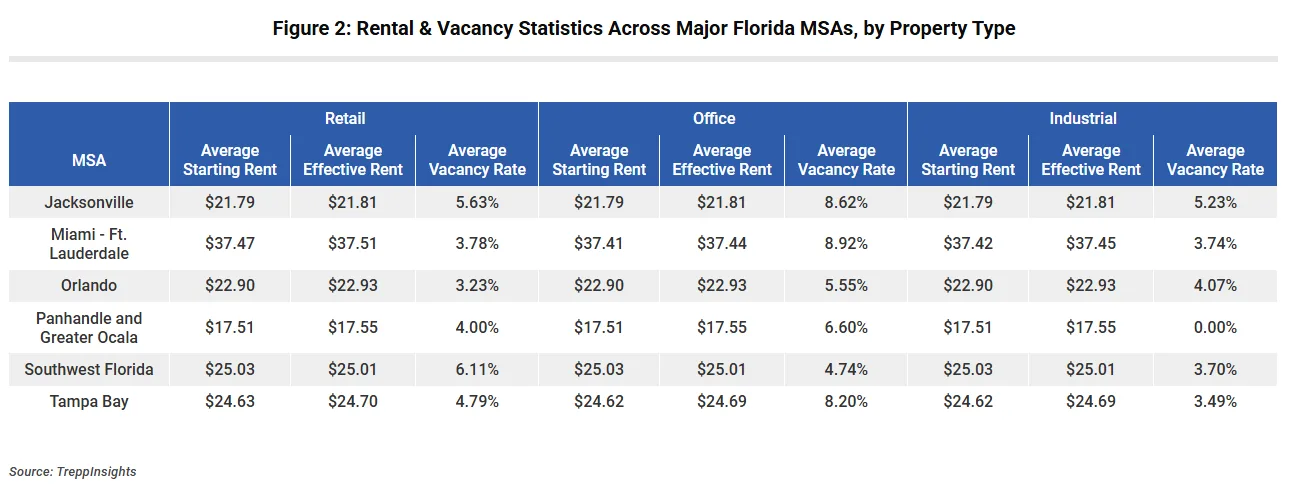

While the tax repeal formally benefits tenants, the real-world impact depends on market dynamics. In high-demand areas, landlords may seek to recapture some of the savings via higher rents. However, in softer markets or buildings with vacancy pressure, competition could keep rents flat, passing the full benefit to tenants.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

CRE Lenders and Investors: Eyes on the Numbers

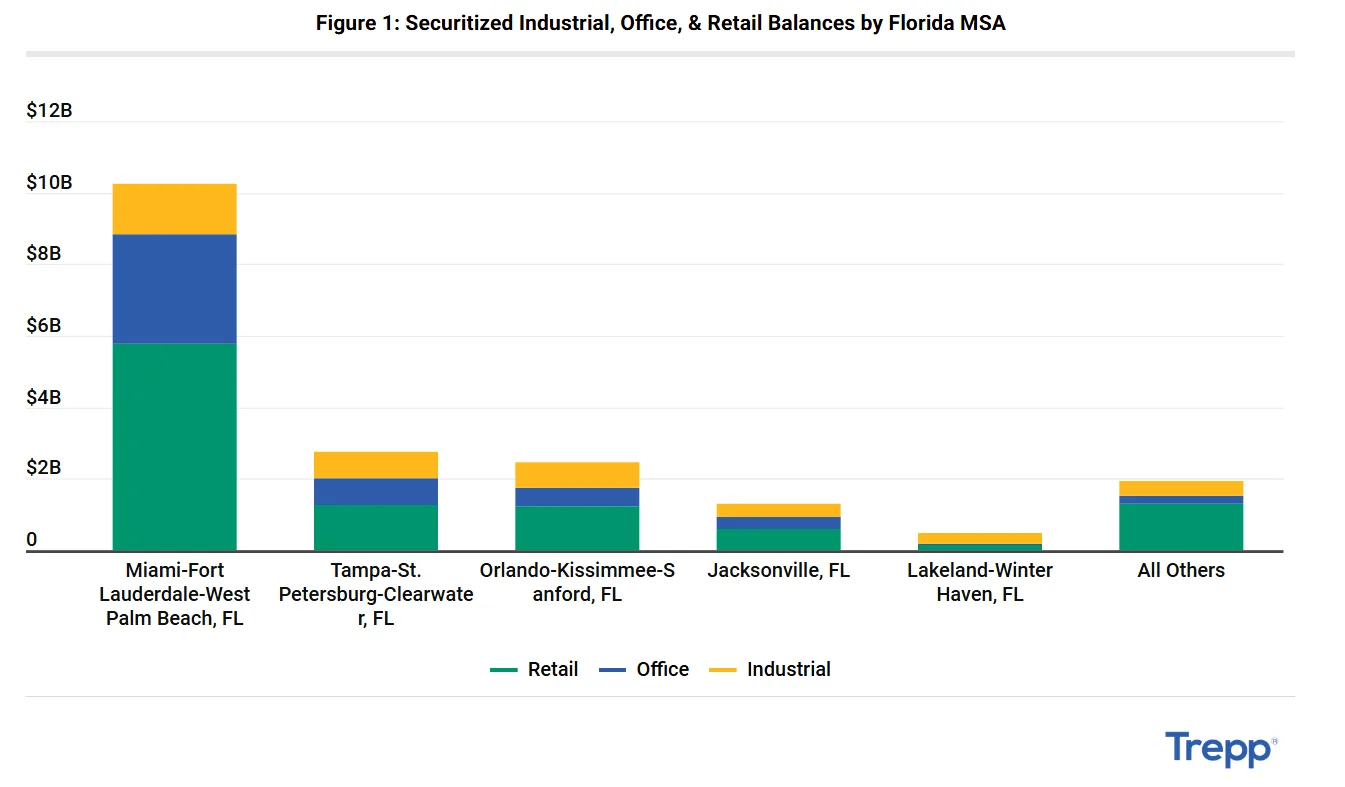

Trepp data shows nearly $19B in securitized loan exposure in Florida’s office, industrial, and retail sectors will be affected by the policy change. The Miami MSA alone holds $10.3B of that total—$5.8B in retail properties. This shift could improve asset-level fundamentals, particularly where leasing activity is most sensitive to occupancy costs.

Market Fundamentals: Boost to Retail and Industrial

Florida’s retail and industrial sectors are well-positioned to benefit from the repeal. Both sectors have maintained sub-5% vacancies and relatively strong demand. In contrast, office vacancies remain elevated, though still below the national securitized office average of 15.08%. Lease affordability improvements could accelerate decision-making for tenants, especially small and mid-sized users.

Refinancing Challenges and the Role of Debt Yield

Industrial loans in Florida have seen sharply lower debt yields—8.98% in 2025 vs. 14.58% in 2023—signaling renewed lender optimism. Office and retail, by contrast, are being underwritten more conservatively. Though the tax repeal won’t boost current NOI, it could enhance leasing prospects and ease refinancing pressure for assets near the margin.

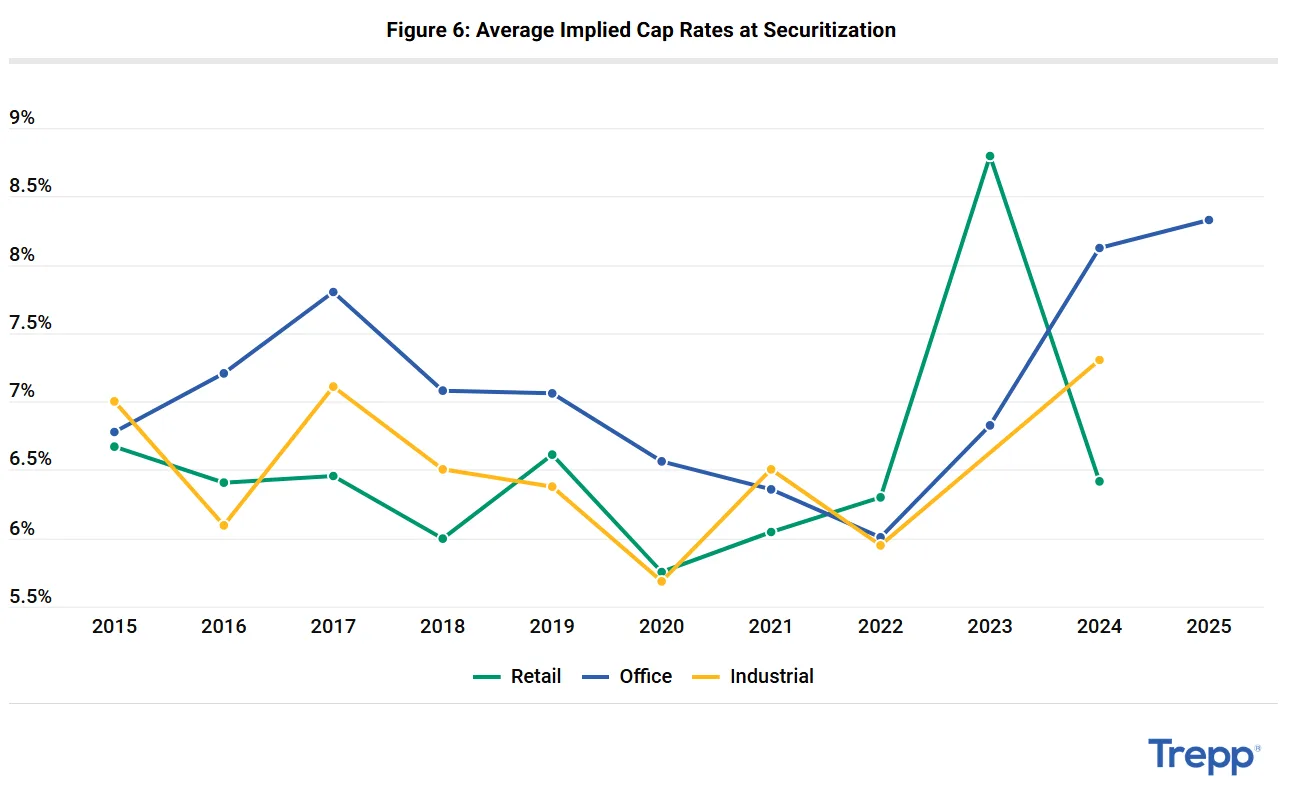

Cap Rates and Risk Perception

Office and retail cap rates have fluctuated in recent years, reflecting increased investor caution. office cap rates rose to 8.33% in 2025, while retail, after peaking in 2023, settled around 6.42% in 2024. The tax repeal may slightly compress cap rates in sectors where gross occupancy cost drives demand—most notably retail and industrial.

Why It Matters

Florida’s move eliminates a leasing friction point that other states never had, creating a more favorable cost structure for tenants and potentially nudging demand upward. For CRE professionals, it’s a rare example of tax policy providing a direct and calculable benefit to property performance.

What’s Next

The near-term effects will show up in leasing metrics and tenant sentiment. Long-term, the repeal could boost NOI growth trajectories and support more favorable lending and valuation outcomes. For investors, lenders, and advisors, it’s a key variable to watch as Florida’s CRE market evolves post-repeal.