- Global real estate’s recovery hit a snag in early 2025 as new US tariffs and geopolitical tensions triggered investor caution and halted deal momentum.

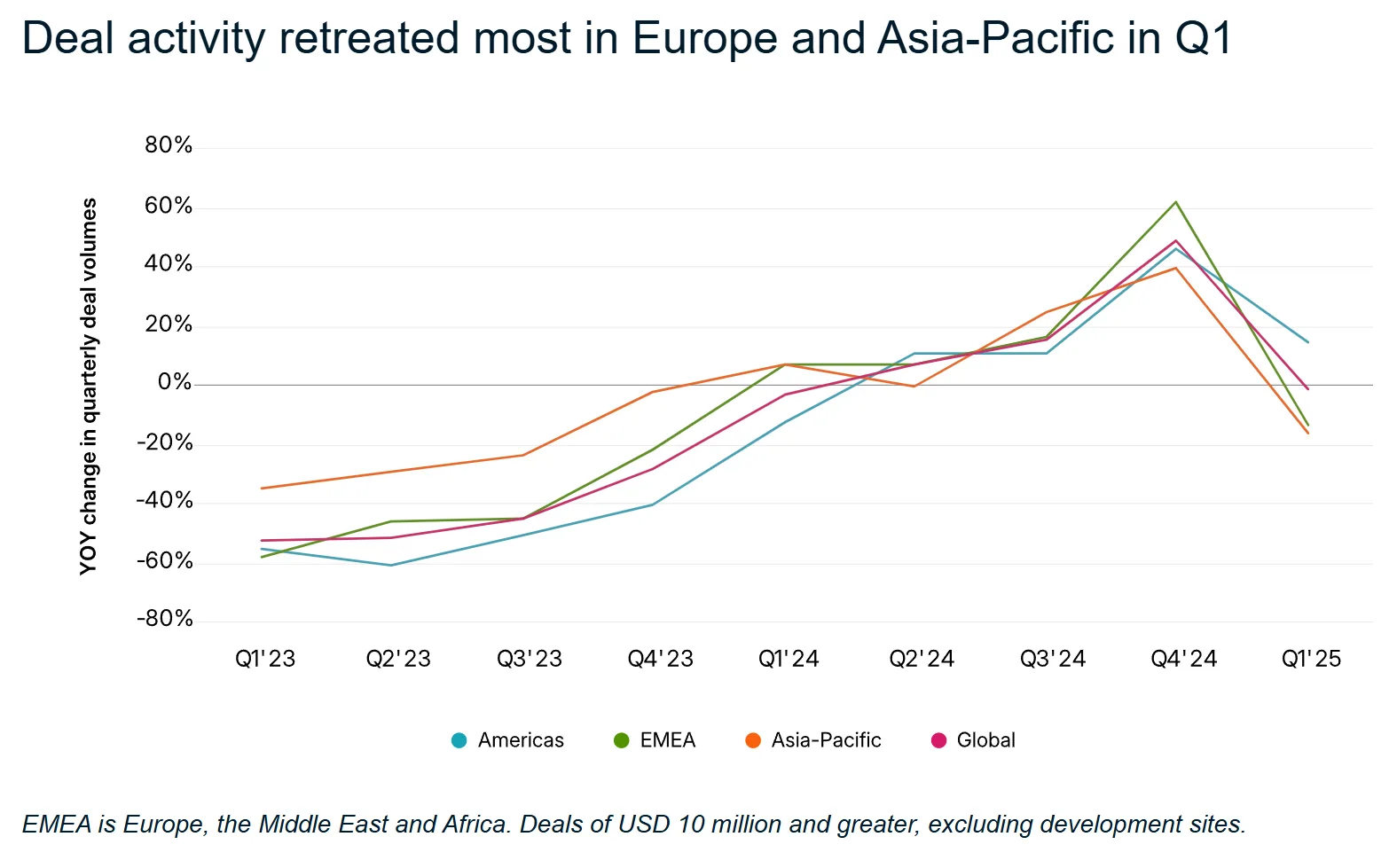

- Investment volumes flatlined globally in Q1 2025, with notable pullbacks in Europe and Asia-Pacific, despite a surge in activity at the end of 2024.

- Structural tailwinds continue to support sectors like multifamily and data centers, while industrial, retail, and office properties face mounting pressures.

A Fragile Rebound Interrupted

Following a promising rebound in late 2024, global real estate and commercial property markets entered 2025 with renewed optimism, per MSCI. Deal activity had surged, capital values stabilized, and global transaction volume rebounded to levels not seen since 2022. But optimism faded fast.

Tariff announcements by the newly installed US administration in early April — including levies on Canadian, Mexican, and Chinese goods — introduced a wave of uncertainty that reverberated through global markets. Add to that renewed tensions in Europe and a potential rollback in US support for Ukraine, and the fragile foundation under real estate’s recovery began to crack.

Q1 2025: A Cautious Turn

Commercial real estate investment volume was flat in Q1 2025 compared to a year prior — a marked slowdown from the near 50% year-over-year growth seen in Q4 2024. The pullback was especially pronounced in Europe and Asia-Pacific, where geopolitical and trade-related concerns hit investor sentiment hardest.

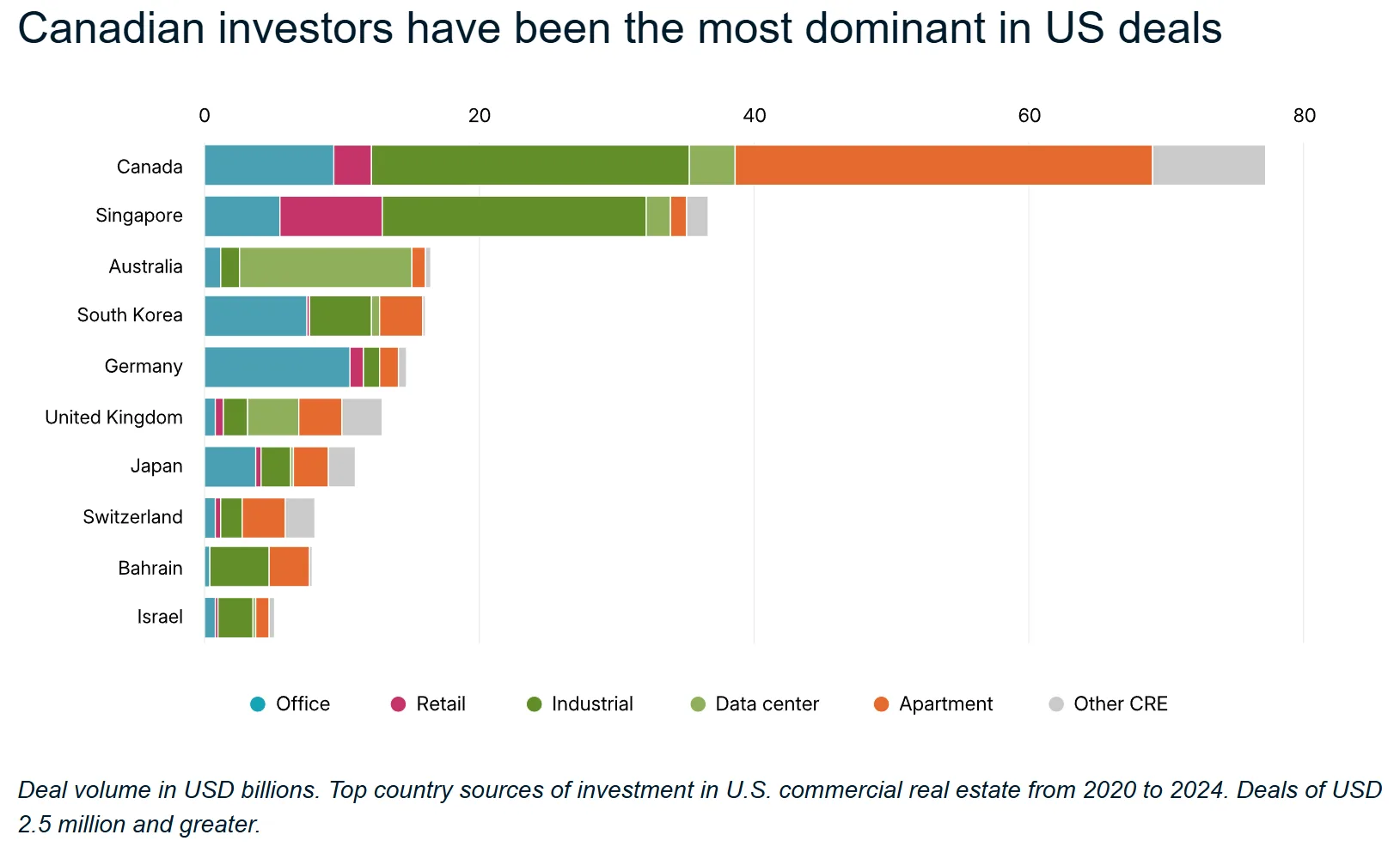

While US deal volume held up better, with transaction activity rising modestly year over year, the future outlook remains clouded. Rising risk premiums, recession fears, and growing hesitation among key foreign capital sources — particularly Canadian investors — could further dampen momentum.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Regional Impacts: Diverging Fortunes

- United States: Resilient so far, but under pressure from elevated risk perceptions and fading cross-border capital. Canadian investors, who have poured nearly $80B into US CRE since 2020, are reportedly pausing activity.

- Europe: Industrial investment slowed as trade uncertainty and rising bond yields weighed on capital flows. While occupier markets remained resilient, geopolitical risks are casting shadows over leasing and expansion plans.

- Asia-Pacific: Investment volumes declined nearly 20% year over year in Q1. China’s uncertain export outlook weighed on sentiment, though Japan may benefit from shifting capital flows amid more favorable rate expectations.

Structural Strength in a Volatile Environment

Despite the volatility, certain segments of the commercial property market may prove more resilient. Industrial assets could suffer from slower global trade, but apartments and data centers — supported by demographic shifts and digital infrastructure needs — may be better positioned to weather this downturn.

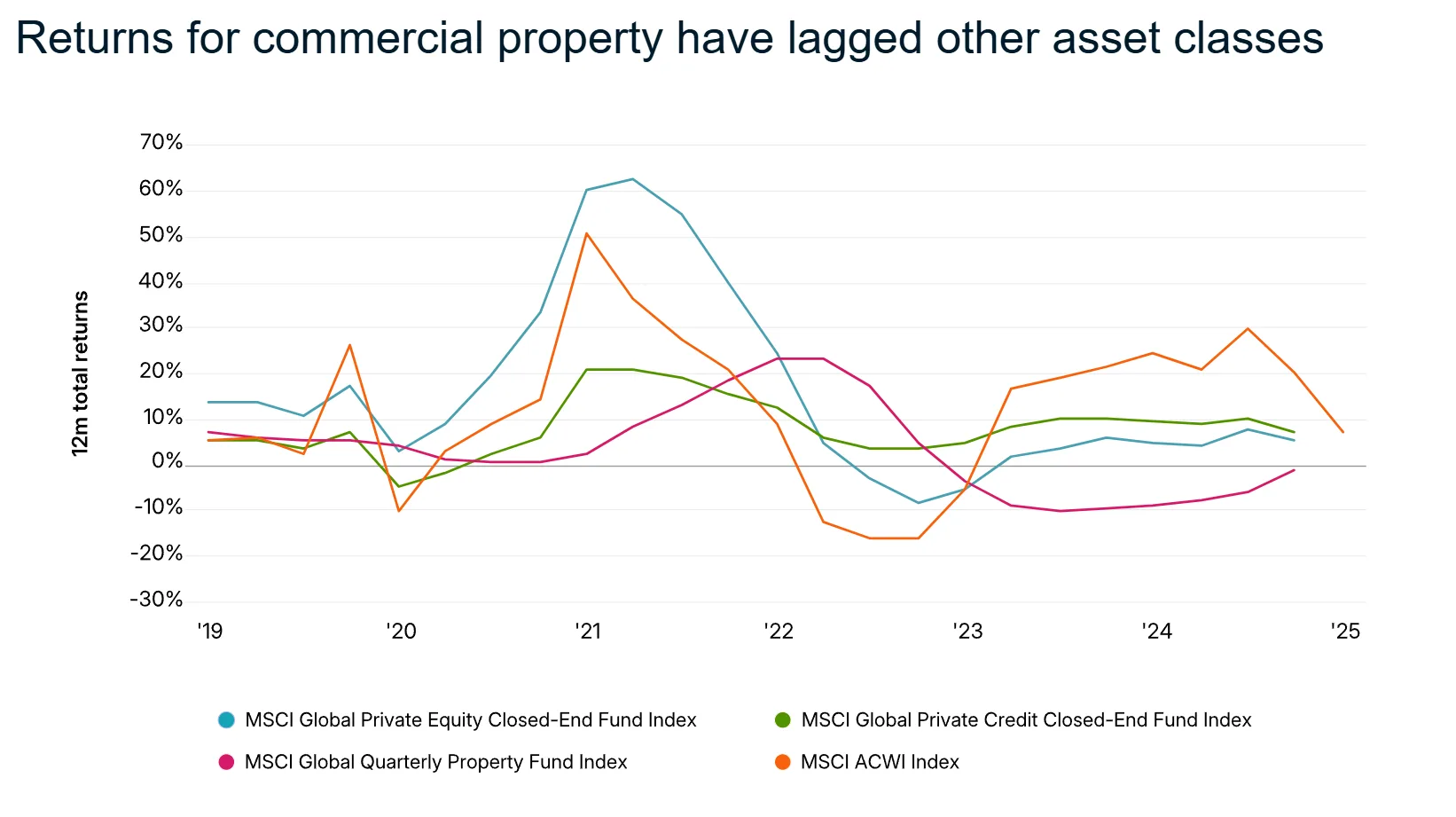

Real estate’s long investment horizons and income-generating potential also offer a relative safe haven as other asset classes face heightened volatility. The asset class has underperformed over the past two years, but with interest rate cuts on the table, its appeal could rebound quickly.

Looking Ahead

The late-2024 recovery now appears to be a false start, disrupted by a wave of policy shifts and geopolitical stressors. However, the fundamental strengths of commercial property — from income generation to inflation protection — remain intact.

If global volatility persists and central banks lean toward monetary easing, real estate may emerge as a relative outperformer. For now, investors are likely to remain cautious — selectively pursuing opportunities while watching for clarity on trade policy and macroeconomic trends.

Bottom Line

The road to real estate recovery has hit an unexpected detour. But amid the disruption, long-term investors may still find opportunity in the asset class’s relative stability and strategic value.