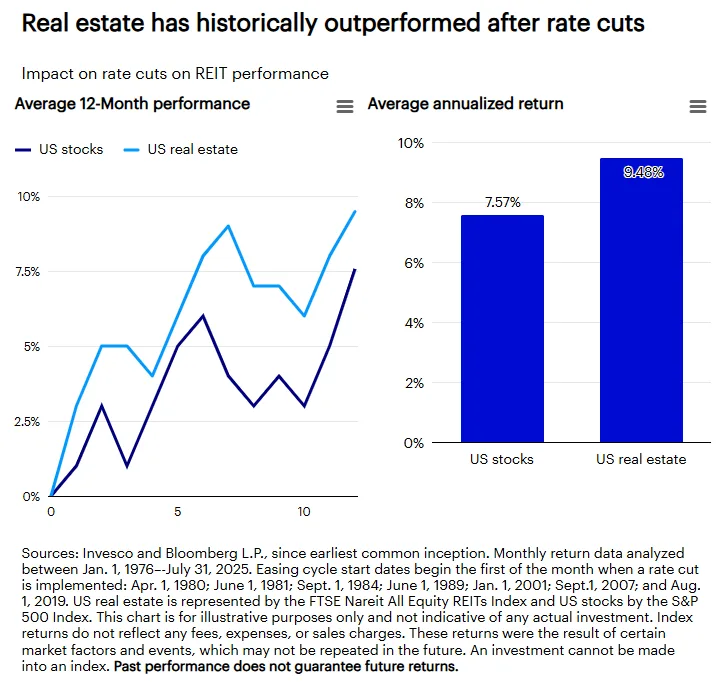

- REITs have historically outperformed after Fed rate cuts, delivering an average 12-month return of 9.48%—beating US equities over the same periods.

- Lower borrowing costs and appealing dividends make REITs more attractive in rate-cutting cycles, especially for income-focused investors.

- Data center, telecom infrastructure, and health care REITs stand to benefit most due to long-term leases and capital-intensive operations.

Rate Cuts Create Tailwinds for REITs

Following the Federal Reserve’s first interest rate cut of this cycle, real estate investment trusts (REITs) are back in focus, per Invesco.

With rates declining, borrowing becomes cheaper, boosting property values and investment activity—key factors that enhance REIT fundamentals.

Historically, REITs have been reliable outperformers during easing periods. Over the past five decades, US REITs returned an average of 9.48% in the 12 months following the start of a rate-cut cycle, compared to 7.57% for the broader market, according to data from Invesco and Bloomberg.

Yield Appeal and Income Strategy

Because REITs are required to distribute most of their taxable income as dividends, they naturally draw investors seeking yield. In lower-rate environments—where fixed-income yields often compress—REITs become increasingly attractive for portfolio diversification and income generation.

Sector Standouts: Data, Towers, and Health Care

Not all REITs benefit equally from lower rates. Historically, three sectors stand out:

- Data Centers: Fueled by long-term digital infrastructure demand and capital intensity.

- Telecom Infrastructure: Supported by growing 5G rollouts and long-duration contracts.

- Health Care: Driven by aging demographics and recession-resilient demand.

In contrast, lodging, retail malls, and multifamily REITs have shown more subdued responses to rate cuts, often due to shorter lease durations or exposure to consumer behavior cycles.

Why It Matters

For investors positioning for the next phase of the economic cycle, REITs could offer a compelling combination of income, inflation sensitivity, and exposure to real assets. Historically, they’ve not only weathered rate-cut environments—they’ve often thrived in them.

As macro conditions shift and monetary policy loosens, REITs may prove to be a timely addition to diversified portfolios looking for stability and yield potential.

What’s Next

As the Fed signals continued easing, investors may increasingly rotate into REITs—particularly those in data and health-driven sectors. If history is any guide, real estate may once again prove its strength in a falling-rate world.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes