- REIT performance diverged sharply by sector in 2025, with US healthcare and global REITs outperforming, while residential and data center REITs lagged.

- Macroeconomic conditions appear supportive heading into 2026, with moderating inflation, the potential for Fed rate cuts, and open credit markets fueling optimism.

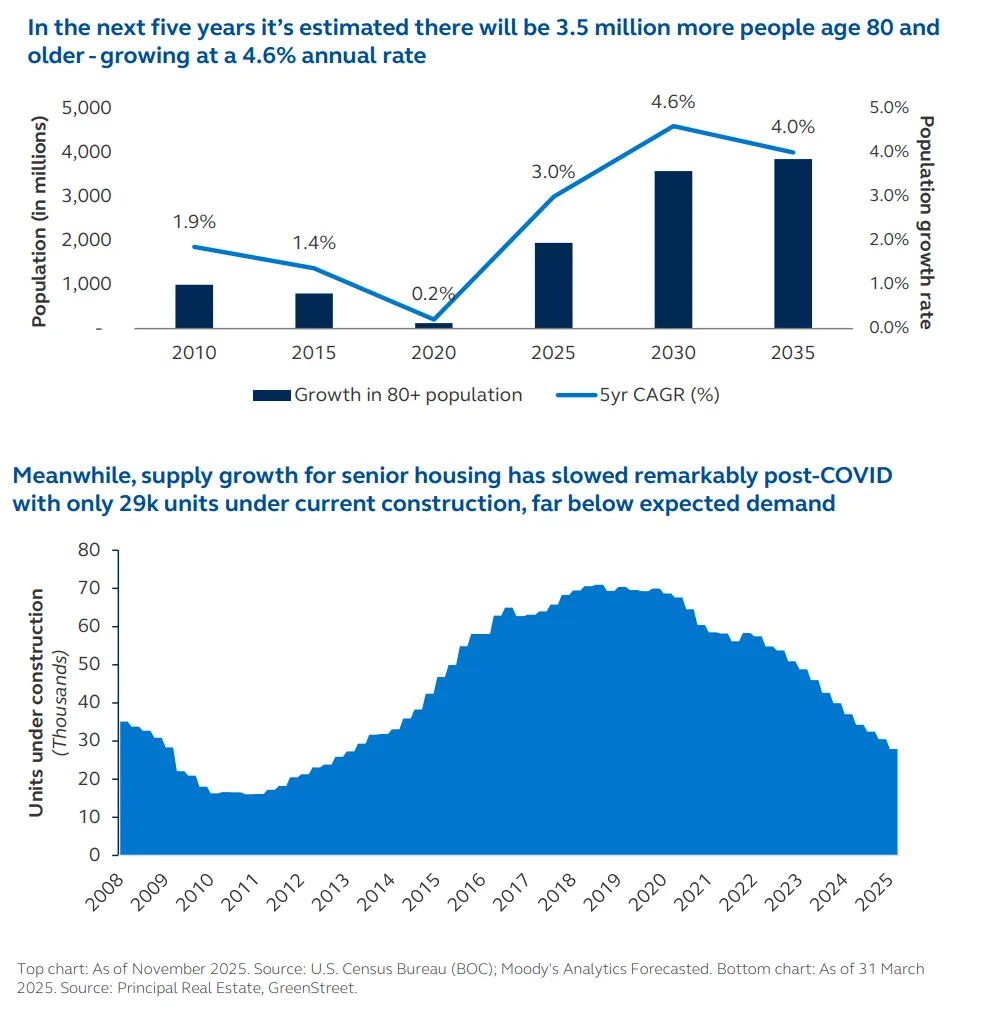

- Senior housing stands out as a compelling opportunity, backed by demographic tailwinds, limited new supply, and rising demand.

- REITs trade at historic discounts relative to broader equities, offering diversification from concentrated AI-driven gains in the equity market.

2025 in Review: AI Hype Overshadows REIT Resilience

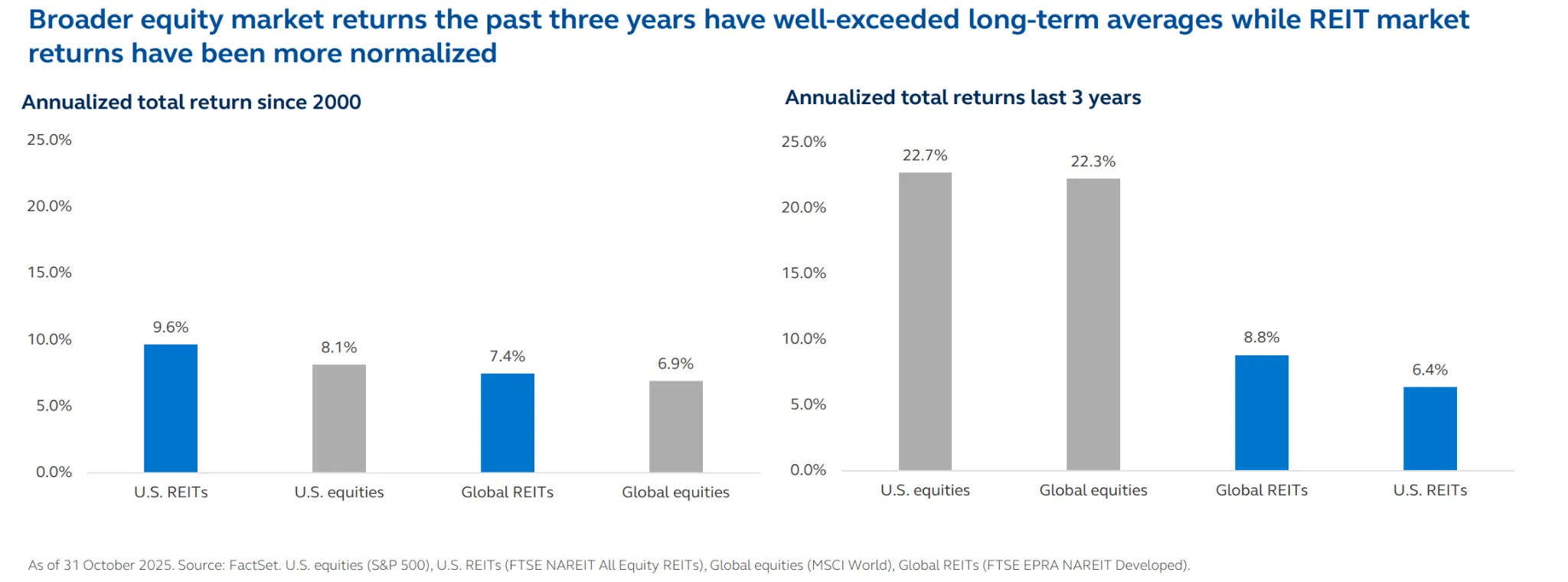

According to Principal Asset Management, this year, AI enthusiasm propelled a small group of mega-cap stocks—the “Mag 7″—to drive most of the equity market’s gains. In contrast, listed REITs delivered more muted, yet positive returns, with international and healthcare REITs leading performance. Fundamentals like earnings growth and improving capital markets supported REIT stability, even as some sectors—like data centers and residential—underperformed.

Macro Tailwinds Point to a Stronger 2026

Heading into the new year, Principal Real Estate sees a constructive macro backdrop for REITs. Key drivers include:

- Stable or declining interest rates, which historically support REIT performance;

- Steady GDP growth, which bolsters real estate demand;

- Open credit markets, enabling greater transaction activity and capital access;

- Attractive valuations, with REITs trading at discounts to long-term average multiples versus equities.

If inflation remains controlled, rate cuts from the Fed could catalyze further gains.

Diversification Opportunity Amid AI Market Saturation

With over 30% of the S&P 500’s market cap concentrated in the Mag 7, REITs present a timely diversification play. Global REITs show historically low correlations to these dominant tech names and now trade at their widest valuation discounts to equities in two decades.

Investor interest has also grown around strategies that focus on pricing inefficiencies and relative value advantages within public real estate—particularly as valuations remain compelling compared to broader equity benchmarks.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Non-Traditional Sectors Dominate REIT Landscape

The public REIT market has shifted dramatically over the past 25 years:

- Office space now accounts for just 3% of the US REIT index, down from 30% in 2000.

- Non-traditional sectors now make up 67% of the index, led by healthcare (16%), net lease (12%), towers (11%), and data centers (10%).

- These sectors benefit from structural demand drivers like digital infrastructure, aging demographics, and logistics growth.

Sector Spotlight: Senior Housing Enters a “Goldilocks” Era

Among sectors, US senior housing stands out. With the 80+ population growing 4.6% annually and construction activity at historic lows, supply-demand dynamics strongly favor landlords. REITs in the space are seeing double-digit earnings growth and rising occupancy rates.

Coupled with affordability supported by stock market and home price gains, senior housing is positioned as a top investment theme for 2026. Additionally, public REITs may benefit from acquisition opportunities as private market owners face refinancing and operational challenges.

Capital Markets and Earnings Trends Are Turning Positive

Real estate capital markets showed signs of recovery in 2025:

- CRE loan originations are rising after years of stagnation.

- REIT earnings growth is expected to be positive across most sectors globally.

- Access to capital remains strong, allowing REITs to act on opportunities while others face constraints.

These trends, combined with resilient fundamentals and moderate growth expectations, suggest a supportive environment for listed real estate.

Bottom Line

After a reset period marked by interest rate volatility and AI-driven market concentration, REITs are entering 2026 on stronger footing. Structural shifts toward essential real estate sectors, attractive valuations, and diversification benefits position REITs as a compelling opportunity for investors seeking steady income and long-term growth.

While economic risks like stagflation or recession remain, listed REITs have historically outperformed in downturns. As equity markets normalize, real estate securities may regain attention as a durable, income-producing component in institutional and diversified portfolios.