- CRE values have dropped almost 20% since 2021, but income growth has held up, leading to record gaps in performance across sectors and markets.rn

- Higher-for-longer rates are limiting new construction, which supports faster rent growth where demand is strong.rn

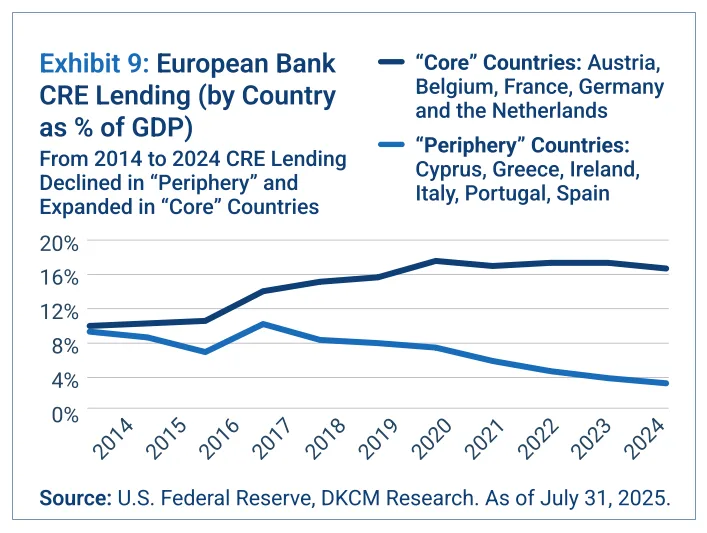

- Europe offers better value and less competition, while US regional banks are creating recap opportunities.rn

- Outperformance depends on picking the right sectors, entering at discounts, and driving cash flow through operations.rnrnrn

A Market Reset, Not a Collapse

According to Davidson Kempner, after the Fed began raising rates in 2022, CRE values adjusted quickly. US prices are down about 18% from the peak, and Europe closer to 22%. Unlike the Global Financial Crisis, this reset was driven by higher risk-free rates, not falling income. Net operating income has generally grown, and cap rate spreads narrowed. Without those supports, losses would have been even steeper.

Higher Rates, Wider Gaps

Periods of higher rates tend to deliver faster rent growth. From 1965 to 1982, when cap rates were high, rents rose nearly 8% annually. In the lower-rate era that followed, growth slowed to around 3–4%. With fewer projects breaking ground today, tight supply is likely to push rents higher again.

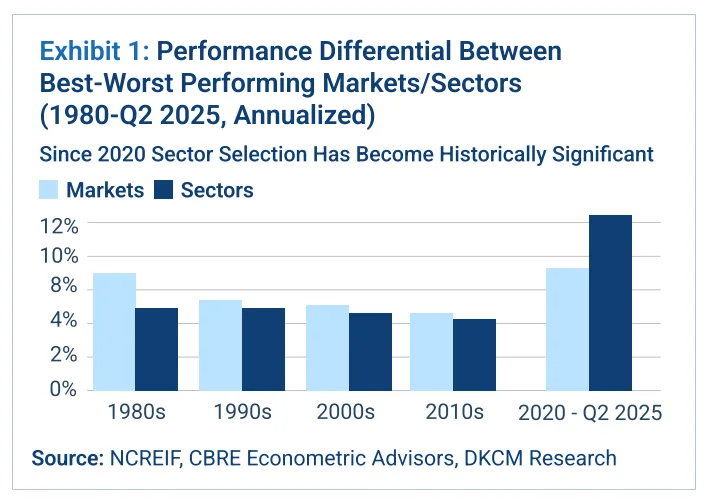

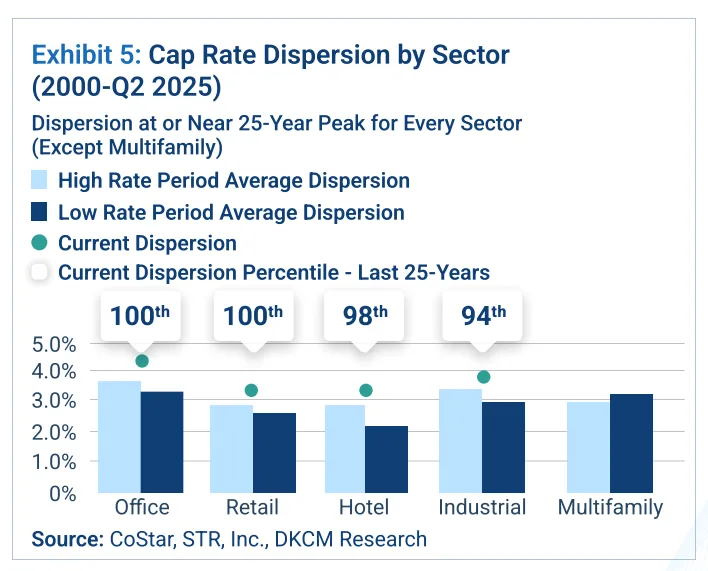

Since 2020, dispersion has surged. Industrial has delivered strong double-digit gains, while office has seen negative returns. Even within sectors, outcomes differ sharply — industrial in California’s Inland Empire has outperformed Chicago by 600 basis points a year. This shows why sector and market selection are now critical drivers of returns.

Supply Squeeze Creates Tailwinds

The cost of building has risen, while financing has become more expensive. As a result, new supply is slowing. In industrial, construction starts are running about 25% below pre-COVID levels. senior housing faces an even larger gap: the US needs over 560,000 new units by 2030 but is on pace to deliver fewer than 200,000. For existing properties, this imbalance should translate into stronger rent growth.

Structural Shifts at Work

Beyond interest rates, policy and technology are reshaping CRE outcomes. Nearshoring has boosted border markets in Texas, with Laredo surpassing Los Angeles as the top US trade port by value. In hospitality, Tampa’s revenue per room is up 40% since 2020, while Los Angeles hotels remain flat due to higher labor costs and weaker demand. Meanwhile, the surge in artificial intelligence is driving massive demand for data centers, where access to power has become the limiting factor.

Where Value Stands Out

In Europe, listed REITs in Europe trade at steep discounts compared with US peers. Private real estate capital is also thinner, creating less competition. Italy’s logistics sector is particularly attractive, with low vacancy, cheaper rents than northern Europe, and room for growth as e-commerce expands.

While in the United States, regional banks, which now hold more than 70% of bank CRE loans, are shedding assets to manage balance sheets. Many deals include seller financing, giving opportunistic investors a chance to buy at discounts through complex recapitalizations.

Alternatives Gain Share

Alternative sectors such as data centers, single-family rentals, self-storage, life sciences, and small-bay industrial now represent nearly $4 trillion, or about 18% of the US CRE market. Small-bay industrial is drawing attention as demand from small and mid-sized tenants has outpaced supply, driving rents higher and vacancies lower than in big-box assets.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

How To Create Alpha

In today’s reset, returns depend less on market beta and more on execution. Investors can outperform by:

- Selecting markets and sectors with lasting demand and limited supply.

- Entering at a discount through complex transactions or bank-driven deals.

- Operating assets to boost free cash flow through leasing, expense control, and capex discipline.

Even modest improvements matter. For example, a 10% discount at purchase combined with a 5% boost in income can lift levered returns from about 13% to more than 20%.

The Bottom Line

CRE is not in freefall. Instead, it is undergoing a structural reset marked by higher rates and wider spreads between winners and losers. With new supply constrained, income growth resilient, and capital flowing unevenly, this is an environment built for active investors. The winners will be those who target supply-constrained sectors, embrace complexity to enter at a discount, and manage well to capture operational gains.