- US average rents fell to $1,708 in October, a 0.3% month-over-month drop — the steepest October decline in over 15 years, according to Apartments.com.

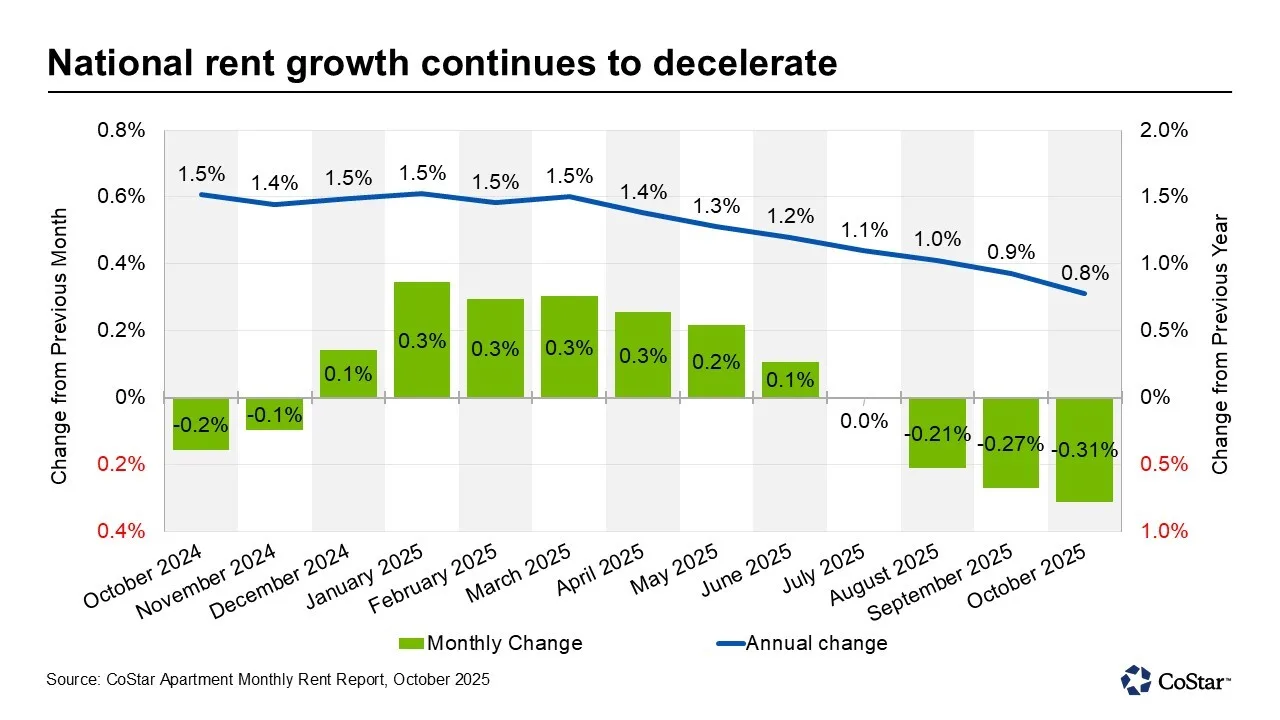

- Rent growth has slowed to 0.8% annually, down from 1.5% at the start of 2025, as elevated supply continues to pressure pricing across all regions.

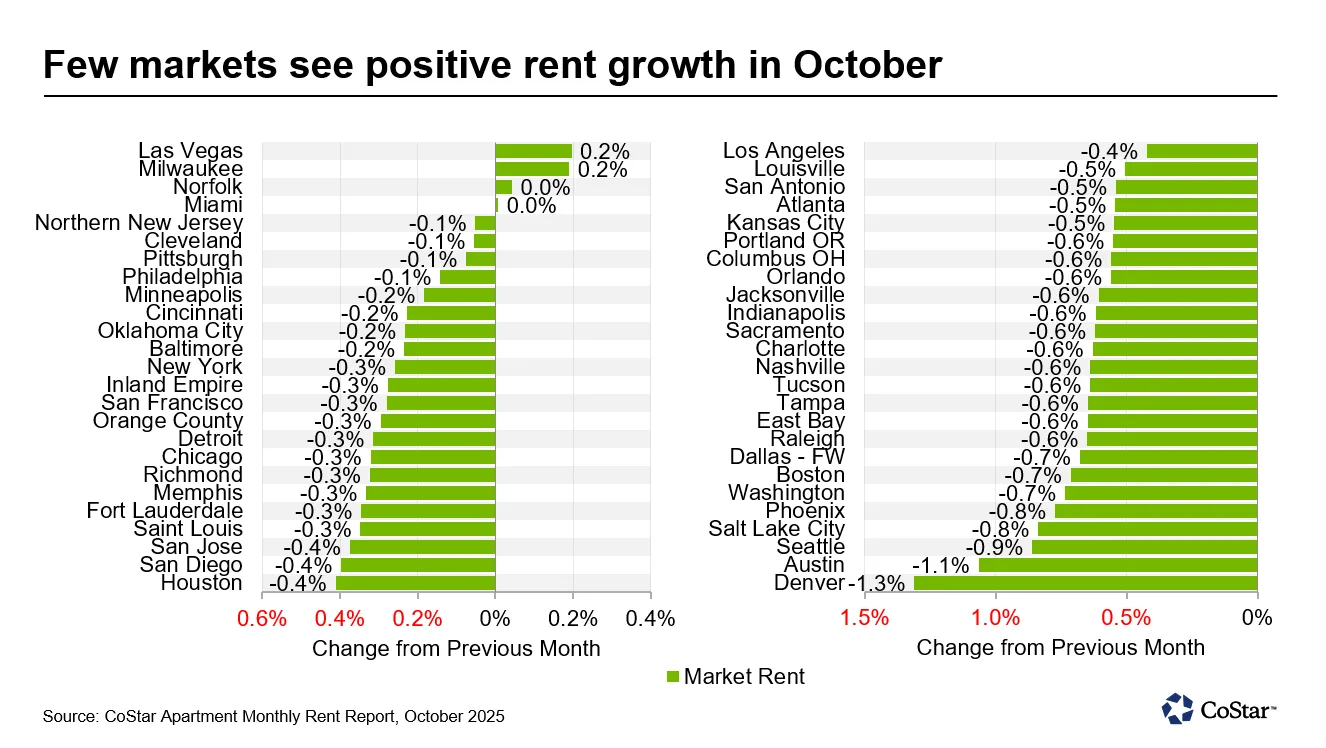

- Denver, Austin, and Seattle saw the steepest monthly rent declines, while cities like San Francisco and Chicago posted strong year-over-year gains.

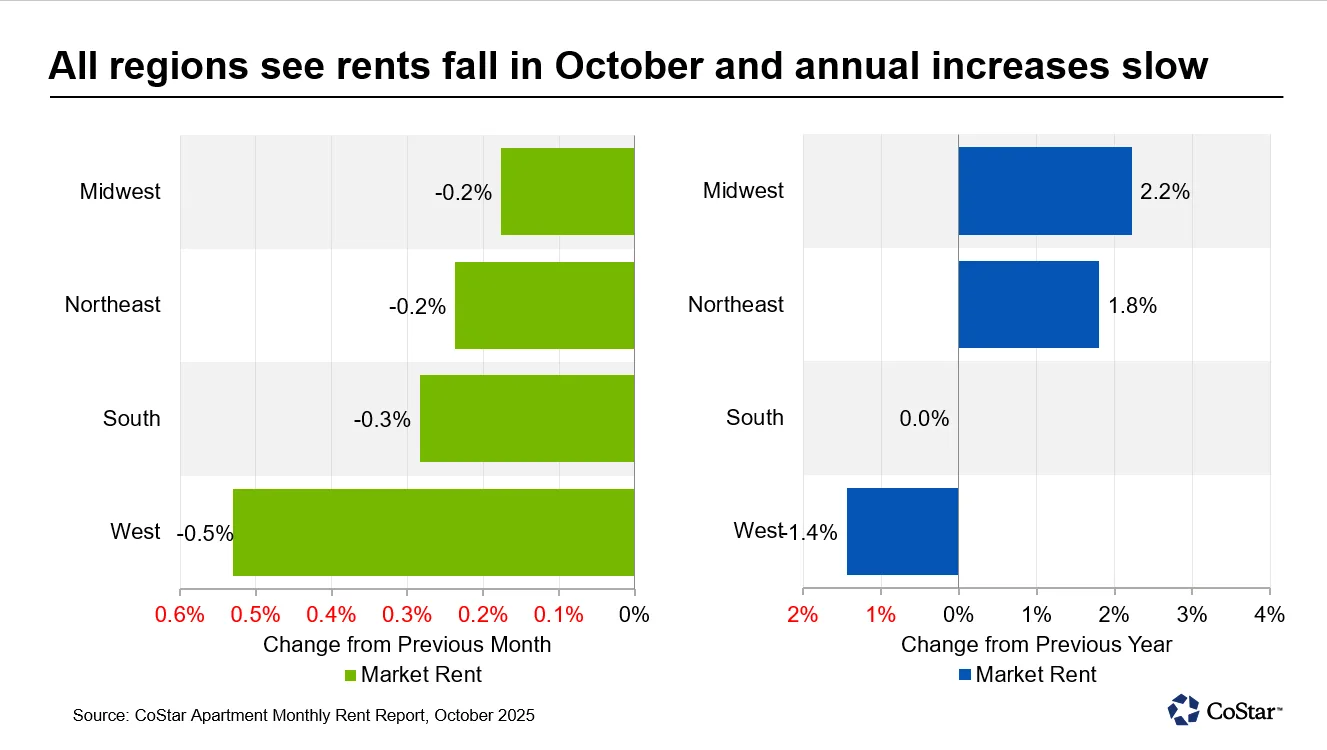

- All four US regions experienced monthly rent decreases, with the West seeing the largest drop at -0.53%.

Supply Surge Outpaces Demand

US apartment rents declined in October for the fourth consecutive month, falling 0.3% to a national average of $1,708, per the latest Apartments.com report. That makes October 2025 the sharpest decline for the month in over 15 years and part of a broader cooling trend driven by record levels of new multifamily construction.

According to CoStar, three of the five most significant monthly rent drops in the past 15 years have now occurred in August, September, and October of this year.

Regional Snapshot: Declines Across the Board

All four major US regions posted rent declines in October:

- West: -0.53%

- South: -0.28%

- Northeast: -0.24%

- Midwest: -0.18%

On an annual basis, the Midwest continues to outperform with +2.2% rent growth, followed by the Northeast at +1.8%. Rents in the South were flat year-over-year, while the West posted a -1.4% decline.

Markets Under Pressure

Cities with high construction pipelines are facing the most severe declines:

- Denver: -1.3% (monthly)

- Austin: -1.1%

- Seattle: -0.9%

- Salt Lake City and Phoenix: -0.8% each

These Sun Belt and Mountain West markets continue to struggle with elevated vacancies. Seattle’s decline may also be tied to recent job cuts at Amazon, dampening renter demand.

Bright Spots Remain

Despite the national slowdown, some metros posted positive annual rent growth:

- San Francisco: +5.8%

- San Jose: +3.8%

- Chicago: +3.6%

- Norfolk: +3.0%

Markets with tighter supply and more stable economic drivers are proving more resilient in the face of broader market pressures.

What’s Next

CoStar predicts a turning point in late 2025, with Q4 expected to be the first time since mid-2021 that absorption outpaces new supply. As construction slows and existing inventory gets leased, vacancies could begin to recede by 2026.

Still, with the national rent growth rate now at its lowest level since 2020, the next 12 months are likely to be shaped by the delicate balance of demand recovery and construction slowdown.

Bottom Line

The steep October rent drop underscores a new phase in the US multifamily market. With supply pressure easing gradually and renter demand remaining resilient, conditions may stabilize in 2026 — but for now, the market remains in correction mode.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes