- US REITs raised $21.3B in Q3 2025, with $14B from debt offerings—65.6% of total capital raised.

- The quarter saw the first REIT IPO of 2025, a data center-focused firm that began trading in October.

- M&A activity remains limited, with one $5.7B acquisition announced in Q3, down from $12.9B in deals in 2024.

- Year-to-date, REITs have issued $39.2B in debt and $16.8B in non-ATM equity, while ATM offerings totaled $9.9B through Q2.

Capital Raising in Q3 2025

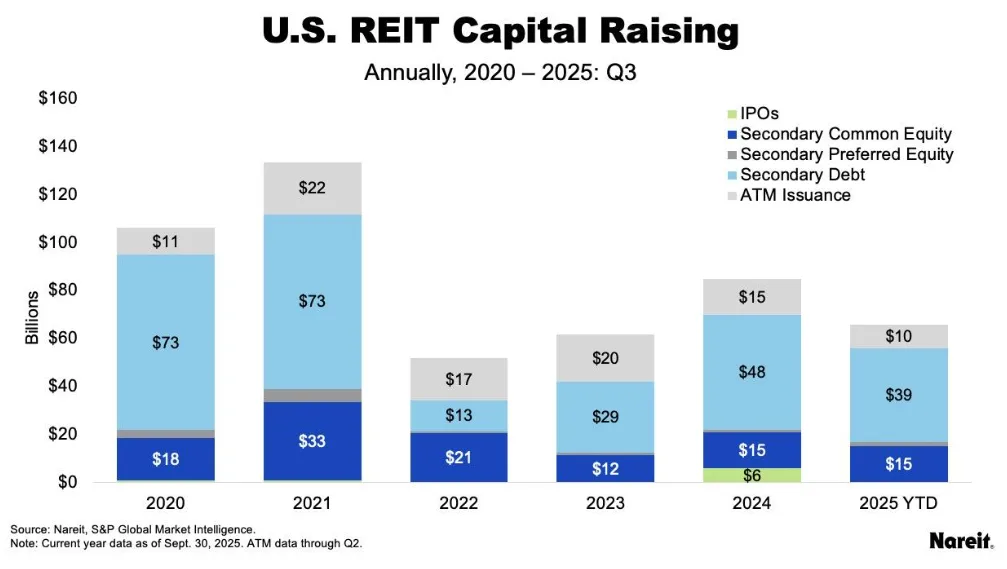

REITs in the US raised a total of $21.3B in capital in the third quarter of 2025, primarily through secondary debt offerings, per Nareit.

Debt issuance accounted for $14.0B, representing 65.6% of total capital raised, up significantly from 59.5% in Q2 and 50.5% in Q3 2024.

Equity markets remained active as well, with $6.6B raised through common equity offerings and $740M via preferred equity. Notably, the first REIT IPO of the year, focused on data centers, priced on September 30 and began trading in early October.

Year-to-date, REITs have issued $39.2B in debt compared to $48.1B in all of 2024. The average coupon for unsecured REIT debt in Q3 was 5.45%, slightly lower than the 2025 YTD average of 5.60%.

M&A Activity: One Deal, $5.7B

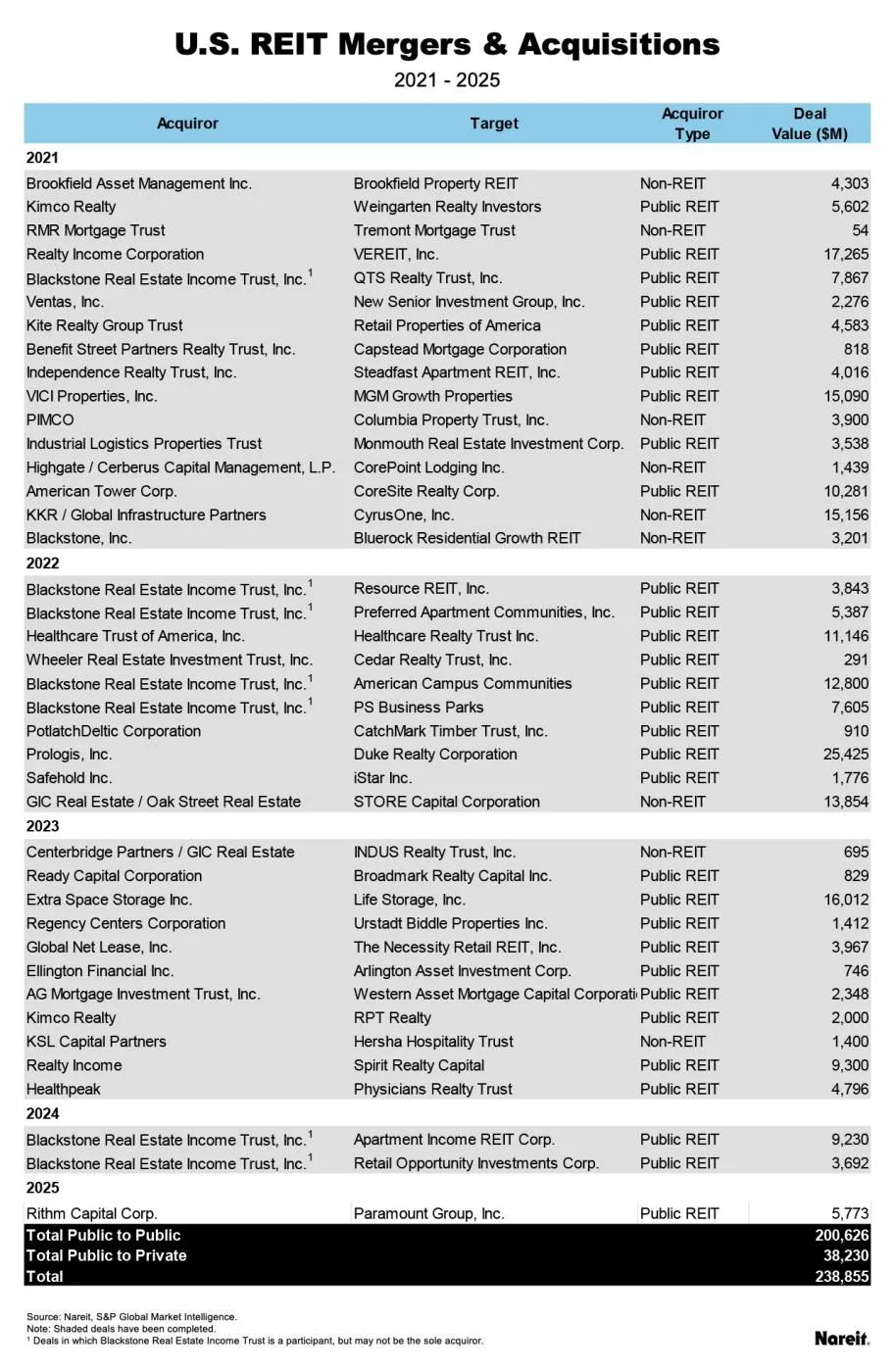

Despite robust capital markets activity, REIT M&A has remained quiet. Just one acquisition of a listed REIT was announced in Q3 2025, valued at $5.7B. This compares to two deals in 2024 totaling $12.9B and 11 deals in 2023 worth $44B.

Since 2019, REIT M&A transactions have totaled $282B, with 60% of that volume coming from deals within the same property sector. From 2021 onward, 40 listed REIT deals have been announced or completed, accounting for $245B, with 77% involving public REIT buyers.

Property Deals: Health Care, Retail, and Residential Lead

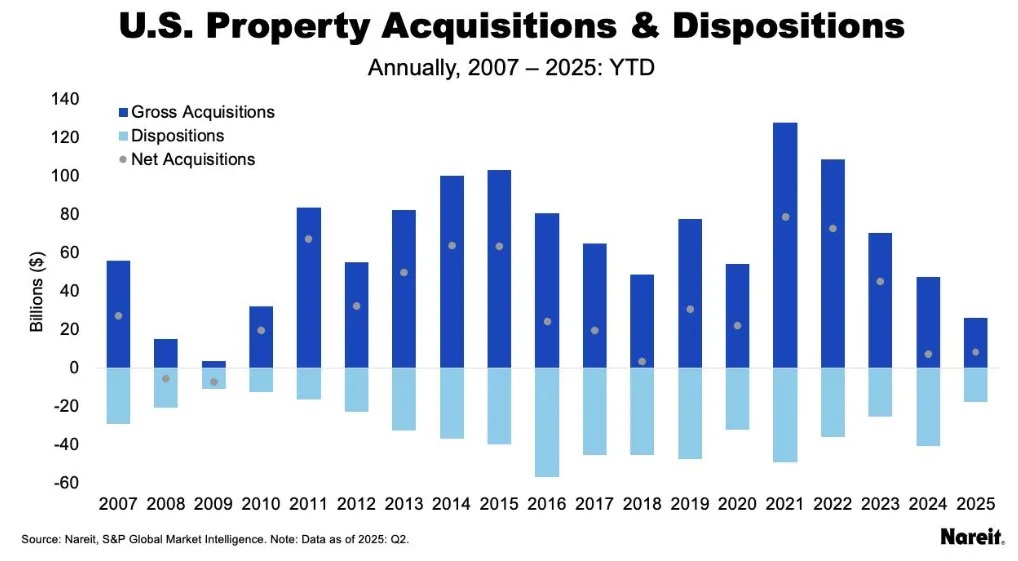

Through the first half of 2025, REITs acquired $26.1B in properties and disposed of $17.7B. That compares with $47.6B in acquisitions and $40.5B in dispositions during all of 2024.

By sector, health care led with $6.7B in acquisitions, followed by retail ($6.2B) and residential ($3.6B).

Outlook

With debt remaining the dominant capital source and IPO activity slowly picking up, REITs are maintaining financial flexibility despite muted M&A. As interest rates stabilize and sector-specific demand persists, especially in data centers, healthcare, and residential, REIT capital markets may continue to see steady issuance, while M&A activity awaits more favorable market conditions.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes