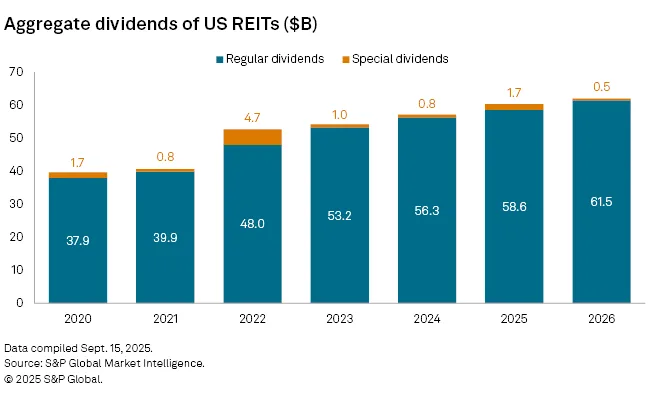

- US REIT dividends will grow 2.8% in 2026, down from the 8.7% five-year average, due to a steep decline in special dividends.

- Regular dividends are projected to rise 4.9% to $61.5B, showing strength in core income.

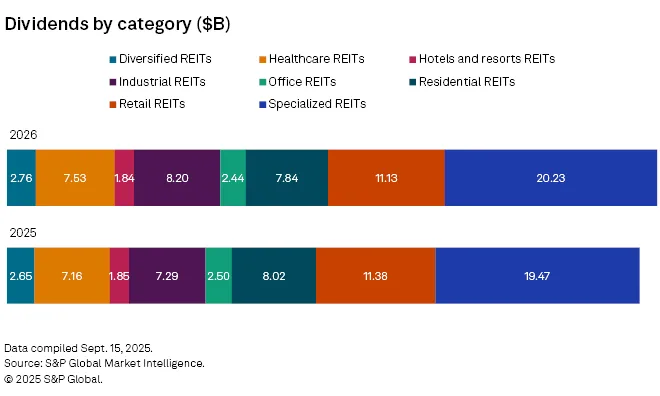

- Specialized REITs will lead with $20B in payouts, followed by retail REITs.

- Office and hotel REITs continue to lag, with payout ratios below 45% due to weak occupancy and demand.

Dividend Momentum Eases

US REITs are entering 2026 with slower dividend growth. S&P Global Market Intelligence forecasts a 2.8% increase in total dividends, well below the 8.7% compound growth rate of the past five years.

The key reason: special dividends will plunge to $500M, down from $1.72B in 2025. However, regular dividends will climb 4.9% to $61.5B, showing steady income performance despite the overall slowdown.

Sector Breakdown: Leaders and Laggards

Specialized REITs, including data centers and infrastructure assets, are expected to lead with $20B in dividends. Retail REITs follow closely, supported by stable consumer demand and tenant leasing.

Office and hotel REITs, however, remain weak. Remote work continues to depress office occupancy, while inflation weighs on travel and hotel demand. Payout ratios for both sectors hover around 40% to 42%, far below the 90% target typical for REITs. In some cases, firms in these segments have trimmed dividends to navigate tighter liquidity or balance sheet pressure, reflecting a broader trend of strategic reductions across the industry.

Signs of Stability Amid Headwinds

Although macro uncertainty and tariffs have limited direct financial impact, they have slowed new developments and investment decisions. Most REITs expect clearer market conditions by late 2026.

In a positive sign, median net operating income (NOI) is now turning slightly positive. This shift suggests improving fundamentals and cautious optimism for future growth.

Outlook for 2026: A Split Market

The sector outlook remains mixed. Specialized and retail REITs are positioned for steady dividend growth, thanks to demand for essential services and consistent leasing. In contrast, office and hospitality REITs face a longer recovery path due to deep structural challenges.

Despite the slowdown in total dividends, core income remains stable. REITs focused on resilient sectors are helping anchor the market as weaker segments continue to struggle.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes