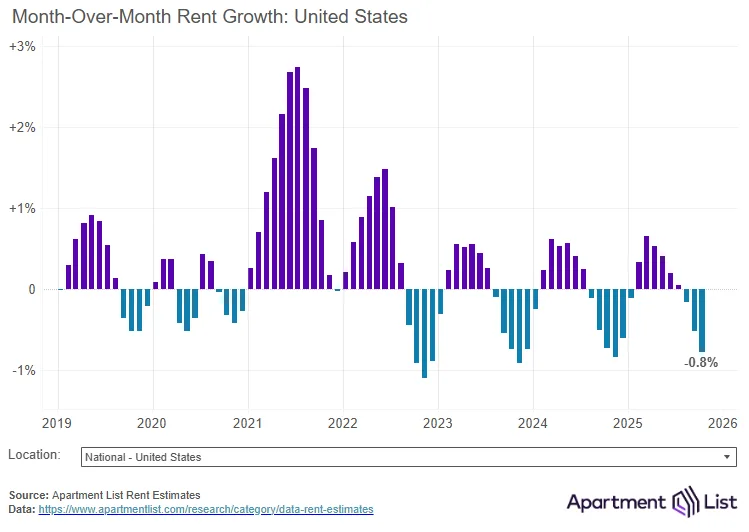

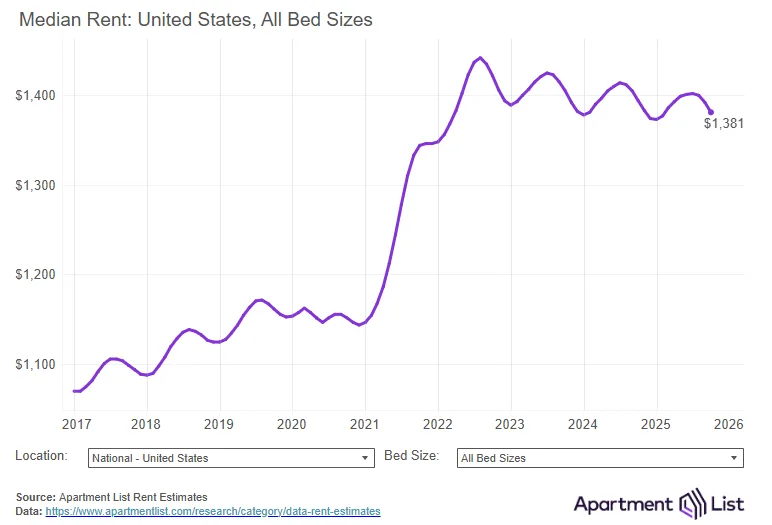

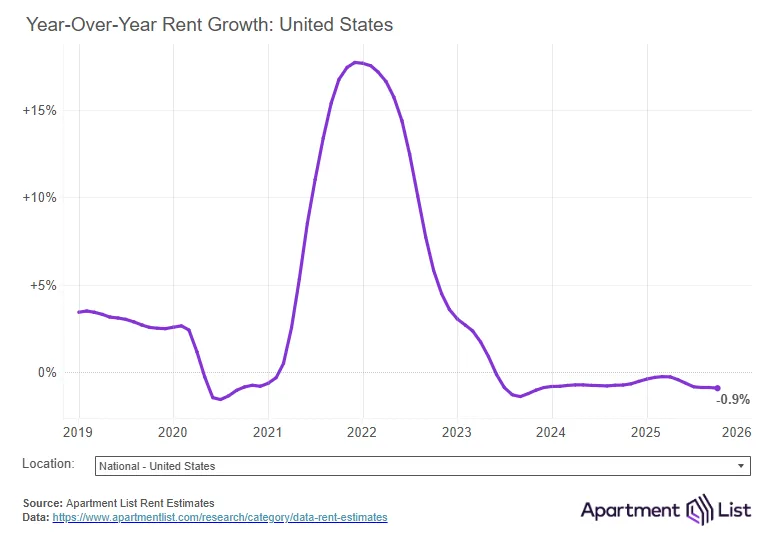

- Rent decline continued in October, with national median rent down 0.8% month-over-month and 0.9% year-over-year.

