- Most REIT debt is fixed-rate (90.9%) and unsecured (79.4%), reducing risk from rising interest rates.rn

- Balance sheets remain conservative, with an average debt maturity of 6.2 years and a debt-to-market asset ratio of 32.5%.rn

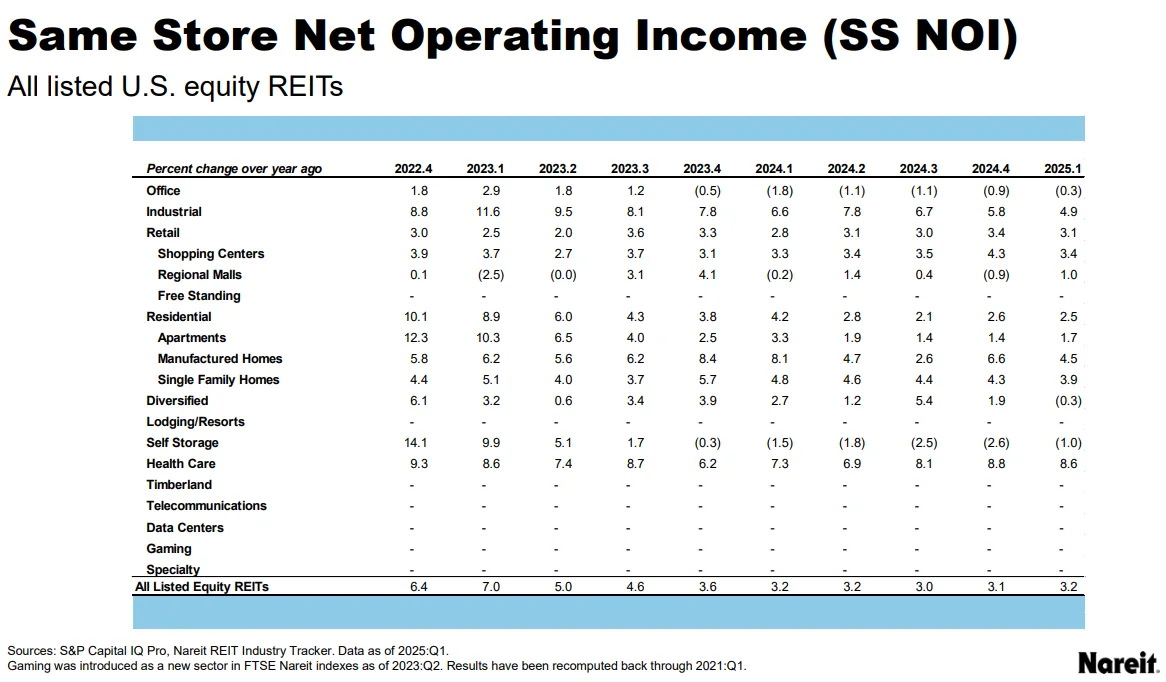

- Net Operating Income (NOI) rose 2.3% year over year, showing that REITs continue to operate efficiently.rn

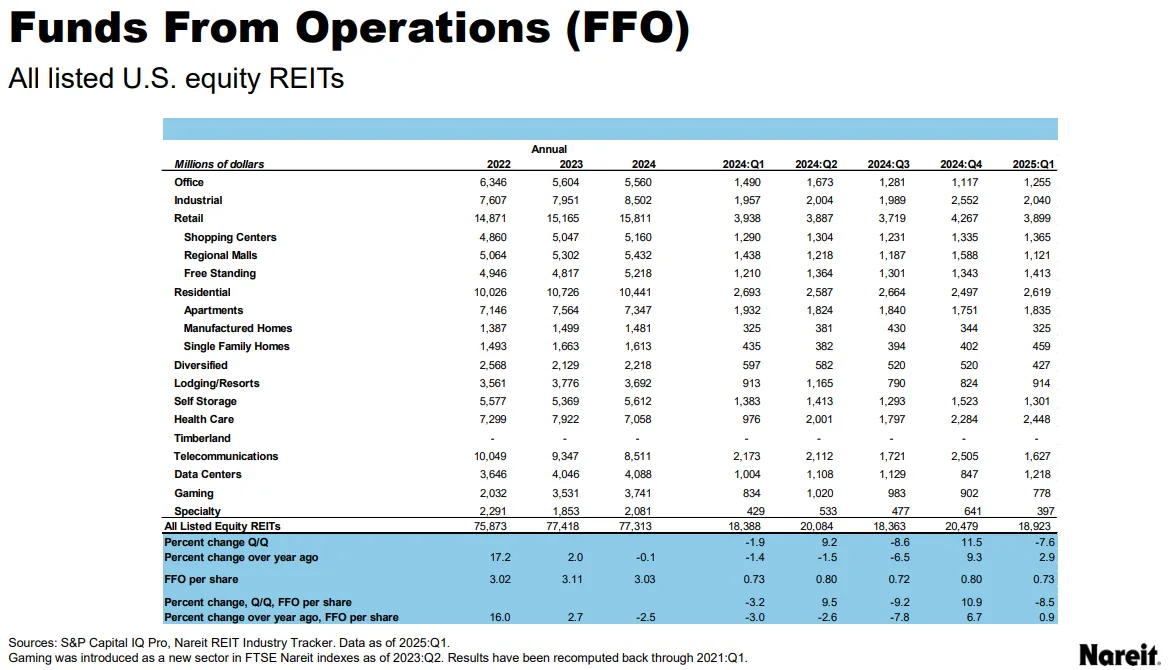

- Funds from operations (FFO) grew 2.9%, with more than half of REITs reporting gains.

Debt Strategy Supports Stability

As reported by Nareit, REITs continue to manage their balance sheets with care. Nearly 91% of total debt uses fixed rates, and about 80% is unsecured. These figures highlight a deliberate strategy to limit interest rate exposure—an approach that has contributed to stable REIT performance. On average, debt matures in 6.2 years, giving REITs more financial flexibility.

Leverage Remains Low

The average interest rate on REIT debt stands at 4.2%. Meanwhile, the average debt-to-market asset ratio is 32.5%. These numbers show that REITs aren’t overleveraged and can weather market shifts more easily.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Operations Stay Strong

REIT performance remained solid, as they earned $29.3B in NOI during the first quarter, a 2.3% increase from last year. Same Store NOI rose 3.2%, showing that REITs are keeping up with inflation. More than 62% of REITs reported higher NOI year over year.

FFO Trends Remain Positive

REIT performance also showed earnings stability, with industry-wide ffo reaching $18.9B, up 2.9% from a year earlier. While some sectors experienced fluctuations, these changes mostly stemmed from currency and international factors. Still, about 52% of REITs reported growth in FFO.

Why It Matters

Strong balance sheets, reliable cash flow, and steady REIT performance give listed REITs an edge over private real estate players. As property transactions return, REITs could pursue acquisitions and drive growth.

What’s Next

If interest rates stabilize and deal volume picks up, REITs will be ready. With disciplined financial management and solid performance, they remain a reliable option for investors seeking steady returns in uncertain times.