- National advertised self storage rates rose 0.9% year-over-year in September, signaling the first broad-based rent growth in nearly three years.

- REIT-owned properties led the recovery, posting 2.6% YOY rate growth, compared to just 0.1% for non-REIT competitors.

- Midwest markets—including Detroit (3.6%), Chicago (3.0%), and Minneapolis (2.9%)—outperformed, driven by tight supply and strong multifamily fundamentals.

Rents Are Finally Rising Again

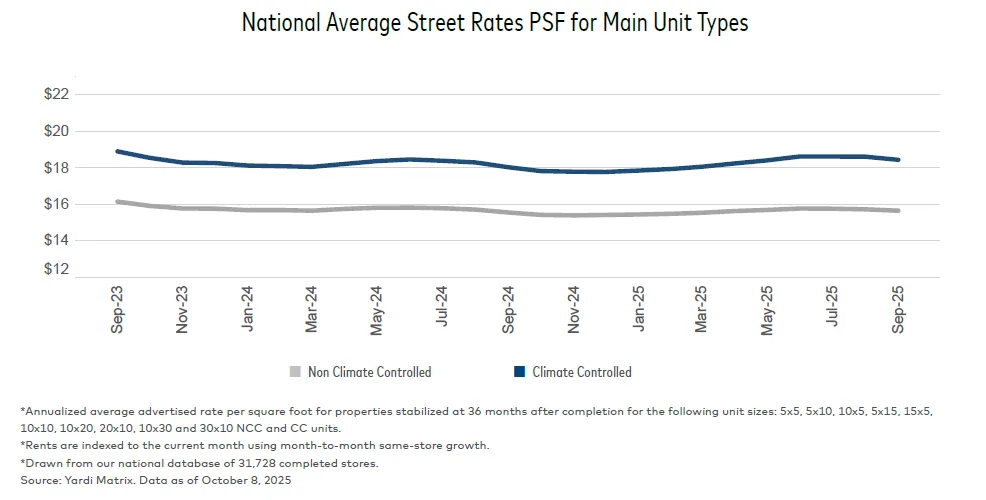

After a prolonged slump, the self storage industry showed signs of a meaningful turnaround in September, reports Yardi Matrix. National advertised rates climbed 0.9% year-over-year, up from just 0.3% in August. The average rate now sits at $16.80 PSF, with both climate-controlled (CC) and non-climate-controlled (NCC) units contributing to the gains.

REITs Take The Lead

Publicly traded self storage REITs are setting the pace. Same-store rents at these properties rose 2.6% year-over-year. In contrast, non-REIT operators posted a marginal gain of just 0.1%. The gap highlights the pricing power of institutional players as they aggressively push rates in stabilized properties.

Midwest Momentum

The strongest rent growth emerged in Midwest metros, where limited new supply and steady demand are creating favorable conditions.

- Detroit led the way with a 3.6% YOY rent jump.

- Chicago and Minneapolis followed closely with 3.0% and 2.9% growth, respectively.

These markets also benefit from resilient multifamily rent growth, which typically correlates with self storage demand.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Supply Trends Diverge By Market

Nationwide, 2.6% of total self storage inventory is under construction, slightly down from 2.7% in August.

- Sarasota–Cape Coral, Tampa, and Phoenix are the most active metros for new supply, with under-construction projects representing over 6% of inventory.

- In contrast, Midwest metros like Indianapolis (0.9%) and Minneapolis (1.7%) face far less competition from new builds.

Resilient Despite Oversupply

Even metros with elevated supply pipelines are seeing stabilization. Sarasota, which delivered nearly 20% of inventory in the past 36 months, still posted 0.6% YOY rent growth after falling 8.6% in 2024. This signals improved absorption and demand, potentially driven by population growth and storm-related relocations.

Why It Matters

With advertised rents back in positive territory and REITs leading the charge, the industry appears to be emerging from a multi-year slump. The Midwest’s strong fundamentals highlight the benefits of supply discipline and demographic support.

What’s Next

As demand stabilizes and supply moderates in most markets, expect continued rate recovery heading into 2026. But markets with rising construction activity—like Nashville and San Antonio—could face headwinds if demand fails to keep pace.