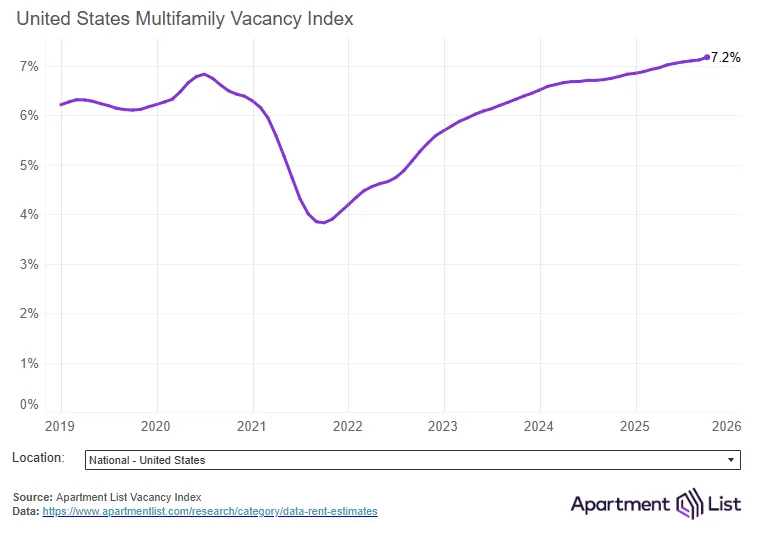

- Vacancy rate reached a record 7.2% amid elevated multifamily supply and slowing renter demand.

- List-to-lease times rose to 33 days, signaling weaker market conditions.

- Sun Belt metros like Austin saw the sharpest rent drops, while Providence led rent growth.

Rents Continue To Slide As Off-Season Sets In

National rents fell 0.8% in October as seasonal cooling and oversupply continue to soften the US rental market, reports ApartmentList. October was the third straight month of rent declines, with the median at $1,381—down $13 from last year and 4.2% below peak.

Despite the pullback, current rent levels remain 21% higher than in January 2021, reflecting the lingering effects of the pandemic-era surge. Year-over-year rent growth remains slightly negative at -0.9%, holding steady over the past three months after dipping for five consecutive months.

Vacancy Rates Reach New High Amid Supply Glut

The national multifamily vacancy rate hit 7.2% in October, the highest level in Apartment List’s index since 2017. The spike follows over 600K new units delivered in 2024—the largest annual supply since the 1980s. Although completions are starting to decline, ongoing construction activity remains elevated above historical norms.

The result: increased competition among landlords, longer leasing times, and less pricing power.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

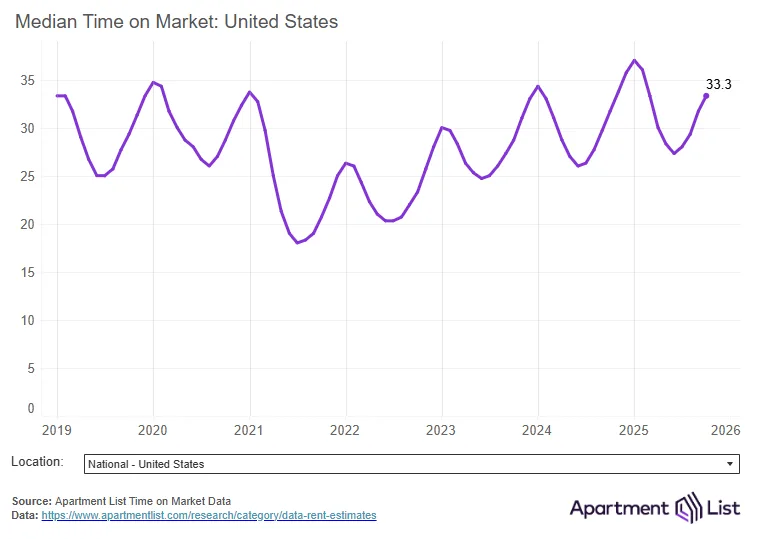

Units Sitting Longer On The Market

October marked the fourth consecutive month of rising list-to-lease times, with the national average increasing to 33 days. That’s one day longer than last month and up 12 days from the tight 2021 market. While some of this is seasonal, it also reflects weakening renter demand amid macroeconomic uncertainty, including a shakier labor market.

Regional Divergence: Sun Belt Softness VS. Northeast Gains

Rent declines are widespread, with 50 of the 54 largest US metros seeing monthly drops. But year-over-year trends vary widely by region. The most pronounced softening is in high-supply Sun Belt metros, where Austin leads with a 6.5% annual rent drop and a 20% decline from its 2022 peak. Other metros like Denver, Phoenix, and Orlando follow similar patterns, all linked by heavy multifamily permitting activity.

In contrast, Providence, RI now holds the top spot for year-over-year rent growth at 5.3%, driven by strong demand from renters priced out of nearby Boston. The region’s median rent is now 41% higher than in early 2020.

Looking Ahead

The current softness in the rental market is expected to persist through year-end. With new supply still entering the market and renter demand potentially dampened by economic headwinds, rent growth and occupancy levels may remain muted well into 2026. However, as construction activity slows and excess inventory is absorbed, analysts anticipate a gradual return to more balanced conditions.