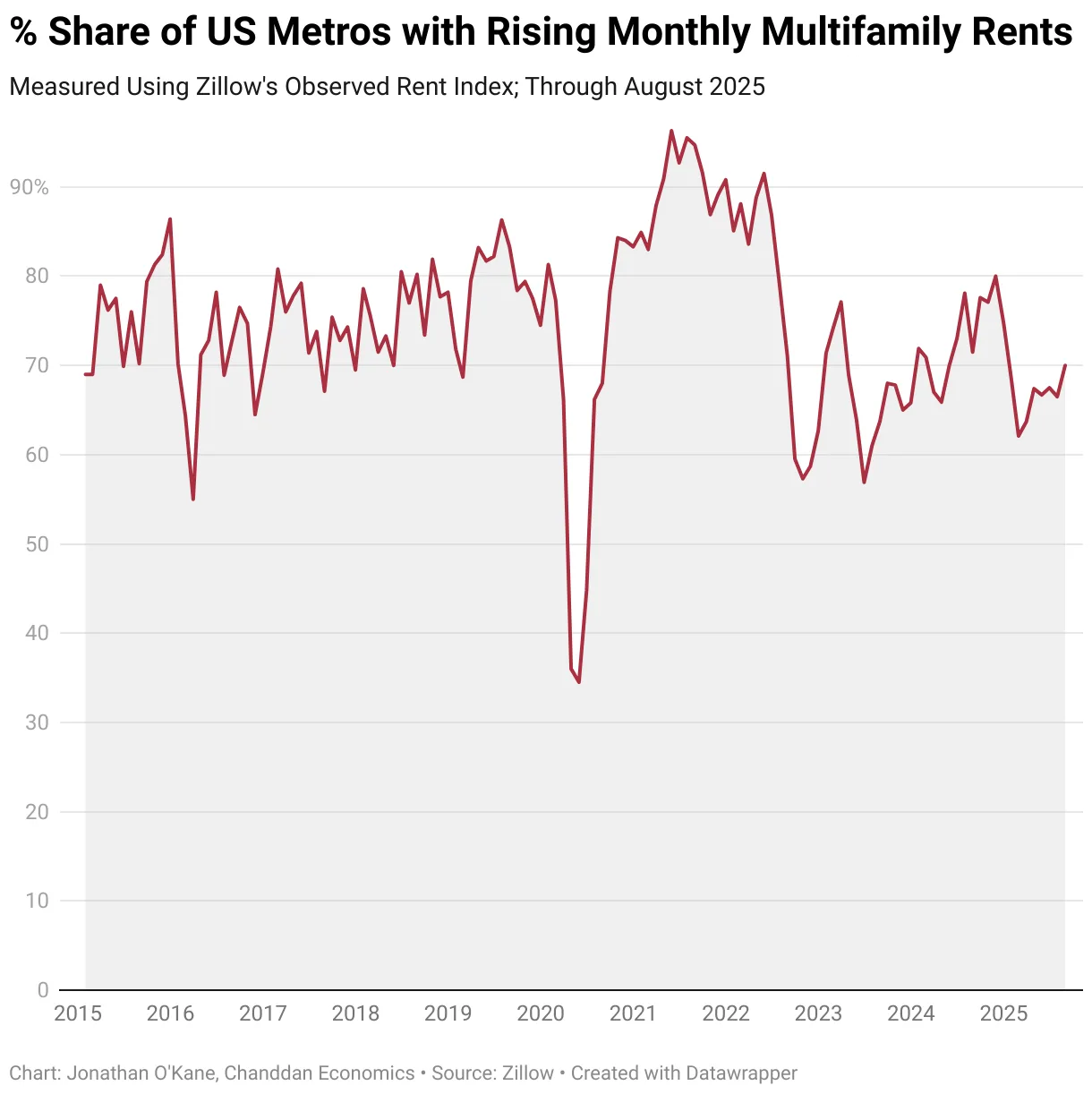

- 70% of US multifamily markets posted rent growth in August, the highest monthly share seen in 2025.

- National rents rose 0.16% month-over-month, translating to an annualized growth rate of 1.9%.

- Wichita, KS, and Urban Honolulu led August’s monthly gains, while Augusta, GA, topped the nation in year-over-year growth at 7.9%.

The Big Picture

Chandan Economics reports that US multifamily rents gained traction in August, marking a clear rebound after a sluggish winter. According to the Zillow Observed Rent Index, seven in ten markets saw rents climb month-over-month, a significant jump from February’s low point when only 62.1% of metros recorded growth.

Month-Over-Month Movers

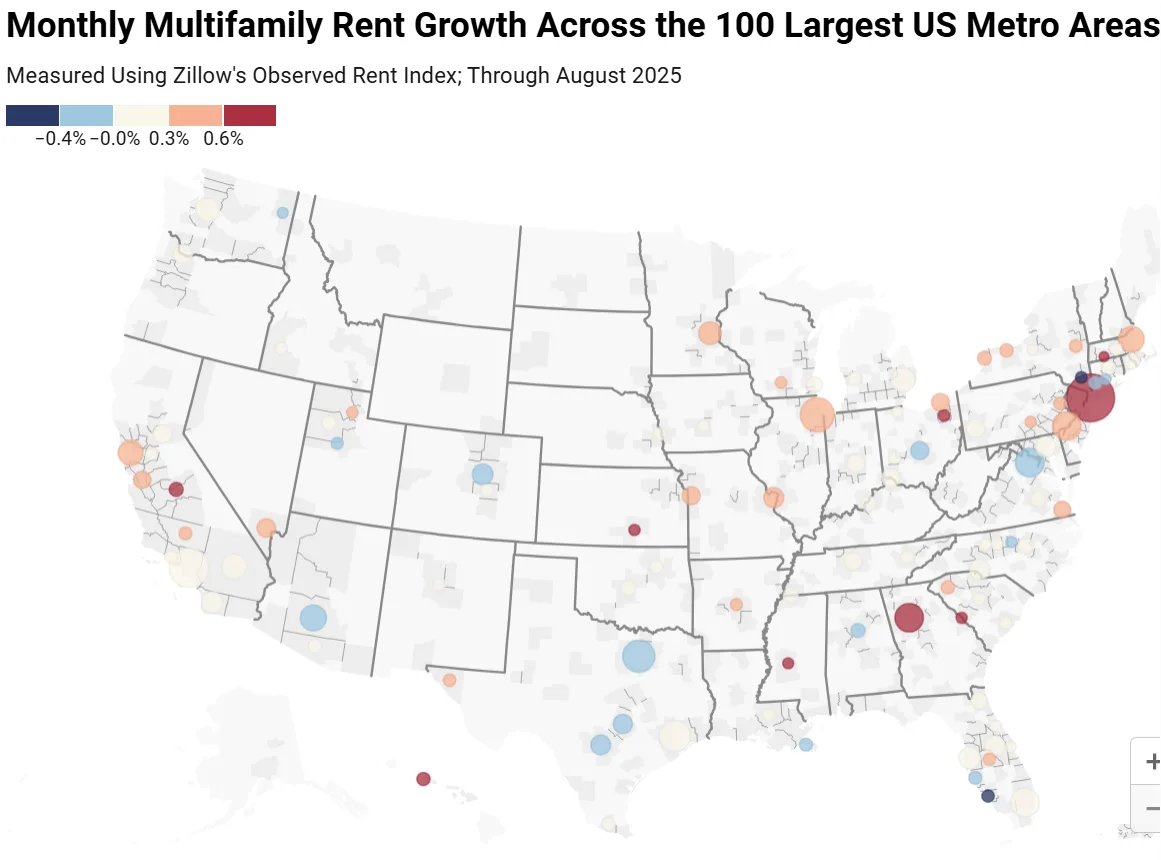

Nationally, rents inched up by 0.16% between July and August. At this pace, annual growth would land just under 2%—modest, but firmly in positive territory.

Among the 100 largest US metros, Wichita, KS, led all markets, with a 0.95% monthly increase. Other top performers include:

- Urban Honolulu, HI: +0.84%

- Fresno, CA: +0.73%

- Augusta, GA: +0.72%

- New York, NY: +0.66%.

Year-Over-Year Leaders

On an annual basis, national multifamily rents rose 2.0% over the past year. Augusta, GA, stood out as the fastest-growing market, posting a 7.9% year-over-year increase. The top five annual performers include:

- Augusta, GA: +7.9%

- Springfield, MA: +7.1%

- Chicago, IL: +6.2%

- Rochester, NY: +6.0%

- Worcester, MA: +5.8%

Why It Matters

The August data suggest the multifamily sector is stabilizing after a slower start to the year. While rent growth remains modest compared to the double-digit surges of the pandemic era, steady gains across a broad set of markets point to durable demand.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes