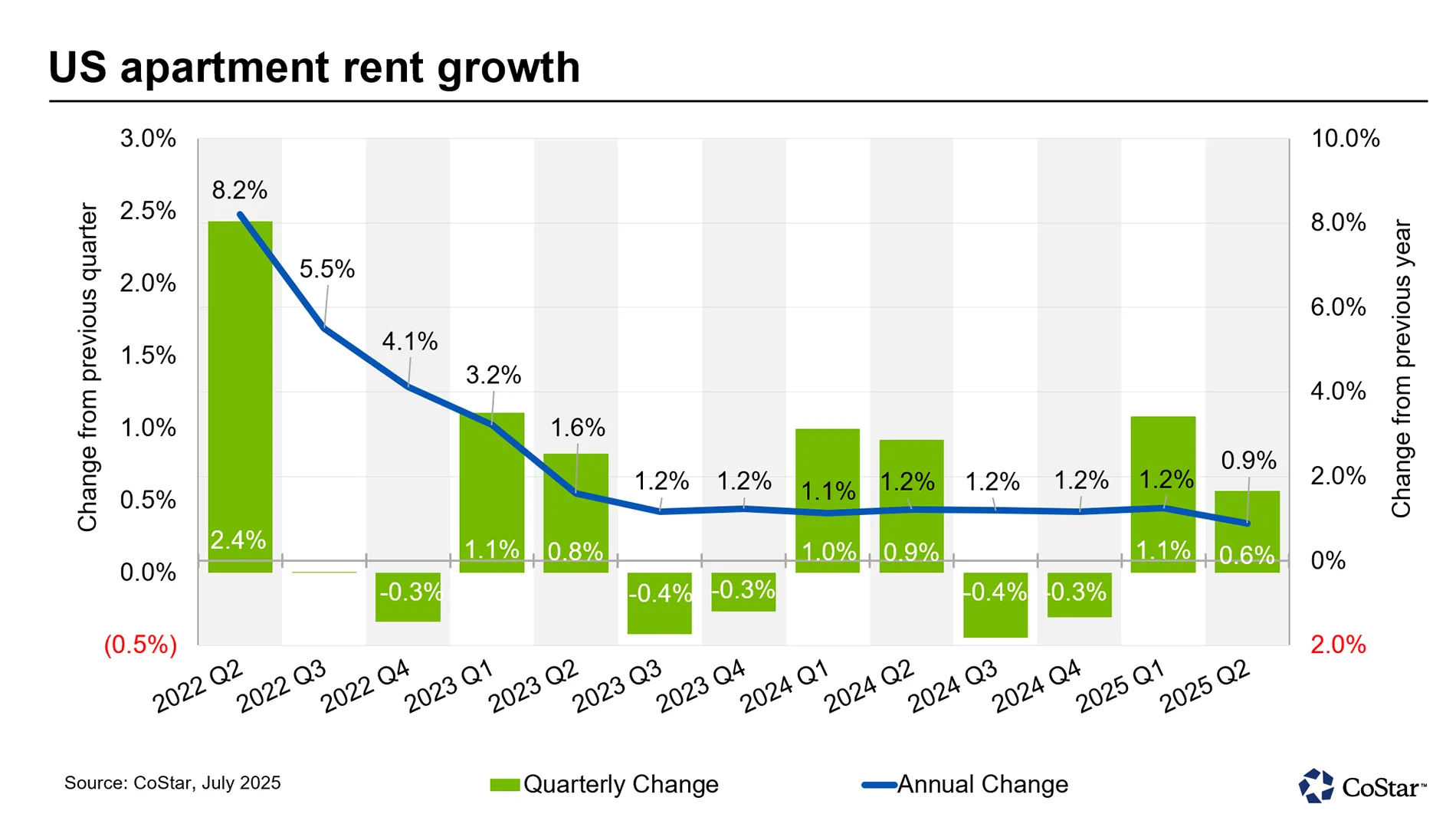

- US apartment rents rose 0.9% year-over-year in Q2, down from 1.2% in Q1 — the first slowdown since early 2024.

- New luxury buildings are still driving rent growth, but they make up only 2.5% of the national apartment supply.

- San Francisco, Chicago, and San Jose posted the highest rent increases, supported by job growth and renewed urban demand.

Rent Growth Slows for the First Time Since 2024

After more than a year of steady gains, US rent growth has finally cooled, per CoStar. In Q2 2025, asking rents rose just 0.9% compared to a year earlier. That’s down from 1.2% growth in Q1, according to Apartments.com, a CoStar Group company. This marks the first quarterly decline in rent growth since early 2024.

New Supply Is Driving the Slowdown

A surge in new apartment construction is giving renters more choices. As a result, landlords are under pressure to offer incentives and limit price hikes.

“The surge of new developments… has increased competition for renters and stymied rent growth,” said Jesse Gundersheim, senior director of market analytics at CoStar.

In many cases, newer buildings are luring tenants from older properties by offering perks like free rent.

Luxury Units Still Outperform, but They’re Rare

High-end apartments continue to see strong demand. Over the past two years, rents in luxury towers have grown at an annual pace of 1.8%. Projects like San Francisco’s 35-story NEMA tower are attracting steady interest.

However, luxury apartments account for just 2.5% of all units. Across the broader market, including more affordable and mid-tier rentals, rent growth slowed sharply in Q2.

Top Markets for Rent Growth

Some cities are still seeing robust increases. San Francisco posted the strongest rent growth among the top 50 US markets, with asking rents up 5.1% year-over-year.

This growth is fueled by population gains, a rising AI sector, and renewed activity in the downtown core.

Chicago followed with a 3.8% increase, while San Jose and Boston also showed solid momentum.

National Trends at a Glance

- Average monthly rent (Q2 2025): $1,773

- Q2 rent growth: 0.6%, down from 1.1% in Q1

- Vacancy rate: 8.2% for the third straight quarter.

What to Expect Next

Despite the slowdown, demand remains strong in many parts of the country. As the current wave of construction begins to level off, rent growth could pick up again — especially in cities with tight housing supply.

For now, the market is entering a more competitive phase. Developers and landlords may need to focus more on incentives and amenities to stand out.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes