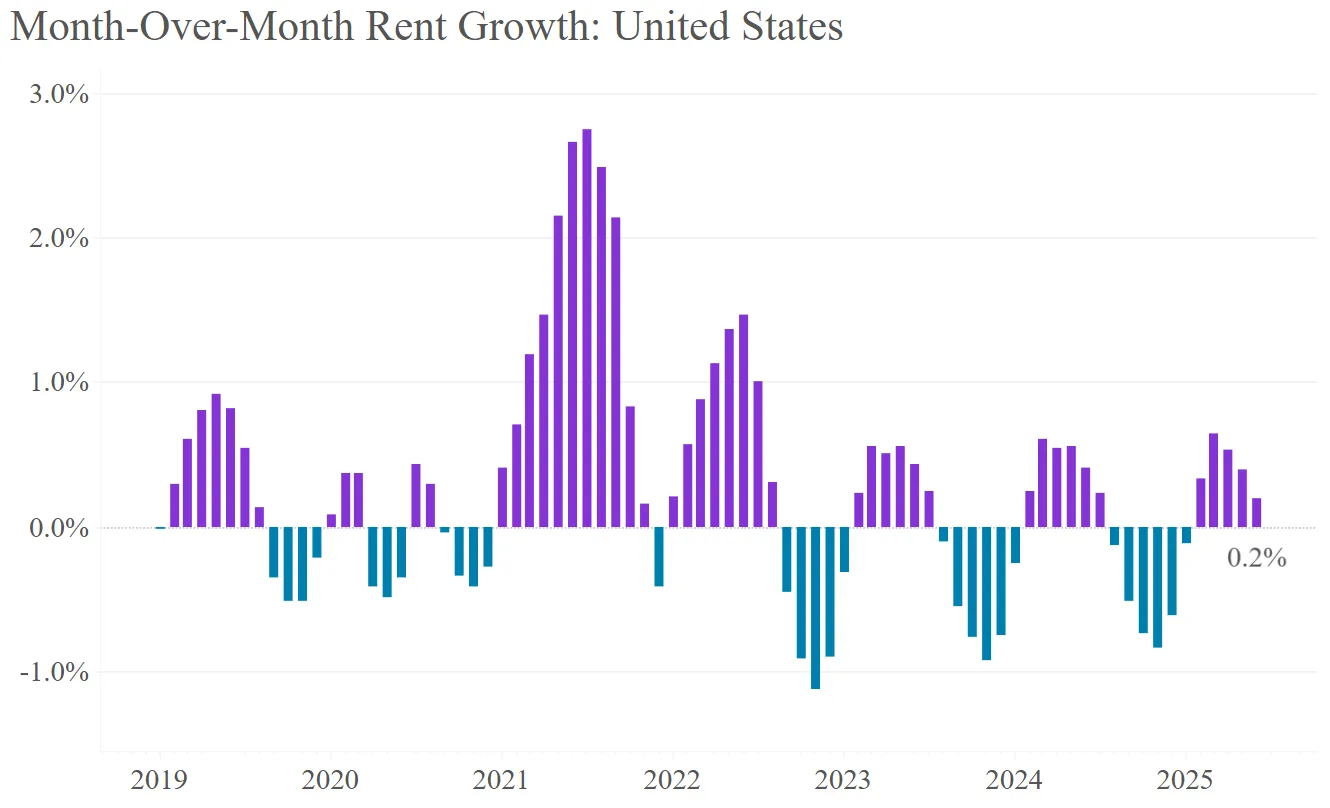

- Rent growth rose 0.2% in June, but gains are slowing despite peak leasing season.rn

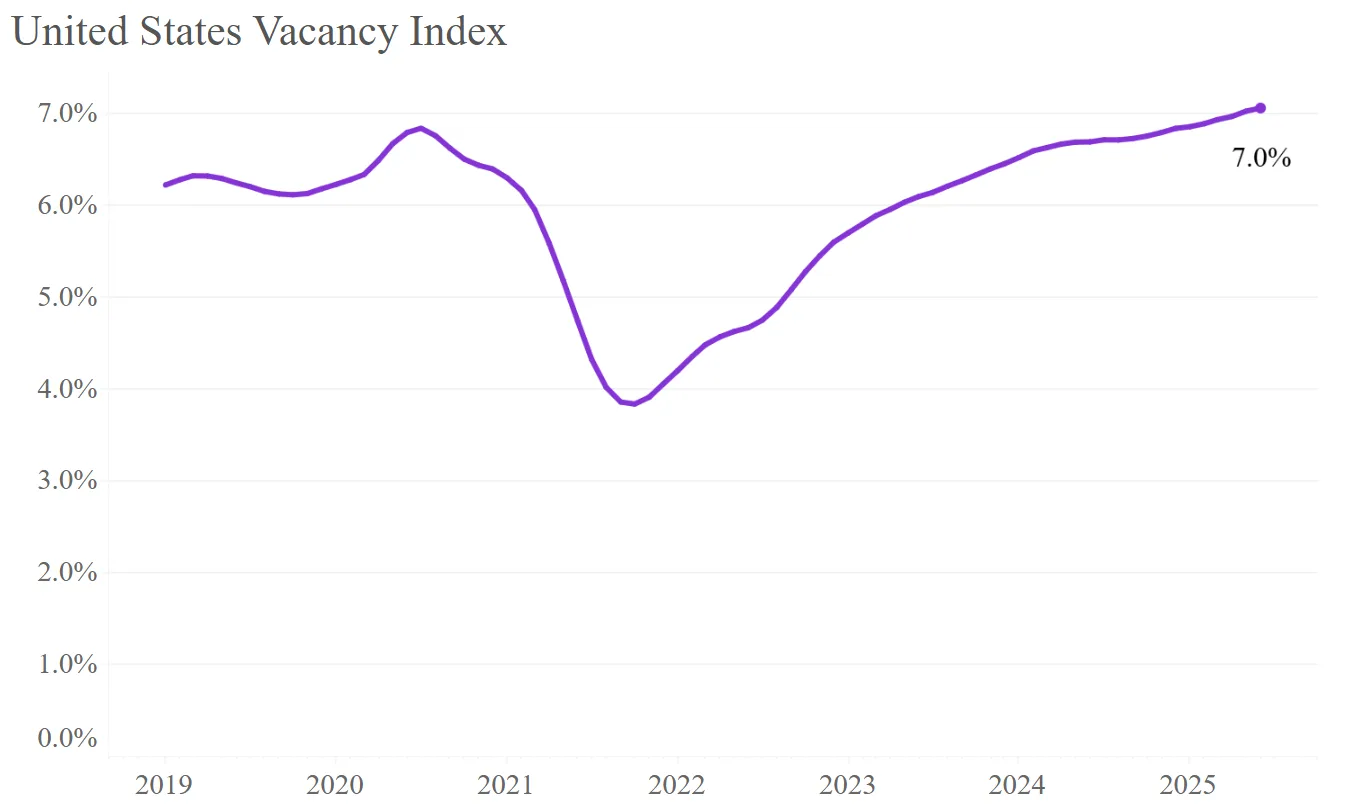

- Vacancy rate hit 7%, the highest on record due to a surge in multifamily supply.rn

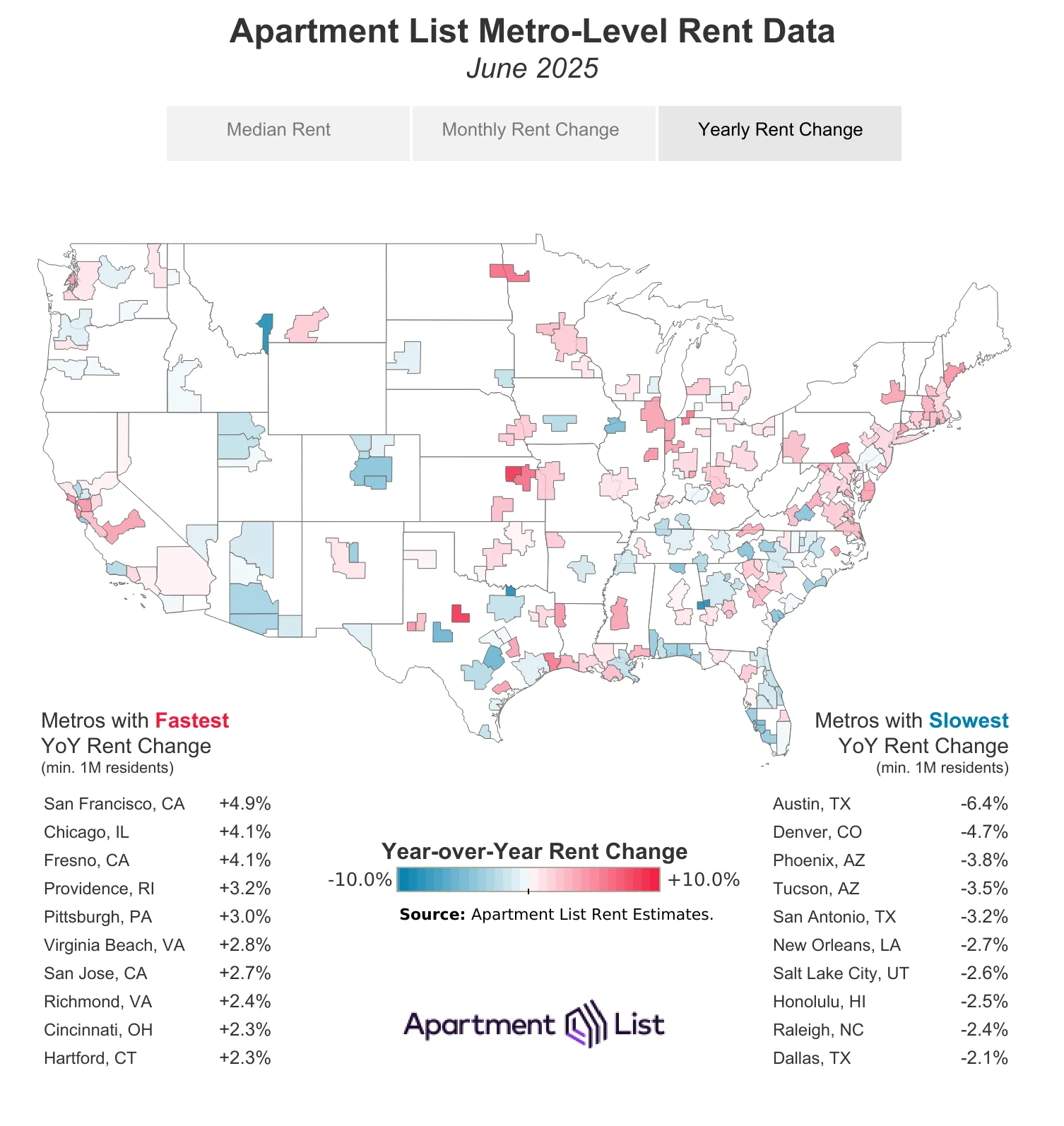

- Austin rents fell 6.4%, while San Francisco posted 4.9% year-over-year growth.rn

- List-to-lease time dropped to 27 days, though units still sit longer than usual.rnrnrn

Slower Growth Amid Peak Season

Apartment List reports that rent growth in June registered a modest 0.2%, marking the fifth consecutive monthly increase—but the pace is cooling. After a 0.6% jump in March, growth has slowed each month, bucking seasonal trends typically associated with summer demand.

In dollar terms, the national median rent now stands at $1,401—just $3 more than last month, and $9 less than June 2024. Rents are now 2.8% below their August 2022 peak, though still 22% above January 2021 levels.

Record-High Vacancy: Supply Surge Still Being Absorbed

The US multifamily vacancy rate has climbed to 7%, the highest level since Apartment List began tracking the metric in 2017. The vacancy spike is the direct result of a record-setting year of construction in 2024, when over 600,000 new units hit the market—a 65% increase over 2022.

Although construction starts are now slowing, the market is still working through this large influx of new units, keeping competition high and pricing power low—factors that continue to suppress rent growth despite seasonal demand.

Leasing Times Improve but Remain Elevated

The average time it takes to lease a unit fell to 27 days in June, down from an all-time high of 37 days in January. However, this list-to-lease time is still longer than in previous years, suggesting that renters are taking their time amid broader economic uncertainty.

Regional Divide: Sun Belt Weakness vs. Coastal and Midwest Strength

Rent trends diverge significantly by region. The Sun Belt continues to experience price drops, driven by new supply. Austin, TX, saw rents fall 6.4% year-over-year, the steepest decline among large metros. Other declining markets with high permitting activity include Denver, Phoenix, San Antonio, and Raleigh.

In contrast, San Francisco led the nation with 4.9% annual rent growth, though rents there remain below pre-pandemic levels. The Midwest and Northeast also posted solid gains, with cities like Chicago, Pittsburgh, Providence, and Hartford showing resilience amid national softness.

What’s Next?

While seasonal demand typically supports higher rents during summer, the market is now contending with record-high vacancies and a cooling economy. Macroeconomic uncertainty—especially around tariffs and policy shifts under the Trump administration—is casting a shadow on renter confidence.

Still, with new supply tapering off and vacancies expected to gradually tighten, a rebalancing may be on the horizon. For now, the rental market remains in a holding pattern, with growth subdued and competition for renters intensifying.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes