- REITs posted a 2.3% year-over-year net operating income (NOI) growth in Q1 2025, despite fewer property deals.

- Same-store NOI grew 3.2%, outpacing the 2.4% rise in inflation.

- Retail, healthcare, and industrial sectors led in both performance and acquisitions.

- Office, telecommunications, and diversified REITs lagged behind and were net sellers.

Steady Performance in a Shaky Market

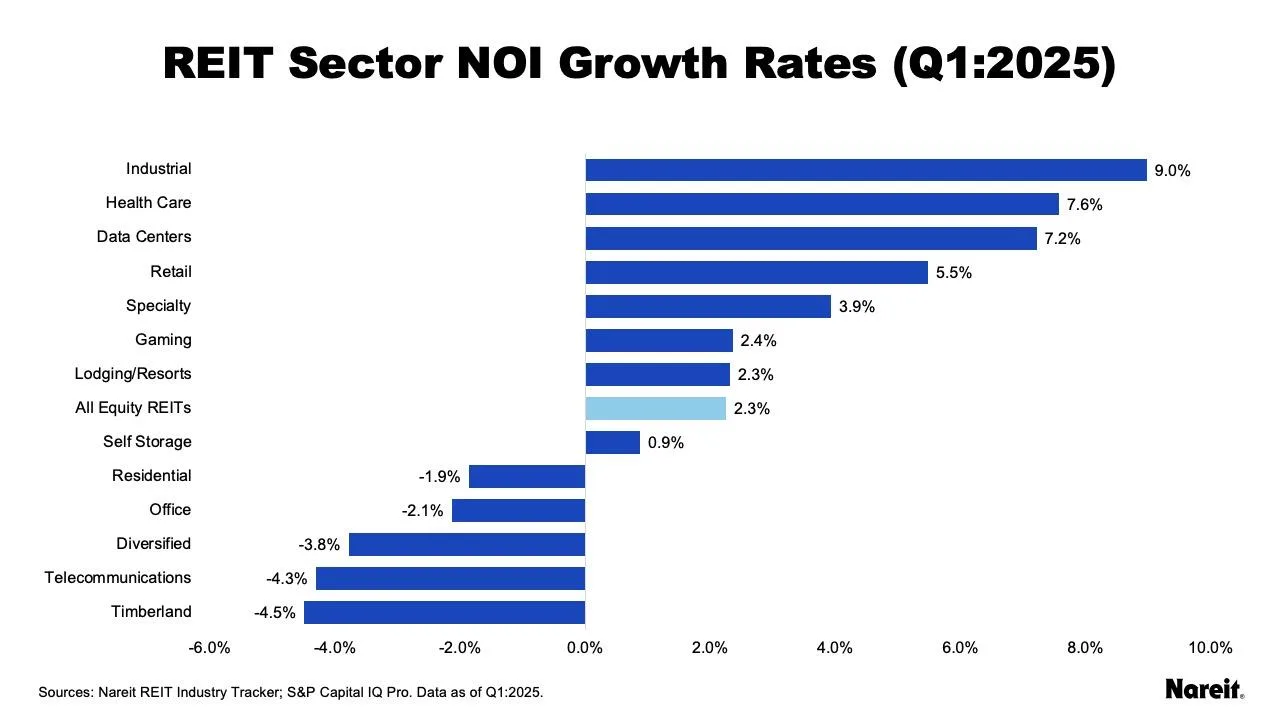

Despite economic headwinds and slower deal activity, REIT performance held firm, showing continued operational strength. According to Nareit’s Q1 2025 REIT Industry Tracker, equity REITs posted a 2.3% year-over-year growth in NOI. This shows that many REITs continue to operate well even as other parts of the market struggle.

Which Sectors Are Winning?

Some sectors showed stronger REIT performance than others. Retail, healthcare, and industrial REITs had the strongest NOI growth. These sectors also saw the most buying activity over the past year. In contrast, office, telecom, and diversified REITs struggled. They were also the biggest net sellers, reflecting weaker demand and investor caution.

Outpacing Inflation

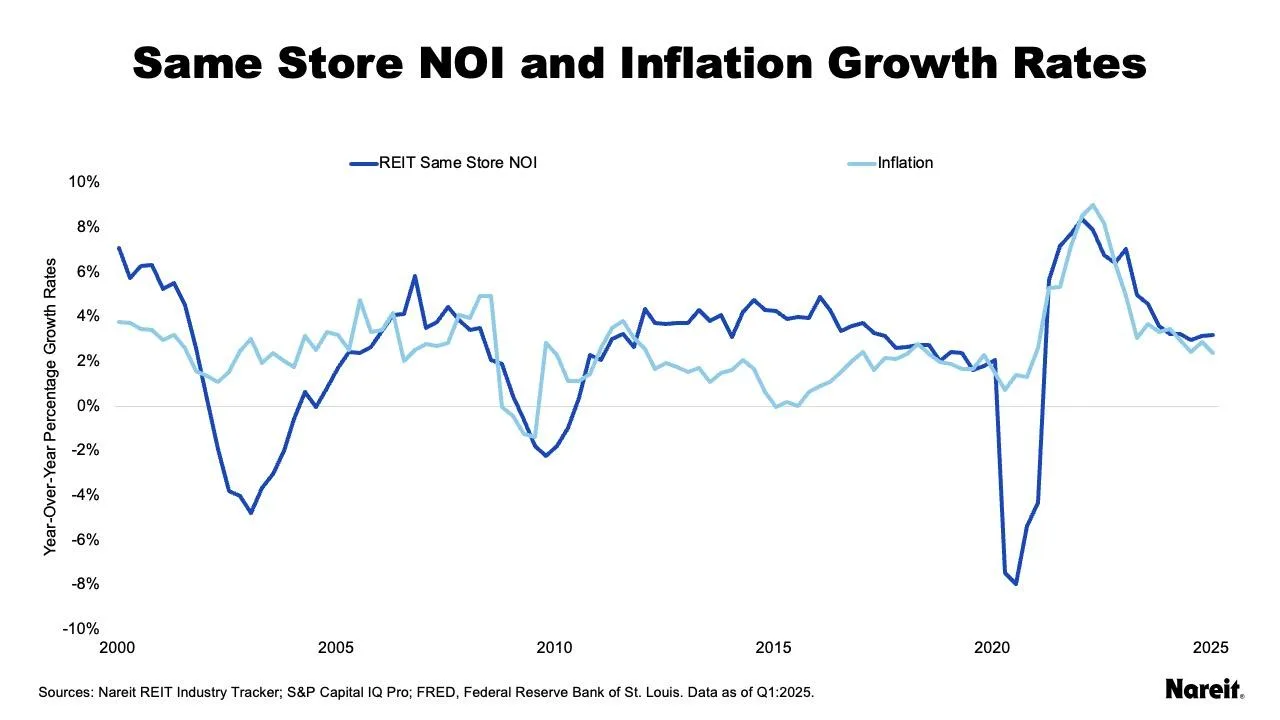

Same-store NOI is a key measure of REIT performance. It rose 3.2% in Q1 2025, while inflation came in at 2.4%. This marks another quarter where REITs stayed ahead of rising costs. Notably, from 2012 to 2025, REITs beat inflation about 80% of the time. This is a big jump from the 40% figure in the decade before.

A Closer Look at Sector Data

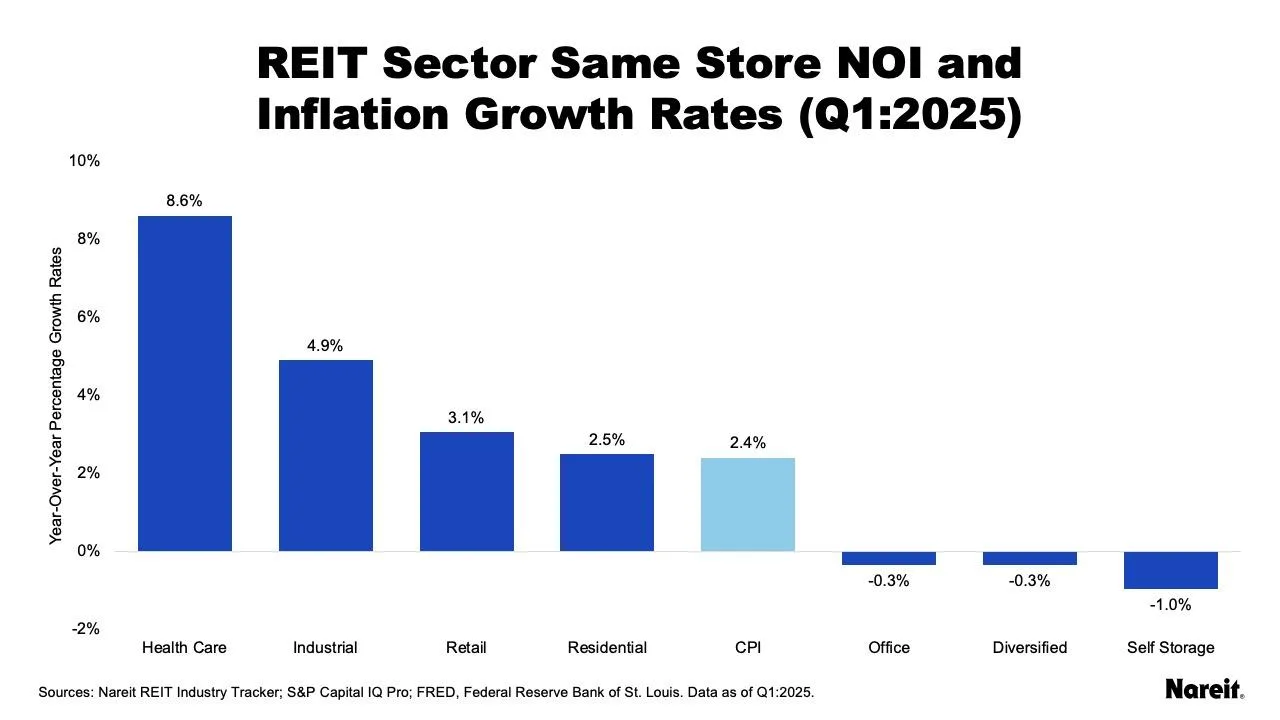

Of the sectors that report same-store NOI, four—healthcare, industrial, retail, and residential—beat inflation in Q1. The remaining three—office, self-storage, and diversified—fell slightly below. These results reflect each sector’s specific strengths and challenges.

Why It Matters

The data highlights strong REIT performance, even when market conditions are unclear. Their smart asset choices and strong management practices give them a clear advantage. Many REITs also have strong balance sheets, which gives them more room to adapt than other real estate investors.

What’s Next

If inflation stays under control and interest rates hold steady, REITs could gain even more ground. Improved deal flow and investor confidence may return later in 2025. Until then, REITs remain in a strong position to weather whatever comes next.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes