- US median rent for 3-bedroom single-family homes reached $2,135 in H1 2025, up 1.7% year-over-year—still trailing wage growth and inflation.

- Midwest rents grew fastest at +6.1%, followed by the Northeast (+4.6%), outpacing all other regions.

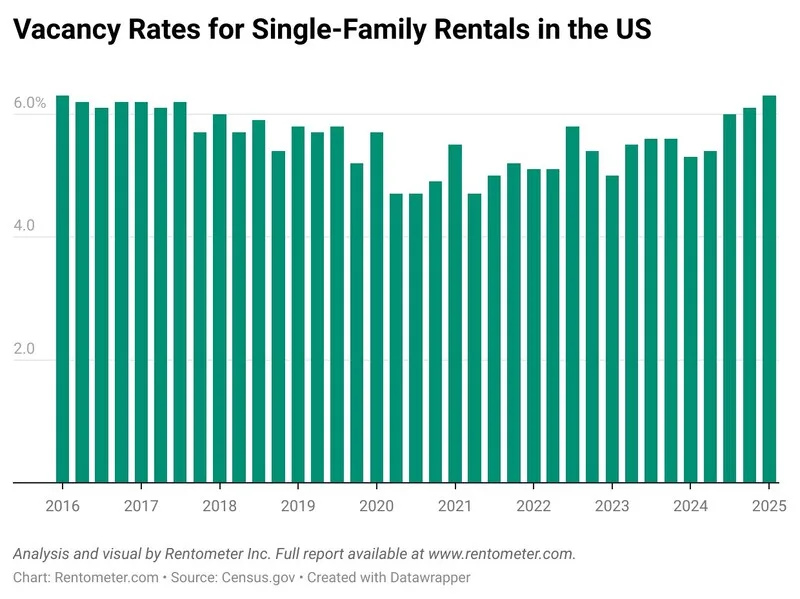

- Single-family rental vacancies hit 6.3% in Q1 2025, the highest since 2016, signaling a market shift.

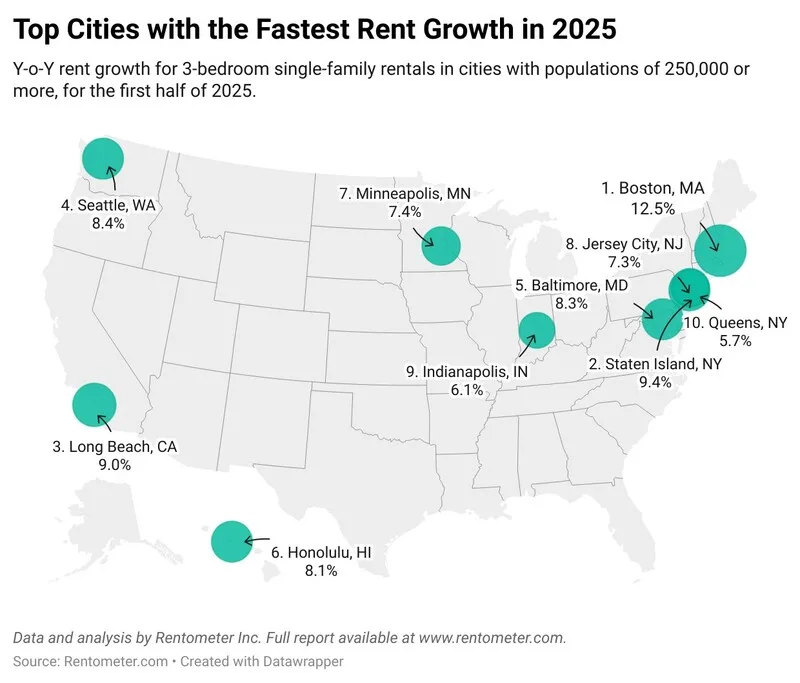

- Boston (+12.5%), Staten Island (+9.4%), and Long Beach (+9.0%) led rent hikes among major cities.

Modest National Rent Gains Amid Growing Vacancies

National rent growth for 3-bedroom single-family homes edged up to 1.7% year-over-year in the first half of 2025, according to Rentometer’s latest mid-year report. The median asking rent now stands at $2,135, a $36 increase from last year. Though stronger than the 0.7% growth posted in early 2024, rents continue to rise more slowly than inflation and average wage growth.

Vacancy rates climbed to 6.3% in Q1 2025—the highest since 2016—driven by new build-to-rent supply and cooling demand. This suggests a shift in market power back toward renters, particularly in oversupplied metros.

Regional Breakdown: Midwest and Northeast Take the Lead

The Midwest posted the strongest rebound in the first half of 2025, with rent growth reaching 6.1% year-over-year—double last year’s pace. Affordable cities like Toledo and Detroit remain attractive to renters, while investor interest is growing due to high rental yields and lower entry costs.

In the Northeast, rents climbed 4.6%, led by Boston’s 12.5% spike to $4,500 for a 3-bedroom home. Smaller cities such as York, PA, and Niagara Falls, NY, also saw double-digit increases.

The Pacific region recorded 3.1% growth, with Seattle seeing an 8.4% jump. Affluent small cities like Palo Alto and Redwood City experienced sharp increases, likely due to tech-driven demand and limited supply.

The Southeast rebounded with 2.7% growth, though performance varied. Florida and Tennessee posted widespread declines, while Alabama and Georgia remained relatively strong.

The Southwest continued to stagnate, with no year-over-year rent growth. Cities like Dallas and Austin saw significant declines, while Phoenix and Albuquerque posted moderate gains.

In the Rocky Mountain region, rents rose by a modest 1.1%. Most major cities remained flat, while areas around Salt Lake City saw price corrections. Billings, MT stood out with a 17% increase.

Price Corrections in Sunbelt Cities, New Highs in Coastal Markets

While Boston posted the highest rent growth among large cities, Staten Island (+9.4%), Long Beach (+9.0%), and Seattle (+8.4%) also saw strong gains. On the flip side, several Sunbelt cities are experiencing market corrections: Fort Wayne (-6.4%), Dallas (-6.3%), and Santa Ana (-5.0%) led declines.

Dallas and Phoenix—build-to-rent hotbeds—have seen a surge in supply, dampening rent growth and pushing vacancy rates higher.

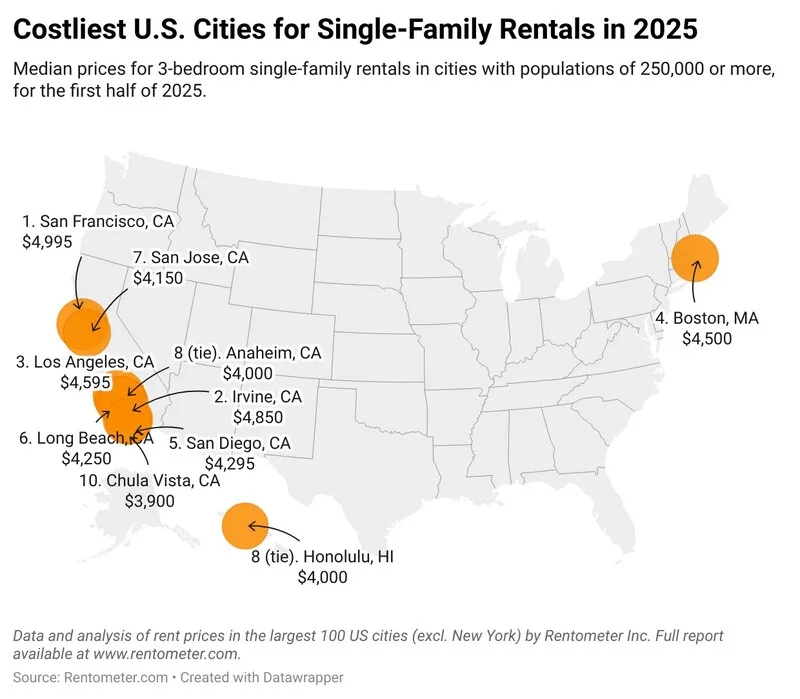

Rent Affordability Worsens in Coastal Cities

Rent growth may be slowing, but affordability remains a concern. Median rents have increased 39.5% over the past five years—outpacing the 23% rise in household income. In cities like San Francisco, Cambridge, and Irvine, renters need annual incomes of $190,000 or more to afford a typical 3-bedroom SFR.

In Cambridge, MA, median asking rents hit $6,000, requiring a household income of $240,000—nearly double the city’s median income.

Midwest Remains the Most Affordable Region

Cities like Toledo ($1,250), Wichita ($1,350), and Flint, MI ($975) offer some of the most affordable single-family rents in the country. In Wichita, the local median income exceeds what’s required to comfortably rent—a rare dynamic in today’s housing market.

Even in Detroit, where rents are affordable, the gap between income and affordability persists, underscoring broader economic disparities in major urban centers.

Market Outlook

Despite rising vacancies and slower rent growth, high mortgage rates and low homebuyer confidence continue to bolster rental demand. Institutional investment remains strong, especially in the build-to-rent segment, suggesting further evolution in the single-family rental market.

Look for regional bifurcation to persist: affordable, high-yield markets in the Midwest and South may attract investors, while demand in high-cost coastal hubs continues to drive luxury rents higher.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes