- REITs are expected to outperform in 2026, as two major valuation gaps—between public and private real estate, and between REITs and broader equities—begin to close. Historical patterns suggest these convergences favor REIT gains.

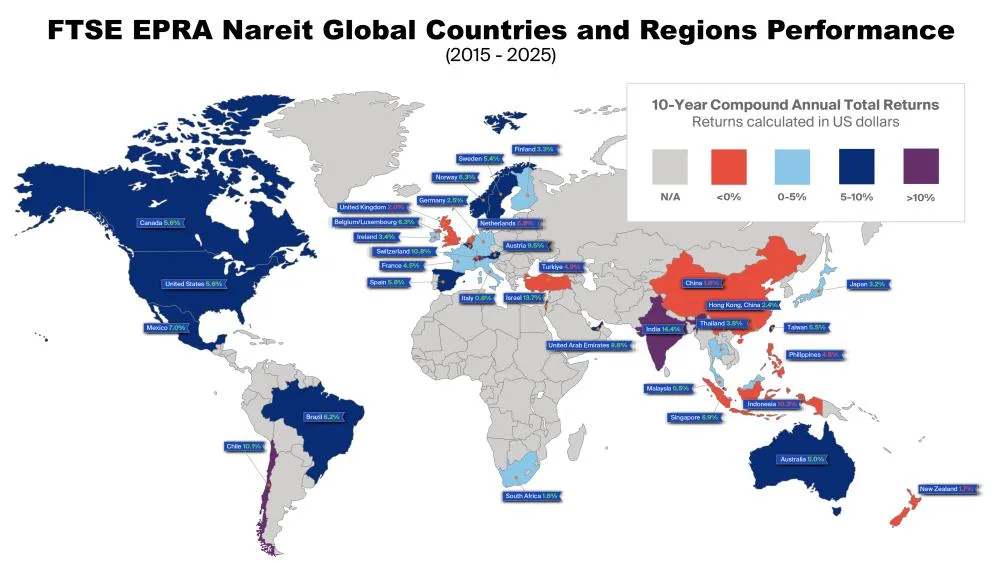

- Global real estate markets showed surprising divergence in 2025, with Asia and Europe outperforming North America. This highlighted the benefits of international diversification, especially in a world of rising trade fragmentation.

- Active managers are reallocating globally, favoring high-performing sectors like health care in Europe and diversified REITs in Asia, while reducing overweight positions in underperforming U.S. sectors like data centers.

Divergence Today, Convergence Tomorrow

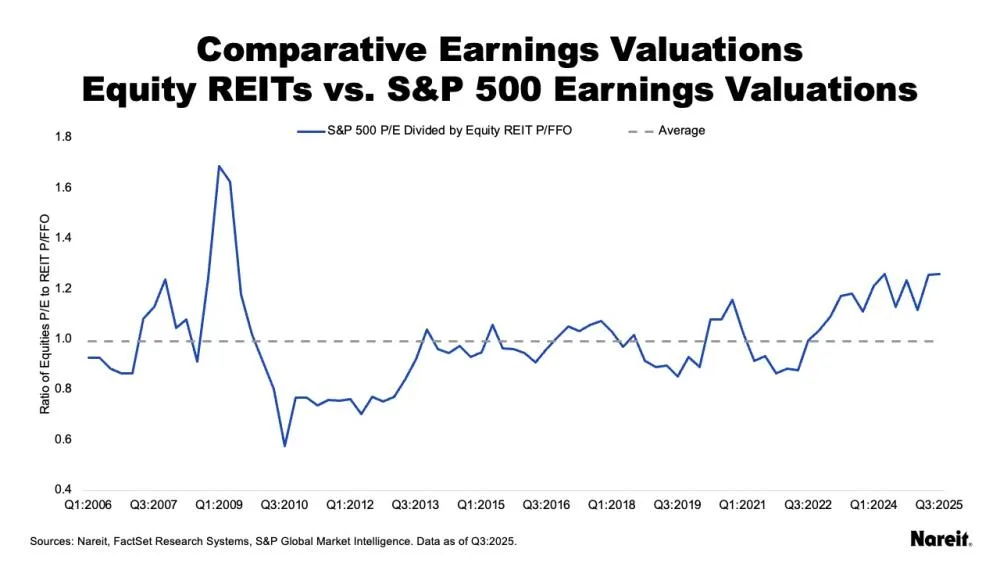

Despite resilient operational performance in 2025—including FFO up 6.2% and dividends up 6.3%—REITs spent much of the year undervalued compared to tech-driven equity markets and private real estate. According to Nareit’s 2026 Outlook, this divergence now rivals gaps last seen during the global financial crisis and early pandemic era.

In 2026, Nareit expects a reversion to the mean, with public-private cap rate spreads (still over 100 basis points) likely to narrow. Historically, such convergences have resulted in strong REIT outperformance, with past cycles showing four-quarter return gaps as wide as 124.7% in REITs’ favor.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

REITs Well-Positioned for the Upside

REITs enter 2026 with low leverage, reliable capital access, and a balanced debt structure that insulates them from high interest rates. Their operational stability and capital flexibility make them better equipped than private peers to act on acquisition opportunities as market dislocations correct.

Furthermore, investor uncertainty—fueled by geopolitical tensions, policy shifts, and a government shutdown in 2025—appears to be easing. With the Fed beginning to cut rates and macro indicators stabilizing, the backdrop for REITs is improving.

Institutional Adoption Deepens

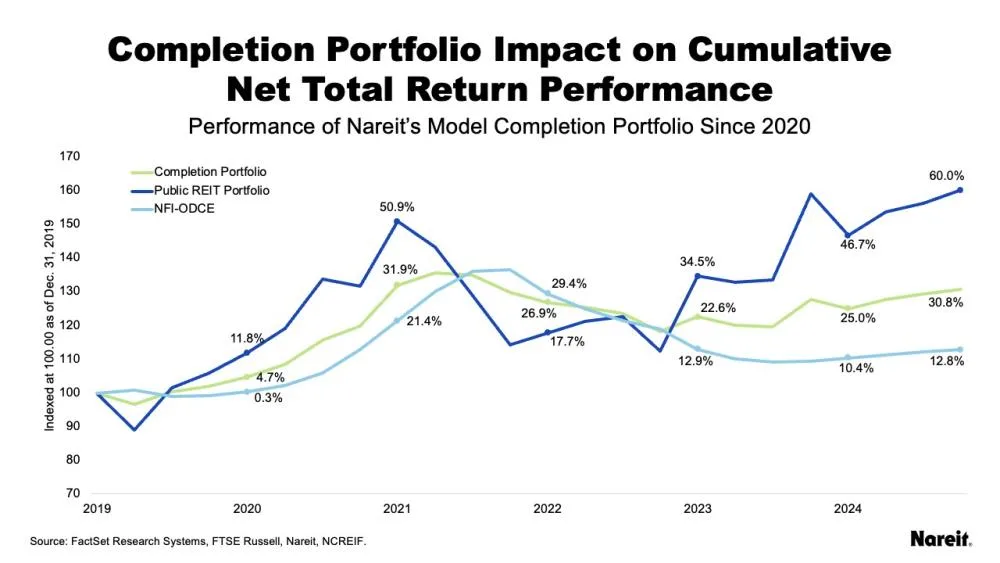

Nareit highlights that more than 70% of U.S. pension plans use REITs, with that number climbing above 75% for plans managing over $25 billion. A growing number of sovereign wealth funds and institutional investors are deploying REITs in completion strategies and to access modern economy sectors like logistics, data centers, and senior housing.

Notably, Nareit’s case studies show that these hybrid strategies—mixing private real estate and REITs—have delivered higher risk-adjusted returns over the past five years. One modeled portfolio outperformed private real estate by 2.7% annually.

Going Global

While U.S. REITs have led over the past decade, 2025 reminded investors of the value of international diversification. The FTSE EPRA Nareit Developed Index returned 10.6%, led by Asia (28.0%) and Europe (19.9%), far outpacing the U.S. REIT index (4.5%).

Active managers are responding by reallocating capital overseas, particularly to the diversified sector in Asia and retail in Europe. Weaker performance in North America triggered slight pullbacks, but health care and residential still remain overweight positions in global portfolios.

What to Watch in 2026

With transaction activity starting to tick up, and two historic valuation gaps nearing convergence, REITs could enter a new growth cycle. Nareit projects that disciplined balance sheets, sector diversification, and increasing institutional allocations will further enhance REIT performance in 2026.

As more investors recognize the strategic value of listed real estate in turbulent markets, REITs may offer not just resilience—but leadership—in a changing investment landscape.