- US apartment occupancy dropped to 94.8% in November, marking a four-month slide and the first year-over-year decline since August 2024.

- Effective asking rents fell 0.4% month-over-month and 0.7% annually — the steepest annual decline since March 2021.

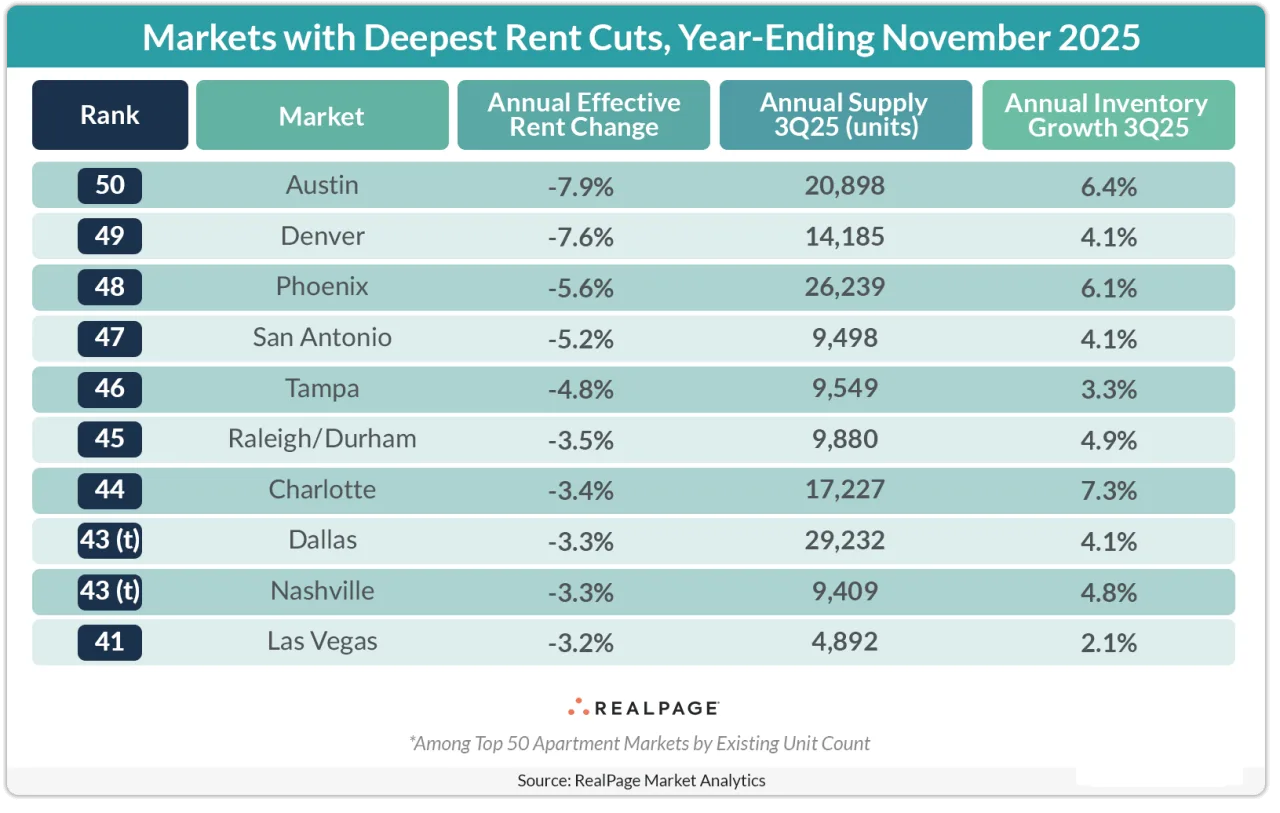

- The South and West continue to see the largest rent cuts, especially in supply-heavy and tourism-driven markets like Austin, Tampa, and Las Vegas.

- Tech-focused markets such as San Francisco, San Jose, and New York are rebounding, posting annual rent growth between 4% and 7%.

Occupancy Falls Below Full Mark

Occupancy across US apartments dipped to 94.8% in November, according to RealPage Market Analytics. This marks a drop below the 95% threshold commonly viewed as “full” occupancy. It was the fourth consecutive monthly decline and a 70-basis-point slide since July. November also marked the first annual occupancy drop in over a year.

Rent Cuts Persist, But Stabilize

Effective asking rents continued to slide, dropping 0.4% from October and 0.7% year-over-year. While rent reductions remain the deepest since early 2021, the rate of decline appears to be stabilizing. November matched October’s annual pace, signaling a possible end to the recent streak of intensifying cuts.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Regional Trends: South And West Feel The Pinch

The South and West regions continue to experience the sharpest declines. In the South, which hasn’t seen any rent growth since mid-2023 due to a flood of new supply, rent cuts eased slightly in November after seven months of steeper declines. The West followed a similar pattern, posting slower rent reductions after four months of sharper losses.

Markets like Austin, Phoenix, Charlotte, and Denver remain under pressure due to elevated supply levels. Meanwhile, tourism-dependent metros such as Tampa, Nashville, and Las Vegas saw deeper rent cuts — a sign that economic sensitivity may be impacting discretionary spending in those areas.

Tech Hubs Drive Rent Growth

While many markets are softening, tech-heavy cities are rebounding. San Francisco, San Jose, and New York all posted strong annual rent growth — ranging from 4% to 7% — fueled by renewed demand and optimism in sectors like artificial intelligence.

Midwestern and secondary markets such as Chicago, Cincinnati, Minneapolis, and Virginia Beach also saw gains. St. Louis made an unexpected appearance among the top-performing metros in November.

Why It Matters

The US apartment market is cooling — especially in overbuilt regions — but rent cuts appear to be moderating. Occupancy trends suggest further softness could lie ahead, but resilience in tech and Midwest markets points to a more nuanced national picture. For investors and operators, understanding these micro-trends will be key as the market moves into 2025.