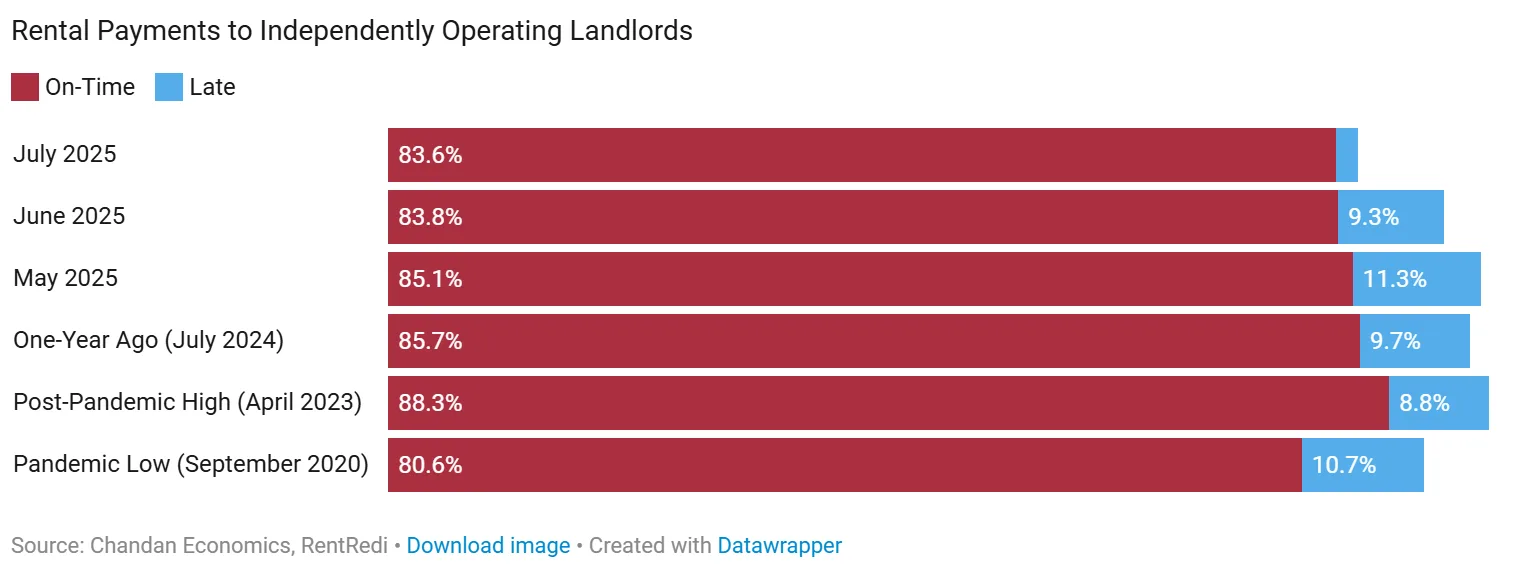

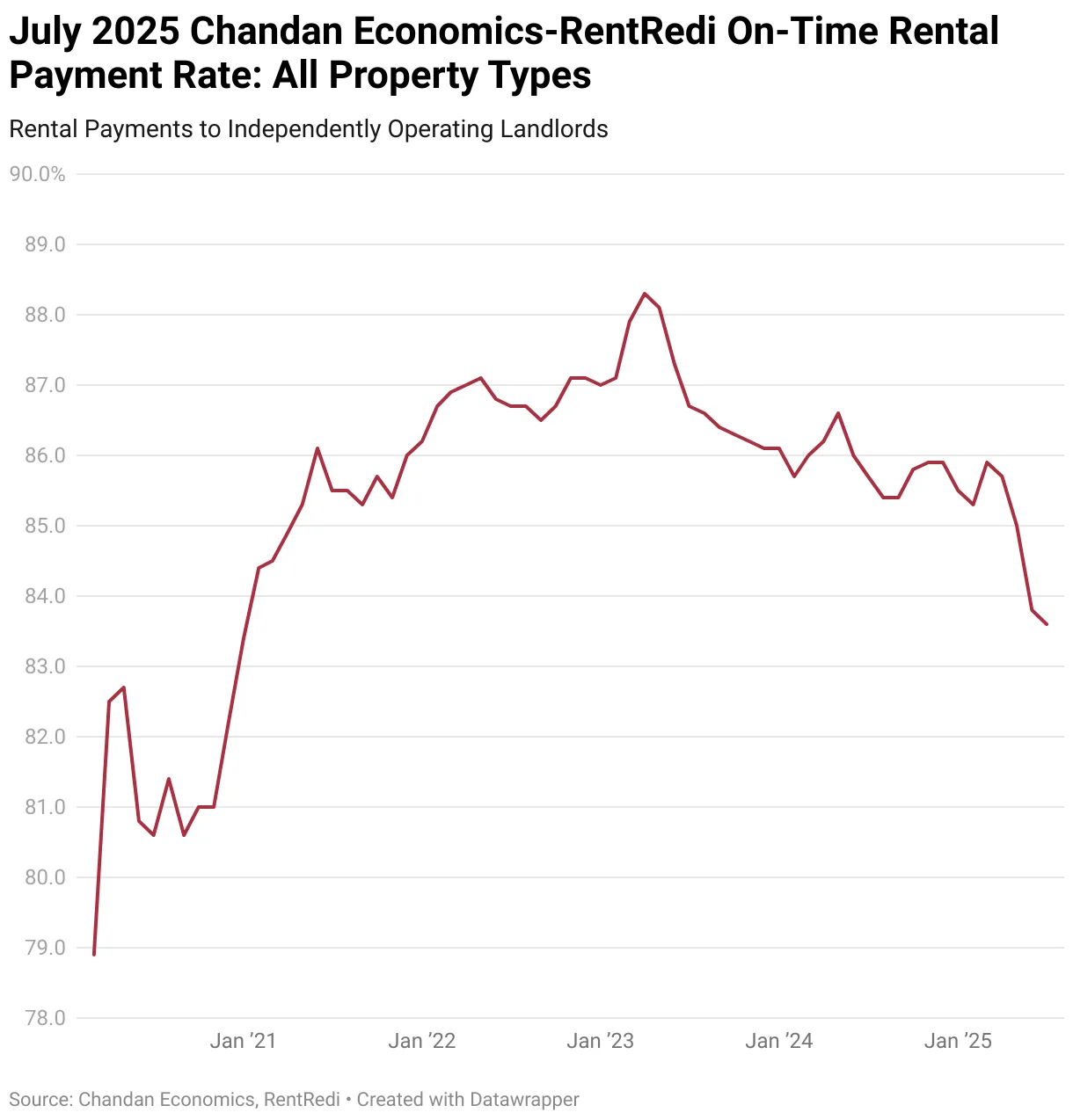

- On-time payment rates in non-institutional rental properties fell 20 bps in July to 83.6%, the lowest since early 2021.

- July marks the 24th consecutive month of year-over-year declines in rent payment performance.

- The full-payment rate dropped to a post-pandemic low of 93.4%.

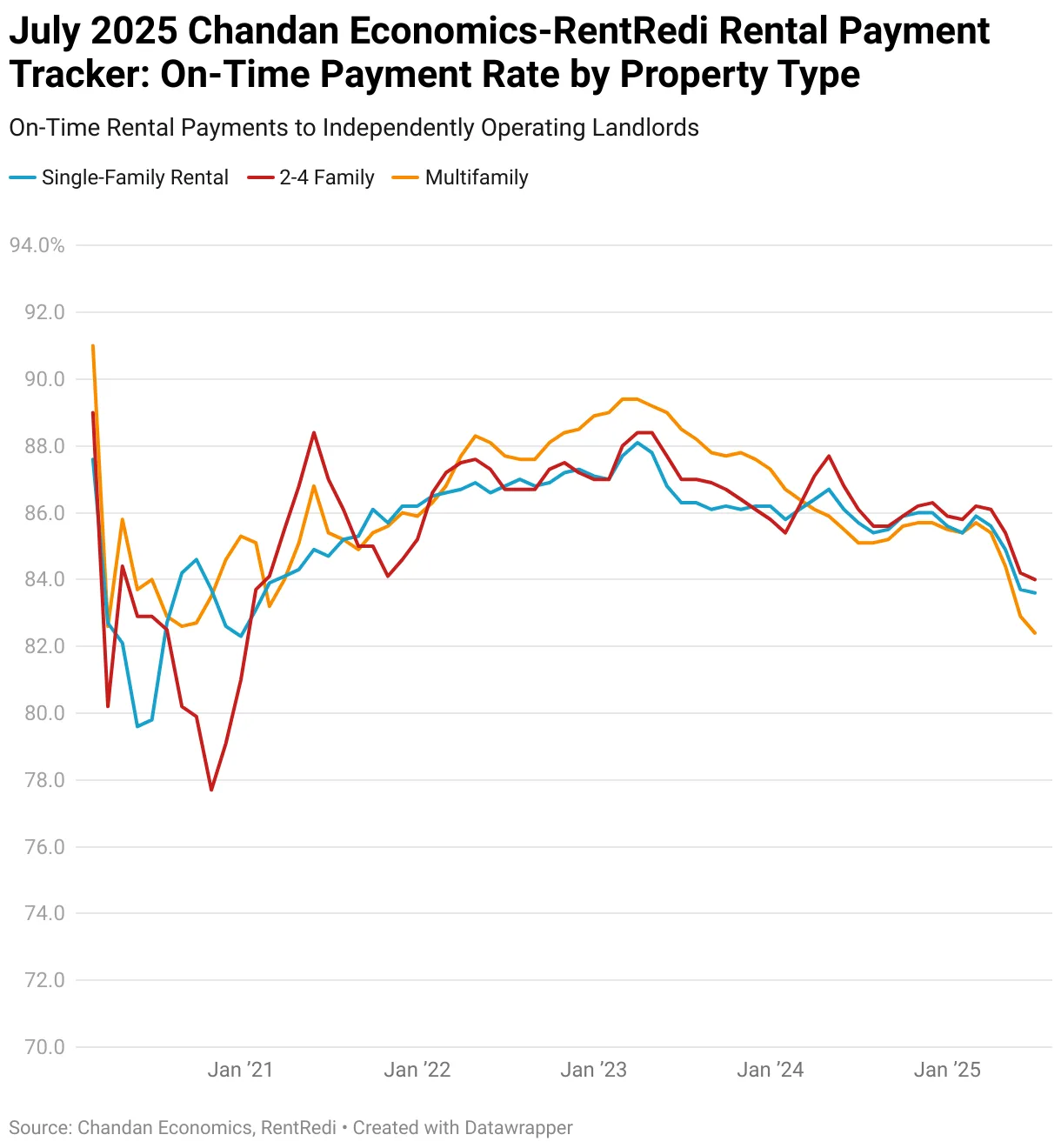

- Smaller 2-4-unit rentals posted the highest on-time rates at 84.0%, while multifamily properties trailed at 82.4%.

National Overview

The financial pressure on renters is increasingly visible in the performance of independently operated rental units. In July 2025, the on-time rent payment rate slipped to 83.6%, according to Chandan Economics’ monthly tracker — a 20-basis-point drop from June. While the pace of decline has slowed, the broader trend remains firmly negative.

Over the past four months, on-time payment rates have dropped by 229 bps, reflecting growing stress among renters. June’s initial 84.3% estimate was also revised down to 83.8%, emphasizing a consistent overestimation in first-pass data.

Two Years of Decline

Year-over-year, on-time payments were down 209 bps in July — the second-largest annual drop in the post-pandemic period. This marks 24 straight months of deteriorating performance, a full two-year streak of weakening rental payment behavior in the mom-and-pop housing segment.

Forecast Full-Payment Rate Hits Post-Pandemic Low

Beyond on-time collections, Chandan’s forecast full-payment rate — which anticipates late payments based on historical trends — also took a hit. July’s estimate fell to 93.4%, the lowest since December 2020. This suggests more renters are struggling to make payments even after the grace period.

Property Type Breakdown

Among tracked property types, 2-4 unit rentals continue to perform best, with an 84.0% on-time payment rate in July. Single-family rentals closely followed at 83.6%, while multifamily units underperformed at 82.4%. The gap between the highest and lowest performing segments has now widened to 162 bps — the largest since May 2024 — underscoring growing segmentation in rental payment behavior.

Regional Trends

Western states maintain their lead in rent collection rates. Idaho (93.5%), Hawaii (92.3%), Alaska (91.6%), Utah (91.2%), and Montana (91.1%) topped the list in July. New Hampshire (90.3%) was the only non-Western state to break into the top 10.

However, geographic disparities were significant. Missouri, Alabama, and D.C. posted the largest year-over-year improvements, while West Virginia (-1002 bps), Vermont (-718 bps), and Massachusetts (-675 bps) saw the steepest declines. Overall, just 11 of 51 jurisdictions recorded an improvement from July 2024.

Why It Matters

The persistent decline in on-time rent payments is a signal that economic stress — especially among lower-income and younger renter cohorts — is deepening. Rising delinquencies in auto, credit card, and student loan payments suggest household balance sheets are under strain. For independent landlords, these trends could signal ongoing cash flow risks and further instability in the small rental property market.

What’s Next

With macroeconomic pressures mounting, including inflation and resumed student loan payments, independent landlords may need to brace for continued volatility. Unless broader conditions improve, rent payment performance in mom-and-pop rentals could remain under pressure well into the second half of 2025.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes