- REITs have remained active across cycles, even amid muted transaction volumes in early 2025.rn

- Retail, industrial, health care, and self-storage REITs were net buyers in Q1, while office and residential sectors were net sellers.rn

- Strong balance sheets, access to capital, and operational scale give REITs an advantage as the market prepares for a rebound.

REITs Stay Active Despite CRE Headwinds

The commercial real estate (CRE) market continues to face several challenges. High interest rates, wide bid-ask spreads, and valuation gaps between public and private markets have all contributed to stalled transaction activity. Still, REIT acquisitions have remained steady, showing resilience even as broader deal flow has slowed.

According to Nareit’s Q1 2025 REIT Industry Tracker, these publicly traded real estate companies have maintained steady acquisition and disposition activity, adapting strategies in response to changing conditions.

A History of Strategic Buying and Selling

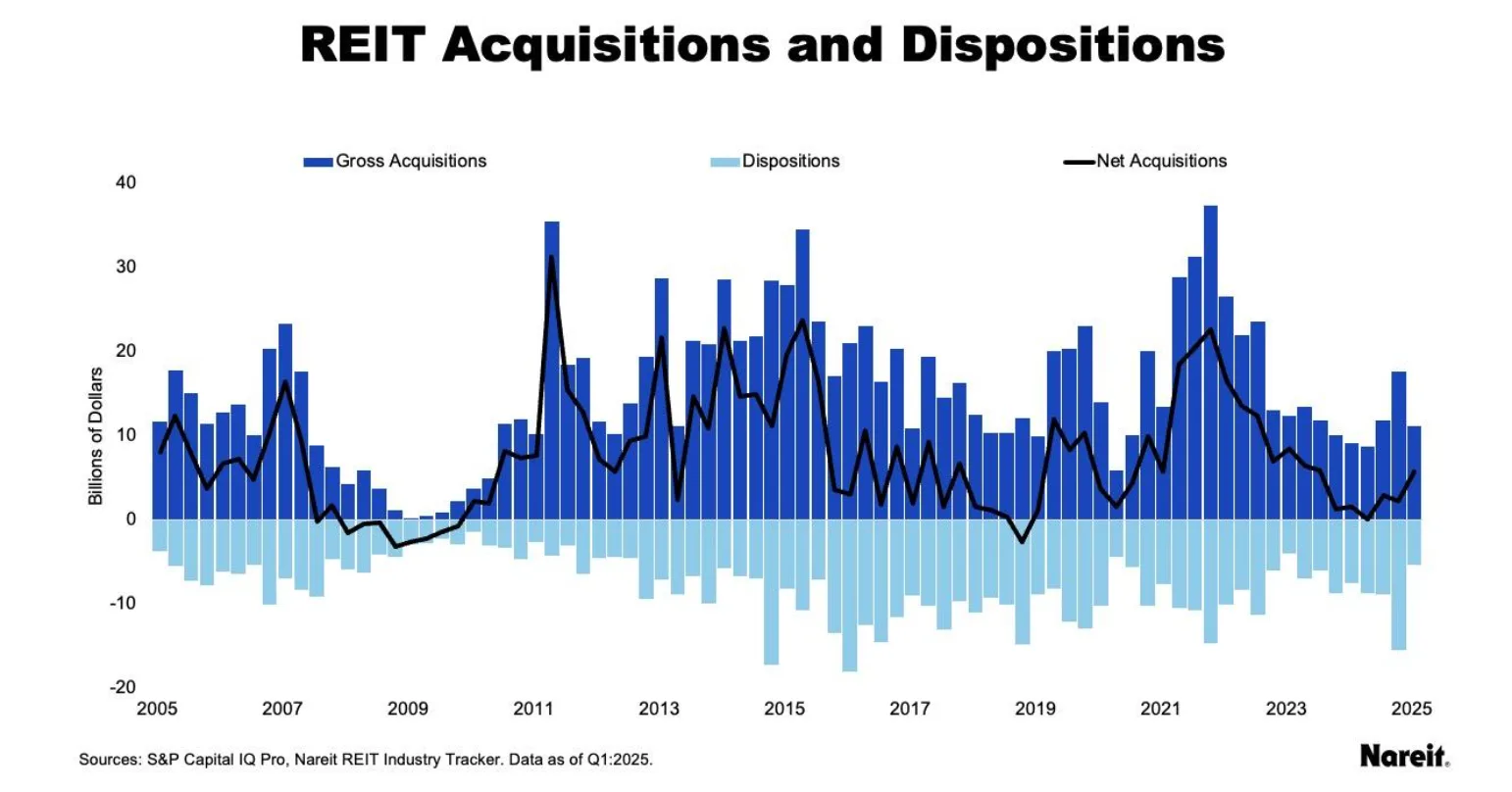

Over the past 20 years, REITs have mostly been net buyers. The only extended period of net selling occurred during the Global Financial Crisis. Since then, REITs have shown consistent discipline—pruning portfolios while pursuing accretive growth.

In Q1 2025, REIT gross acquisitions and dispositions were well below the 20-year average. But this decline aligns with broader market trends, not a shift in strategy. REITs continue to manage portfolios actively, even when total deal volumes fall.

Sector Performance Shows Divergence

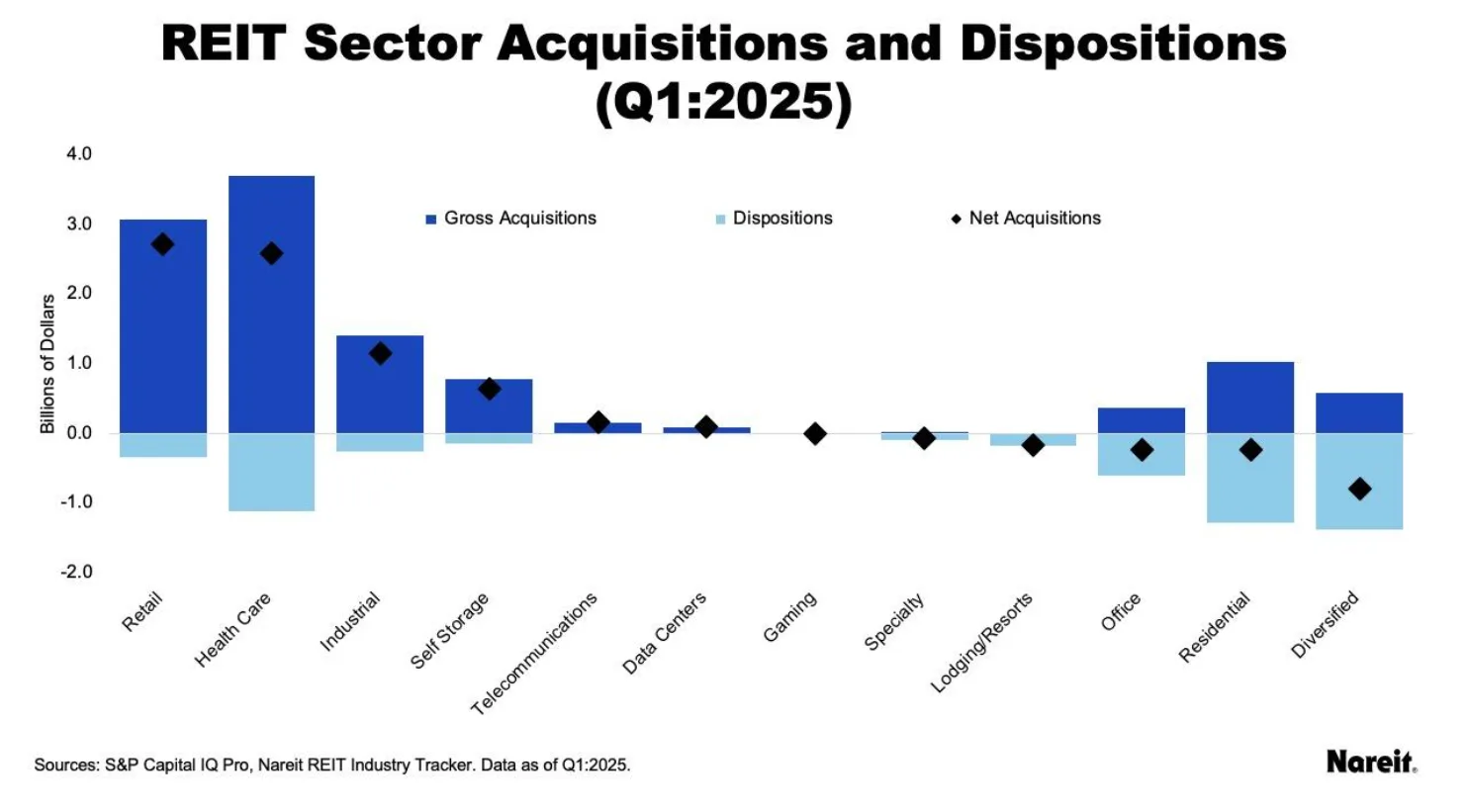

Transaction trends varied widely by property type. Retail, industrial, health care, and self-storage REITs led the way in net acquisitions. These sectors likely reflect stronger fundamentals, investor demand, or long-term growth confidence.

On the other hand, office, residential, and diversified REITs were net sellers. This reflects ongoing concerns about office demand and pricing in a post-pandemic environment, as well as strategic repositioning in the residential space.

Why REITs Are Better Positioned

REITs benefit from unique structural advantages. As public companies, they have broad access to capital markets, including equity, debt, and joint venture financing. They also tend to have lower leverage and greater transparency than many private CRE investors.

In addition, REITs often operate with institutional scale and efficiency, giving them a performance edge. These strengths position them well to act quickly when valuations between public and private markets begin to align.

Looking Ahead

As market conditions stabilize and transaction activity picks up, REITs are expected to be among the first movers. Their disciplined capital management, experienced leadership, and liquidity access give them a competitive edge in identifying and securing attractive deals.

With investor focus shifting to recovery opportunities, REITs are likely to play a central role in the next wave of CRE investment.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes