- A handful of overlooked US cities are posting rent increases far above the national average of 0.6%.

- Growth in jobs, enrollment, and suburban migration is pushing demand—and rents—up in places not traditionally on renters’ radars.

- Many of these cities lack the rental inventory to absorb new demand, fueling steeper price hikes.

Small Cities, Big Increases

The broader rental market may be stabilizing, but zoom in, and a different story emerges: smaller markets are posting the kind of double-digit rental hikes typically seen in major metros. In many cases, local economies are booming—but housing stock hasn’t kept up, reports Apartments.com.

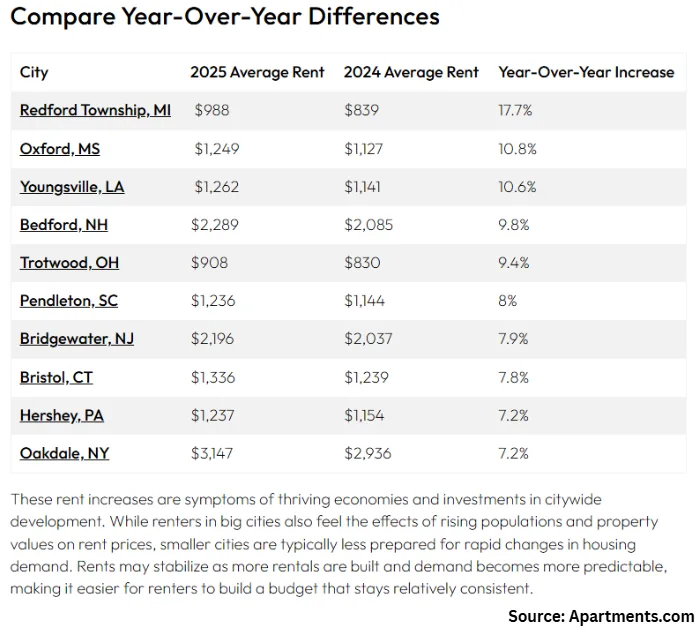

Here are 10 cities where rents have jumped significantly over the past year.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

1. Redford Township, MI

- Rent: $988

- Annual Increase: 17.7%

As Detroit continues its comeback, suburbs like Redford Township are absorbing spillover demand. With new construction still lagging and commuter appeal rising, rents have spiked more than 17%.

2. Oxford, MS

- Rent: $1,249

- Annual Increase: 10.8%

Enrollment gains at the University of Mississippi are pushing Oxford’s rental supply to its limits. A record-breaking freshman class and limited campus housing are translating into higher off-campus rent.

3. Youngsville, LA

- Rent: $1,262

- Annual Increase: 10.6%

Population growth and commercial incentives are fueling housing demand in this fast-growing Lafayette suburb. As new businesses move in, renters are following—and paying more.

4. Bedford, NH

- Rent: $2,289

- Annual Increase: 9.8%

Long considered a commuter town, Bedford is transforming into a standalone destination. New developments and high-performing schools are attracting families and professionals alike, tightening the rental market.

5. Trotwood, OH

- Rent: $908

- Annual Increase: 9.4%

This Dayton-area city is benefiting from Ohio’s booming data center and aerospace industries. Job growth is strong, and housing demand is rising in tandem.

6. Pendleton, SC

- Rent: $1,236

- Annual Increase: 8%

Close to Clemson and surrounded by lakes and trails, Pendleton is attracting newcomers looking for lifestyle and affordability. Local infrastructure improvements are also pushing values higher.

7. Bridgewater, NJ

- Rent: $2,196

- Annual Increase: 7.9%

Priced-out New Yorkers are heading west to the New Jersey suburbs. Despite new construction, demand is outpacing supply, keeping rents elevated.

8. Bristol, CT

- Rent: $1,336

- Annual Increase: 7.8%

An influx of upscale rental properties and efforts to revitalize downtown Bristol are lifting average rents. Though supply is growing, demand for newer units is keeping prices high.

9. Hershey, PA

- Rent: $1,237

- Annual Increase: 7.2%

The opening of a major chocolate processing plant is bringing jobs—and new renters—to Hershey. With little change in housing stock, rents are moving up,

10. Oakdale, NY

- Rent: $3,147

- Annual Increase: 7.2%

On Long Island’s South Shore, Oakdale is seeing post-pandemic population gains and persistent low supply. Proximity to NYC keeps demand strong, especially as affordability remains a challenge in the metro.

What’s Driving The Increases?

While each city has its own growth story, the common thread is demand outpacing supply. Whether it’s jobs, university growth, or migration from more expensive metros, these small cities are being asked to absorb more renters than they were built for.

The Outlook

These localized surges may slow as construction catches up—but for now, renters in these markets face steeper competition and higher prices. For developers and investors, these hotspots signal where new housing might be most needed.