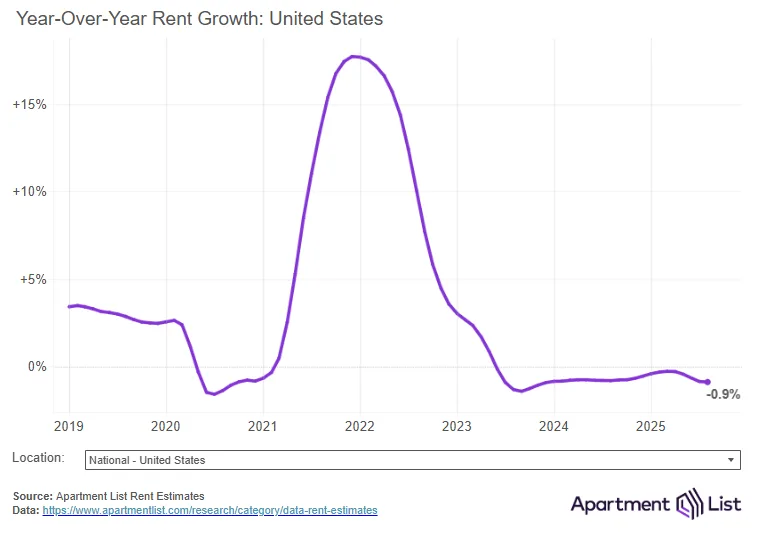

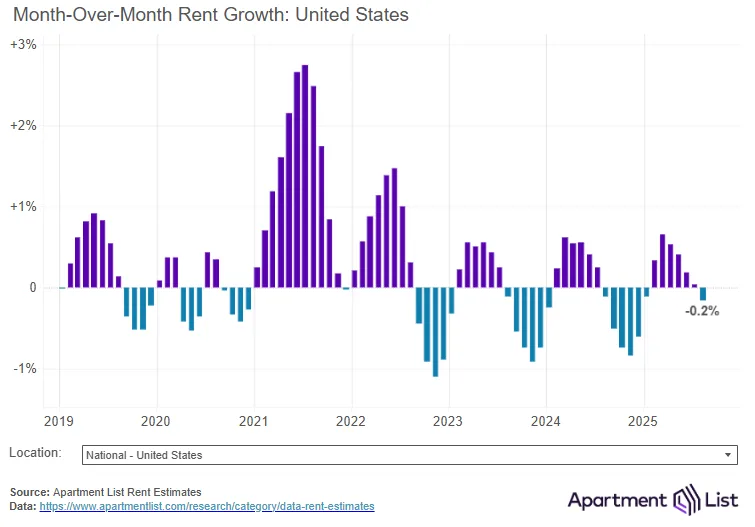

- The US median rent fell 0.2% month-over-month in August and is down 0.9% year-over-year, with rent growth slipping for the fourth consecutive month.

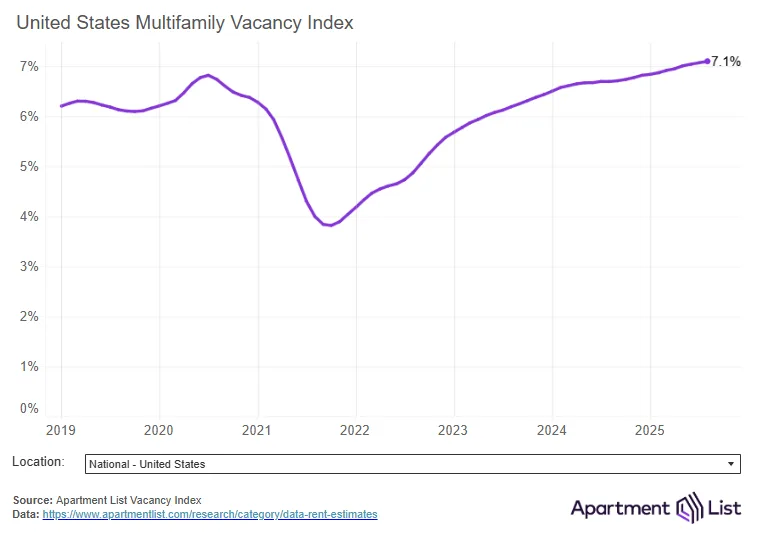

- Multifamily vacancy rates hit an all-time high of 7.1%, driven by a historic wave of new supply that’s still working its way through the market.

- Rents are falling most sharply in Sun Belt markets like Austin (down 6.6% YoY), while San Francisco leads on the upside with 4.7% rent growth.

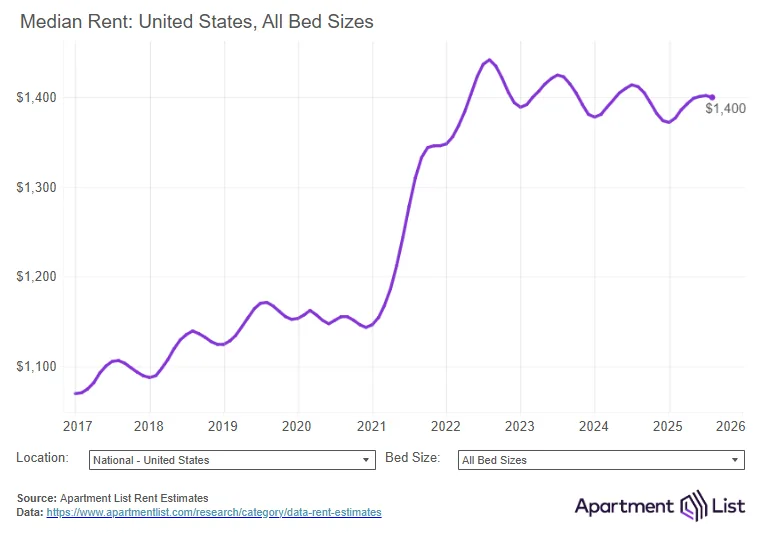

National Rents Begin Seasonal Decline

The national rental market is entering its typical off-season. Median rent in the US dropped 0.2% in August, the first decline since January, bringing the national median to $1,400, reports Apartment List. On a year-over-year basis, rents are down 0.9% — the lowest annual growth rate since December 2023.

August’s decline marks a turning point after monthly rent growth peaked at 0.6% in March. Rents typically weaken heading into fall. However, this year’s decline began slightly earlier than in pre-pandemic years. It’s also part of a broader trend of market softening.

Record-High Vacancy Rate Reflects Wave Of New Supply

A flood of newly completed apartments continues to push up vacancy rates. The national multifamily vacancy rate reached 7.1% in August — the highest on record in Apartment List’s data going back to 2017. While the peak of new deliveries has likely passed, over 243K multifamily units were completed in the first half of 2025, still well above historical norms.

The resulting oversupply has reduced landlords’ pricing power, especially in high-construction markets across the Sun Belt.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

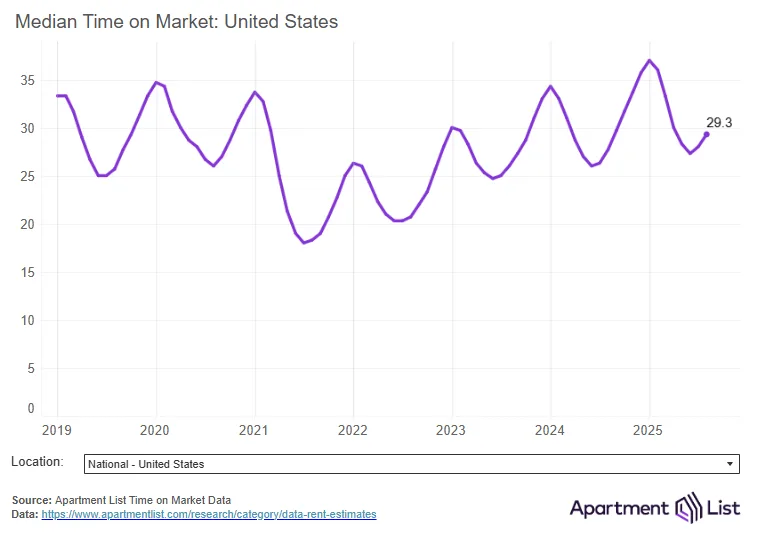

Units Sitting On The Market Longer

As supply increases, leasing velocity is slowing. The average time to lease a unit rose to 29 days in August, up from 28 days in July and two days longer than the same period last year. Though down from a January high of 37 days, this uptick reflects weaker renter demand heading into fall.

Sun Belt Rent Drops, Bay Area Rebounds

Rent trends remain highly regional. In Austin, the median rent dropped 6.6% year-over-year — the steepest decline among major metros — and is now 18% below its 2022 peak. Austin leads the nation in new home permitting, illustrating how fresh supply continues to pressure rents.

Other markets with major rent drops include Phoenix, Denver, and Raleigh, all of which have seen elevated levels of multifamily development.

In contrast, the San Francisco metro posted the strongest YoY rent growth (+4.7%), with the city of San Francisco itself seeing an 11.5% jump. Despite this surge, rents in the region are just now recovering to pre-pandemic levels. Additional strength is showing in urban Midwest and East Coast metros like Chicago, Providence, and Virginia Beach.

Why It Matters

Softening rents and rising vacancies are key indicators of a market struggling to absorb a historic construction boom. While this presents challenges for landlords and developers, it’s welcome relief for renters after years of sharp increases. The average national rent remains 22% higher than in January 2021 — despite the recent pullback.

What’s Next

The pipeline of multifamily supply remains elevated but is expected to taper off into 2026. A rebalancing may eventually lead to firmer market conditions. For now, however, oversupply and shifting macroeconomic factors — including policy uncertainty — are likely to keep rent growth muted.

According to Apartment List, the market still has a way to go before it fully digests the rapid expansion in rental housing stock.