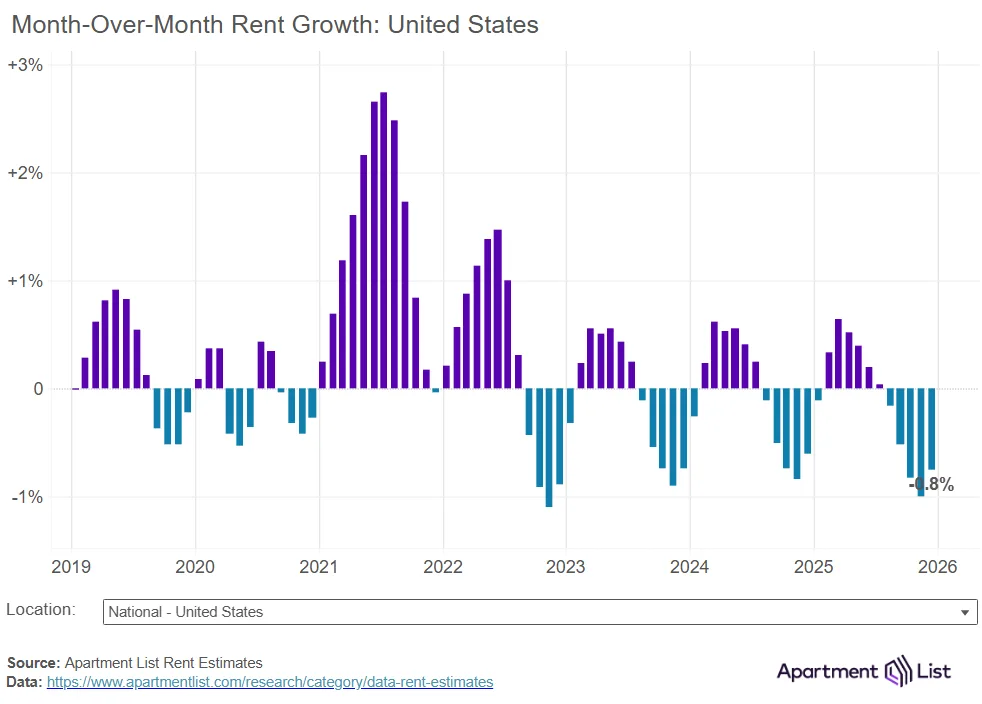

- National median rent declined 0.8% in December to $1,356 — a 1.3% drop year-over-year and 5.9% below its 2022 peak.

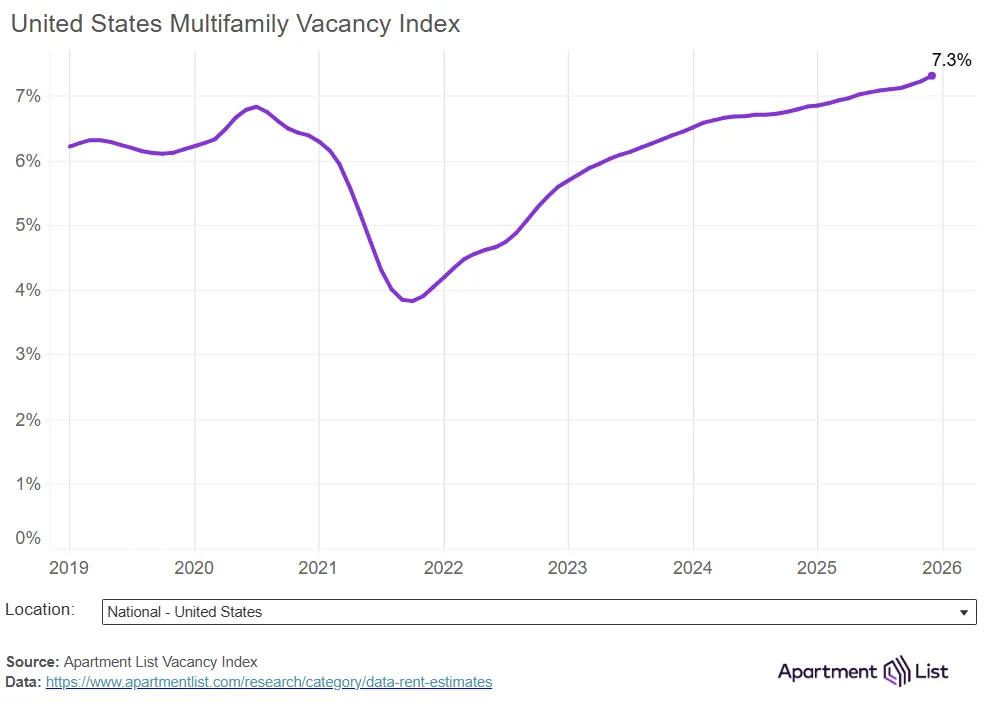

- Vacancy rates hit a record 7.3%, driven by an ongoing wave of new multifamily completions and sluggish demand.

- List-to-lease times reached 39 days, the highest since tracking began, reflecting oversupply and reduced renter urgency.

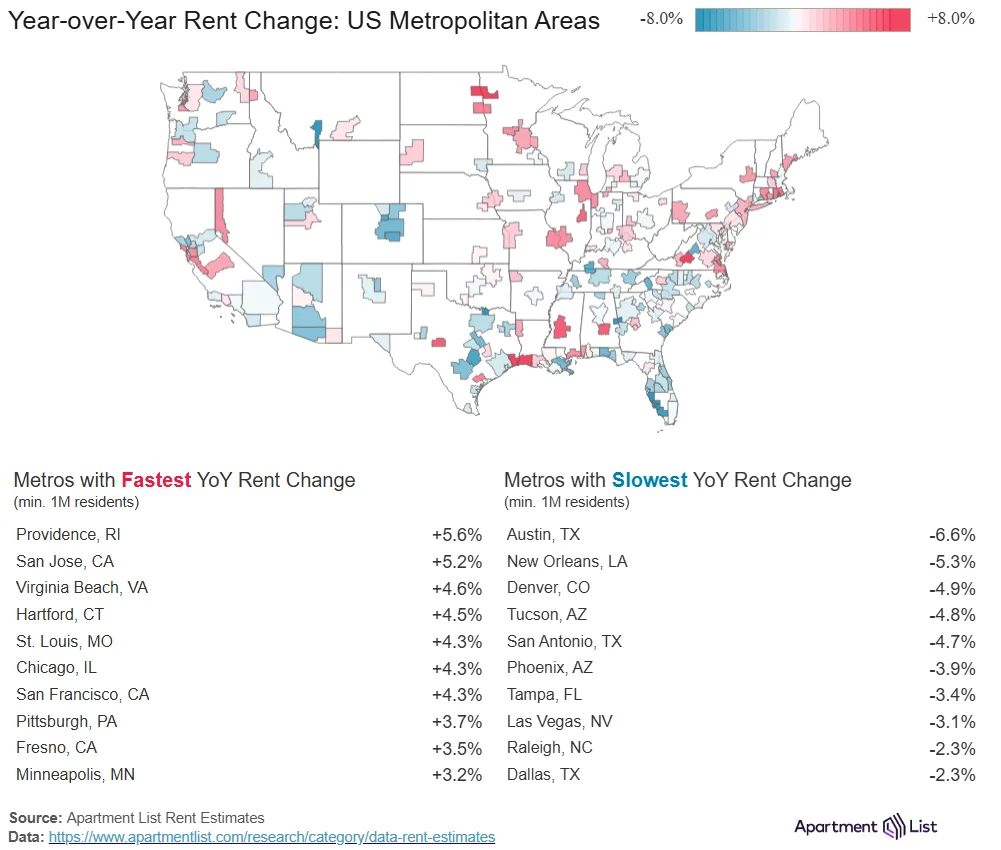

- Sun Belt metros, especially Austin, lead rent declines, while supply-constrained markets like Providence, RI, see continued growth.

A Market Reset: Rents Fall Again to Close Out 2025

The US rental market ended 2025 on a softer note, with national rents falling for the fifth consecutive month. December’s 0.8% drop brought the median rent down to $1,356 — 1.3% lower than a year earlier and nearly 6% below the national peak seen in 2022, according to Apartment List’s latest data.

While some of this decline is seasonal — winter tends to cool the market — the downturn has been steeper and longer-lasting than in years past. Historically, rents peak in May or June, but since 2023, March has marked the high point. This year, rent growth reversed course by August, a month earlier than the pre-pandemic norm.

Oversupply Is Driving the Shift

The primary culprit behind falling rents is not dwindling demand — it’s oversupply. Developers added over 600,000 multifamily units in 2024, the largest annual total since 1986. Although construction has since slowed, the first half of 2025 still saw 243,000 new units come online, 31% higher than the 10-year average.

This deluge of new housing has overwhelmed absorption rates. National vacancy reached 7.3% in December, a new record since Apartment List began tracking in 2017. Units are also lingering on the market longer — averaging 39 days to lease, three days longer than last year and more than double the speed seen during the 2021 boom.

Sun Belt Squeeze: Where Rent Drops Are Sharpest

The rent correction has hit some regions harder than others, especially markets that saw the most construction activity. Among the 54 largest US metros, 51 posted monthly rent declines in December, and 33 showed year-over-year drops.

Austin, TX — where new home permits lead the nation — experienced the steepest decline, with median rents down 6.6% year-over-year and more than 20% off their 2022 highs. Similar trends are playing out in other Sun Belt metros like Phoenix, San Antonio, Denver, and Orlando, where developers built aggressively in recent years. This widespread construction surge has led to localized rent drops, particularly in Florida and Texas, where renters are starting to see more favorable pricing.

Not All Markets Are Cooling

Despite widespread declines, a few markets remain on an upward trajectory. Providence, RI topped all large metros with 5.6% rent growth in 2025. The city continues to benefit from demand spillover from pricier nearby markets like Boston, though its affordability edge is narrowing — rents in Providence are now 40% higher than in early 2020.

These regional differences highlight a deeper structural shift: while oversupply is dampening rents in high-growth metros, tight inventory in older, slower-growing markets is keeping upward pressure on prices.

Outlook: Sluggish Conditions Likely to Persist Into 2026

With construction activity still elevated and the labor market showing signs of weakness, soft conditions in the multifamily sector are expected to continue into the first half of 2026. New supply is still making its way through the pipeline, while demand remains tepid — a combination that could delay a broader market rebound.

As developers and investors reassess strategies in an oversupplied landscape, the new normal may be one where rents are no longer tied solely to seasonal patterns but to broader shifts in supply dynamics, migration, and affordability.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes