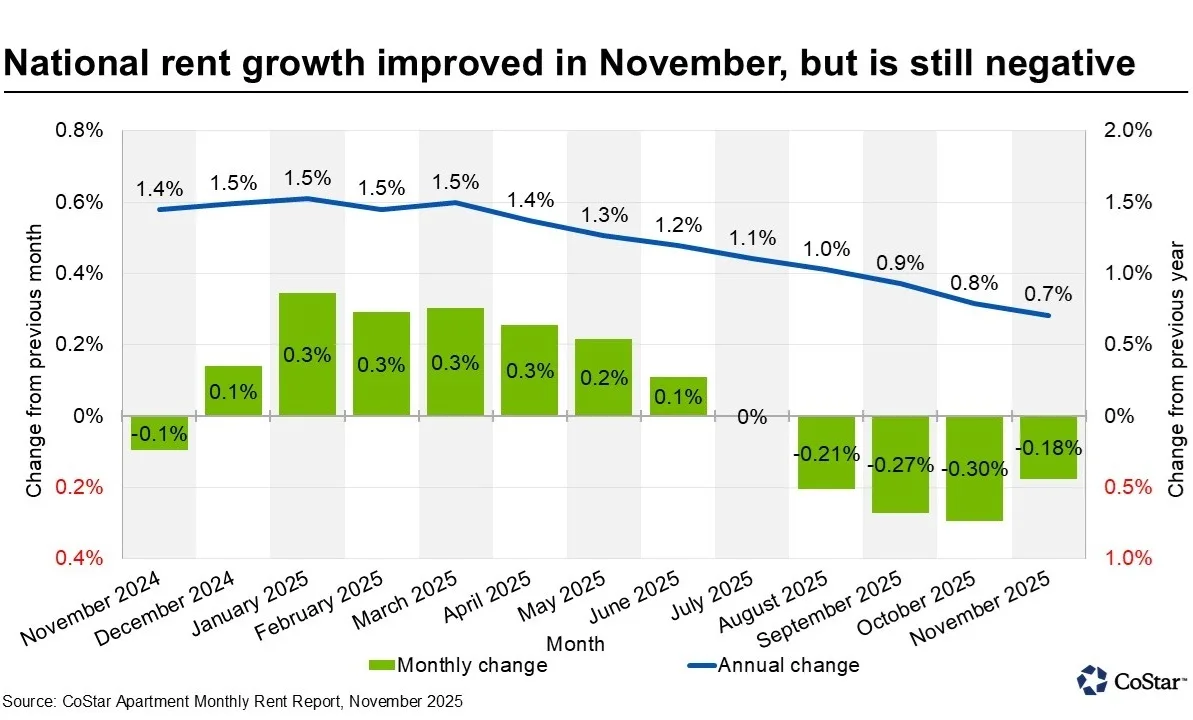

- US apartment rents fell 0.18% in November to $1,706, marking the steepest November decline in over 15 years and the fifth straight month of flat or negative rent change.

- Annual rent growth slowed to 0.7%, down from 0.8% in October and 1.5% at the start of the year.

- All four US regions posted monthly rent declines, led by the West (-0.4%) and South (-0.2%); the Midwest showed resilience, falling just -0.01%.

- Mountain West and Sun Belt metros saw the steepest monthly drops, with Las Vegas (-0.8%), San Antonio, Austin, and Denver (-0.7%) among the hardest hit.

National Overview: A Market Under Pressure

Business Wire reports that the US multifamily market continued to see rent softening in November. National average asking rents fell to $1,706, marking a 0.18% decline from October, according to the latest data from Apartments.com, a CoStar Group platform. While the pace of decline slowed from October’s -0.30%, November’s figures mark the sharpest downturn for the month in more than 15 years.

The report attributes the decline to a combination of seasonal cooling and structural oversupply, noting this is the fifth straight month without positive rent growth. Despite rents remaining slightly above year-ago levels, annual growth has dwindled to just 0.7%, a sharp deceleration from earlier in 2025.

Vacancy and Supply Weigh Heavy

Elevated supply continues to be the dominant force dragging down rent growth. CoStar reports that the national multifamily vacancy rate climbed to 8.4% in Q4, up from 8.26% earlier this year. This uptick is driven largely by rising vacancies in stabilized properties, even as lease-ups of new construction show some absorption.

Markets that have seen the most aggressive building activity — particularly in the Sun Belt and Mountain West — are now feeling the squeeze, with oversupply far outpacing demand in several metros.

Regional & Metro-Level Trends

All US regions posted rent declines in November:

- West: -0.4%

- South: -0.2%

- Northeast: -0.1%

- Midwest: -0.01%

On an annual basis, the Midwest (+2.2%) and Northeast (+1.7%) outperformed, benefiting from more constrained supply pipelines. Meanwhile, the West (-1.5%) and South (-0.1%) lagged, reflecting heavier development activity and weaker absorption.

Metro-level standouts include:

Top Monthly Declines:

- Las Vegas (-0.8%)

- San Antonio, Austin, Denver (-0.7% each)

- Salt Lake City, Raleigh, Portland (-0.6% each)

Top Annual Growth:

- San Francisco (+5.6%)

- San Jose (+3.6%)

- Chicago (+3.4%)

- Norfolk (+3.3%)

Worst Annual Performance:

- Austin (-4.7%)

- Denver (-3.6%)

- Phoenix (-3.2%)

Markets with the most severe monthly and annual declines share a common thread: oversupply and rising vacancy, often paired with weakened demand due to layoffs or slowing local economies.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Outlook: Uneven Recovery Ahead

While multifamily supply pipelines are beginning to taper in some regions, inventory overhang remains a challenge, especially for high-growth metros that have added significant units over the past two years.

According to CoStar’s Grant Montgomery, the path to rent recovery will vary widely depending on regional demand dynamics, employment conditions, and how quickly new supply can be absorbed. Builder sentiment has also shown signs of weakening in recent months, reflecting broader economic pressures that may slow future construction activity and shift market dynamics heading into 2026.