- REIT performance outpaced private real estate by nearly 2% in defined benefit pension plans from 1998 to 2023.

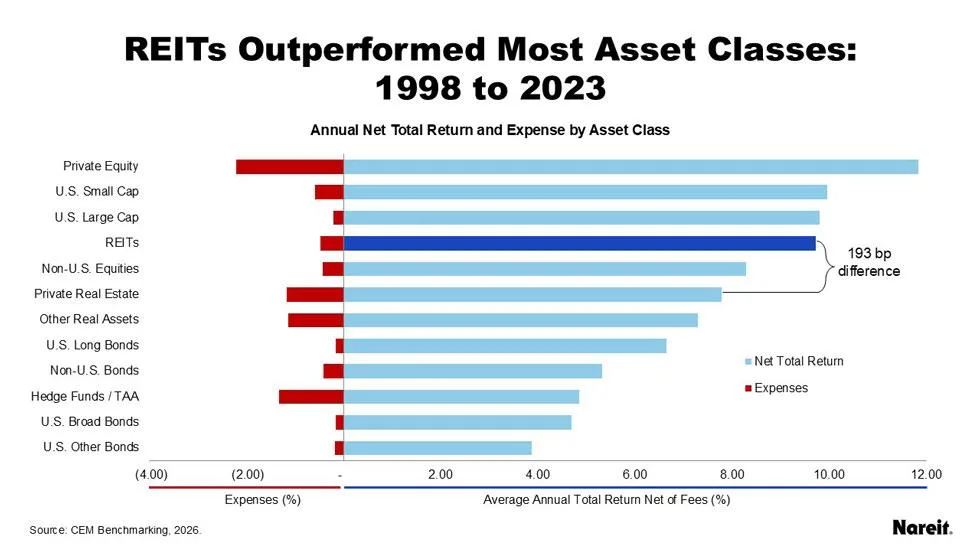

- REITs held the fourth highest annual returns among 12 asset classes analyzed in the CEM study.

- REITs and private real estate showed highly correlated returns, reflecting similar underlying assets.

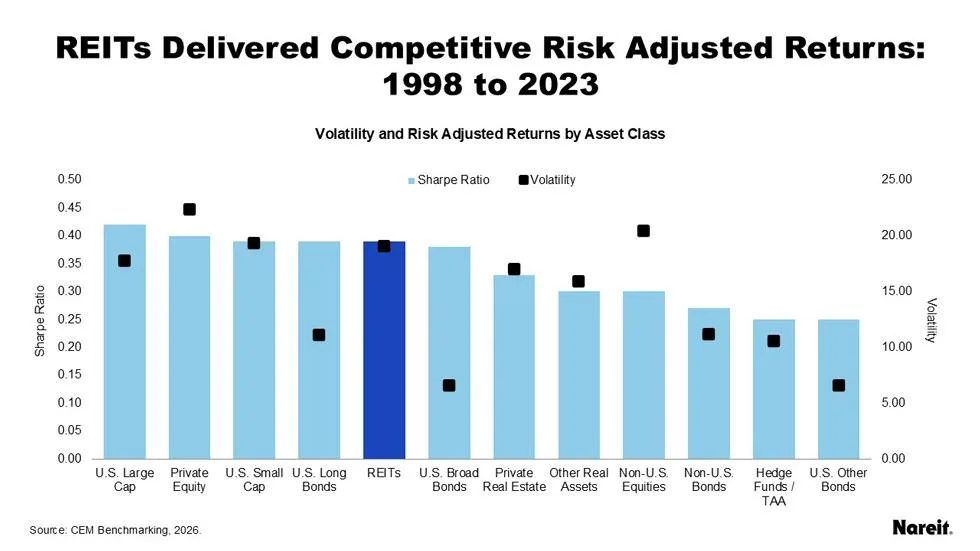

- REITs offered comparable risk-adjusted returns but slightly higher volatility than private real estate.

Study Overview

CEM Benchmarking analyzed the realized investment performance of 462 US public and private pension plans over a 26-year period ending in 2023. The study, sponsored by Nareit, compared net returns, volatility, and risk across 12 major asset classes, with a focus on REIT performance versus private real estate. In 2023, the combined asset base across all plans studied reached $3.8T.

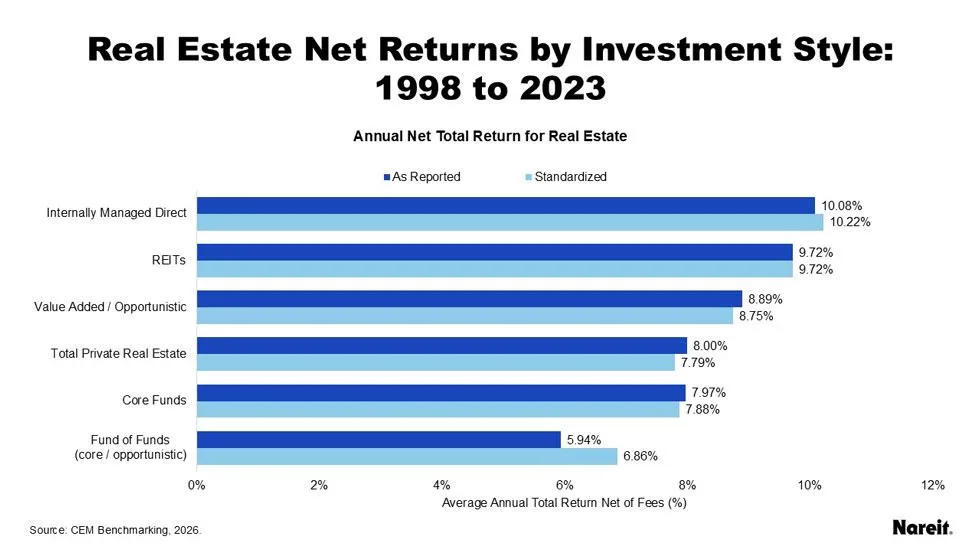

REIT Returns Outpace Private Real Estate

REIT performance averaged a 9.72% annual net return, while private real estate averaged 7.79%. This placed REITs among the top-performing asset classes, with only private equity and US equities showing superior results. The nearly 2% REIT performance advantage was consistent across most private property investment styles, except for internally managed direct holdings where results were similar.

Risk and Correlation Analysis

Annual returns for REITs and private real estate were highly correlated after accounting for reporting lags, with a correlation coefficient of 0.90. Risk metrics showed REITs had a volatility of 19.08%, compared to 16.98% for private real estate. Both segments delivered competitive Sharpe ratios, with REITs at 0.39 and private real estate at 0.33, suggesting similar risk-adjusted returns. Recent patterns in REIT behavior during volatile market periods further reinforce the reliability of these long-term findings.

Why It Matters

Defined benefit plans seeking real estate exposure may benefit from allocating more to REITs. The CEM study shows REITs outperformed private real estate while offering similar risk profiles. This performance edge strengthens the case for REITs in long-term investment strategies.

REITs also showed strong diversification benefits. Their returns correlated differently with bond and equity classes compared to private real estate. This suggests REITs can enhance overall portfolio balance and resilience.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes