- New housing reduces rent growth, especially in older, affordable units, according to a Pew study analyzing rent data across US metro areas.

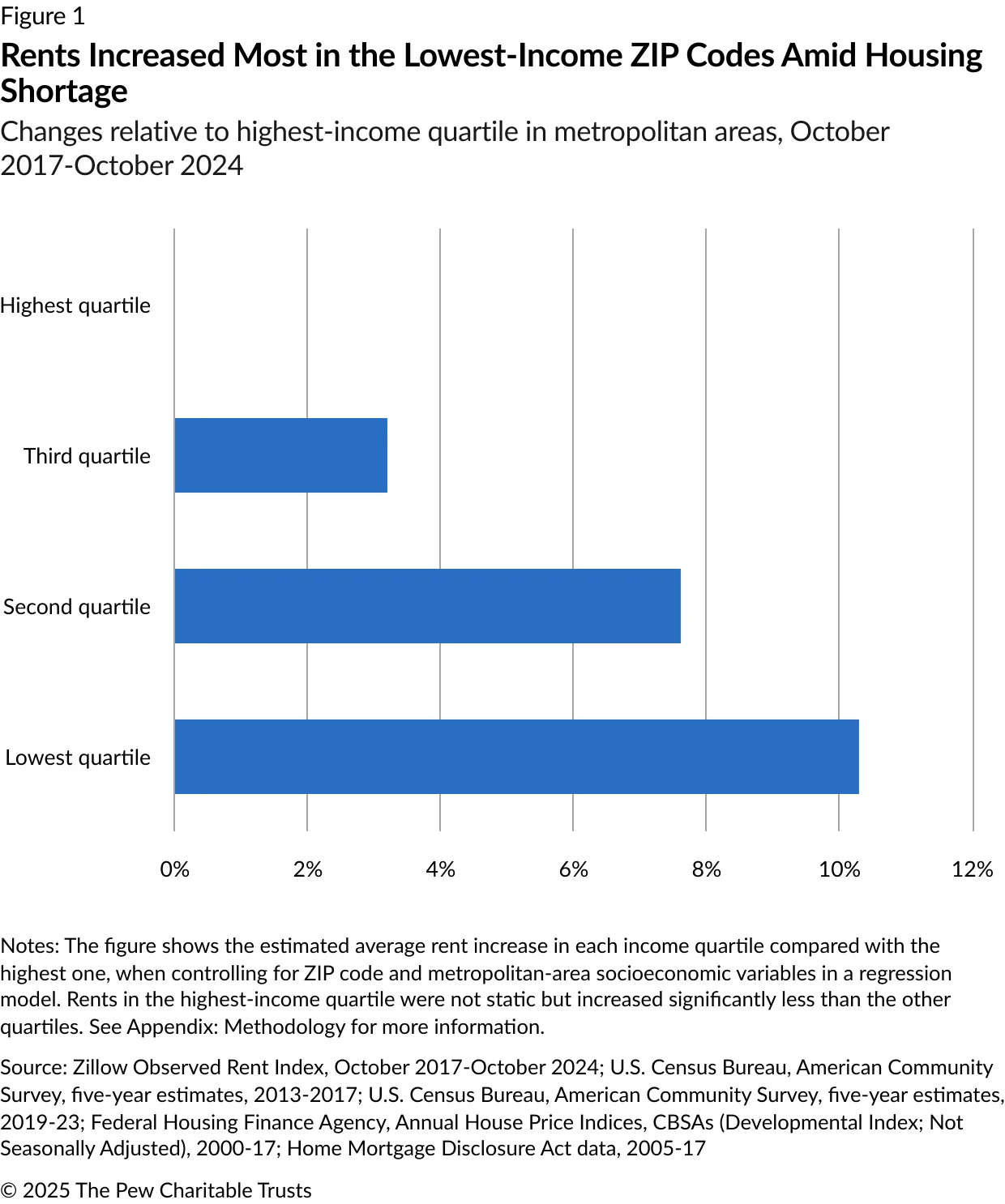

- Low-income ZIP codes saw the steepest rent increases—10 percentage points higher than high-income areas—from 2017 to 2024.

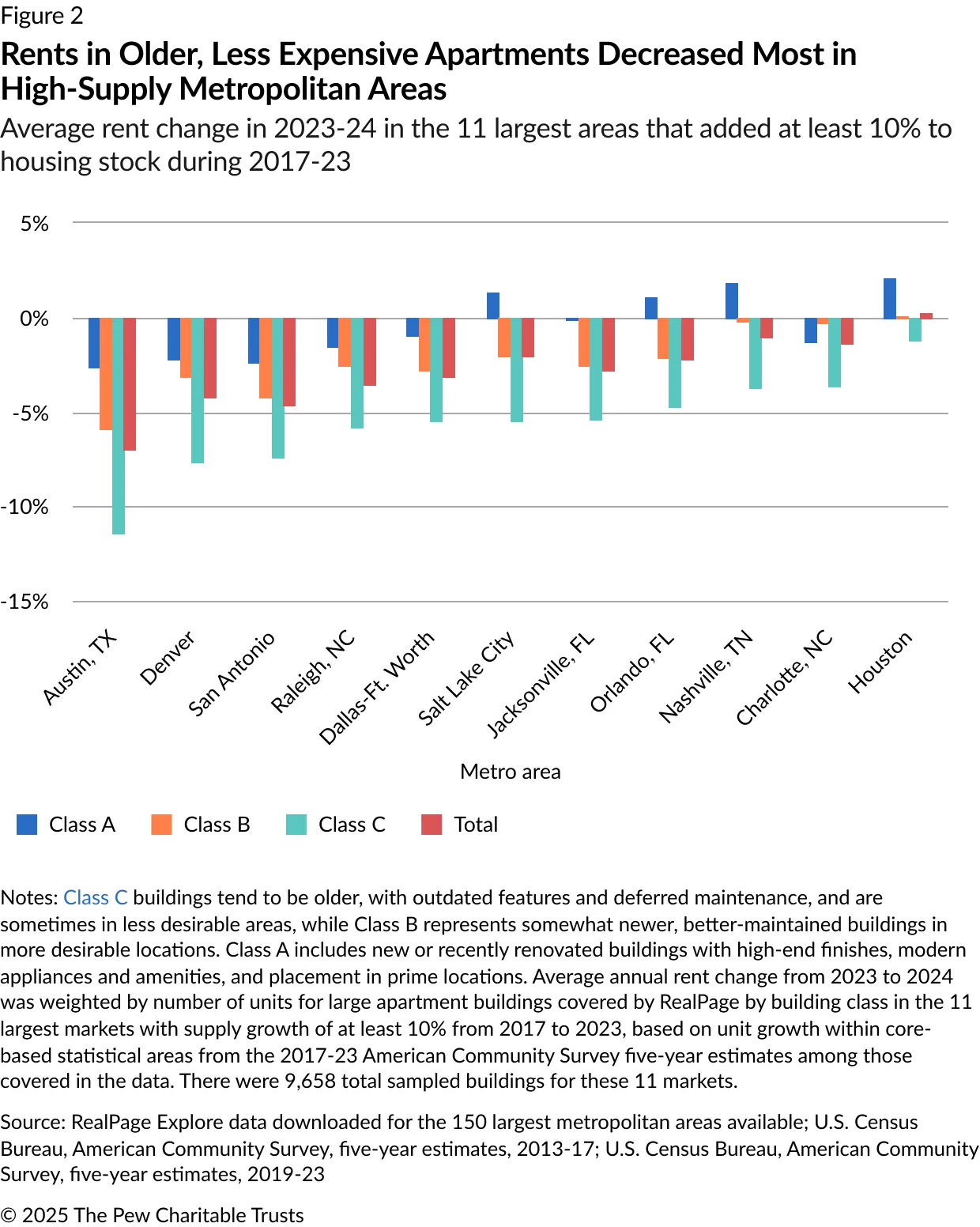

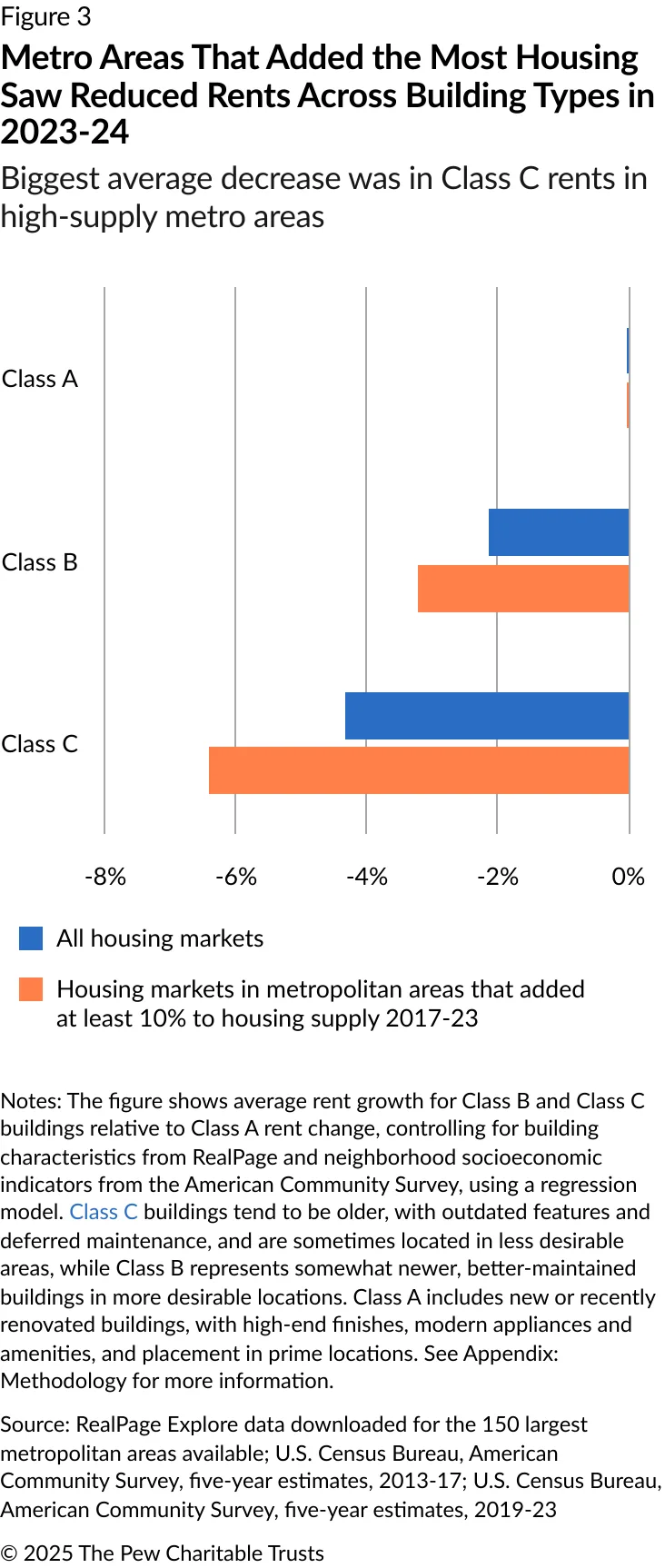

- Class C apartments (older, lower-cost units) saw the biggest rent drops in metro areas with at least 10% housing growth, proving supply growth supports affordability.

A Widening Affordability Gap

Renters in low-income neighborhoods are hit hardest when housing is scarce. Pew data shows that rent growth in the lowest-income ZIP codes far outpaced that of wealthier areas between 2017 and 2024.

In that period, rents rose 49% nationwide, driven by a shortage of 4 to 7M homes. When not enough housing is built in high-income areas, renters tend to move down-market. This creates a chain reaction that squeezes low-income neighborhoods the most.

Supply Growth Eases Pressure

Adding more housing helps. ZIP codes that grew their housing stock by at least 10% from 2017 to 2023 saw rents rise 1.4% less than in areas with no growth.

At the metro level, a 10% increase in housing stock led to a 5% slower rent increase overall. And the biggest relief was in older buildings, where the need is greatest.

Class C Units See Biggest Declines

In high-growth metros like Austin and Minneapolis, rents in Class C apartments dropped the most from 2023 to 2024. These buildings are typically older and less expensive.

Though new apartments are often high-end, they relieve pressure on older units by reducing demand. That benefits lower-income renters directly.

Moving Chains Benefit All

Economist Evan Mast has shown how new buildings in wealthy areas start “moving chains.” High-income renters move into new units, vacating older homes. Those older homes then go to middle- and lower-income renters.

For every 100 new units built, up to 70 homes in lower-income areas can be freed up.

Why It Matters

New housing—no matter the price point—helps curb rent hikes for older, affordable units. Restrictive zoning that blocks new supply drives up rents and deepens inequality.

To protect vulnerable renters and ease displacement, cities must allow more housing across all neighborhoods. The data shows it works—especially for those who need relief the most.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes