- The Madison Real Estate Liquidity Index (MRELI) rose to 35.6 in Q3 2025, marking the sixth straight quarter of improvement.

- Liquidity remains below fully normalized levels, but conditions are the strongest since the Fed began raising rates in 2022.

- Improvements were driven by stronger loan origination in the US and Europe, liquid debt markets, and revived public market activity.

Liquidity on the Rise

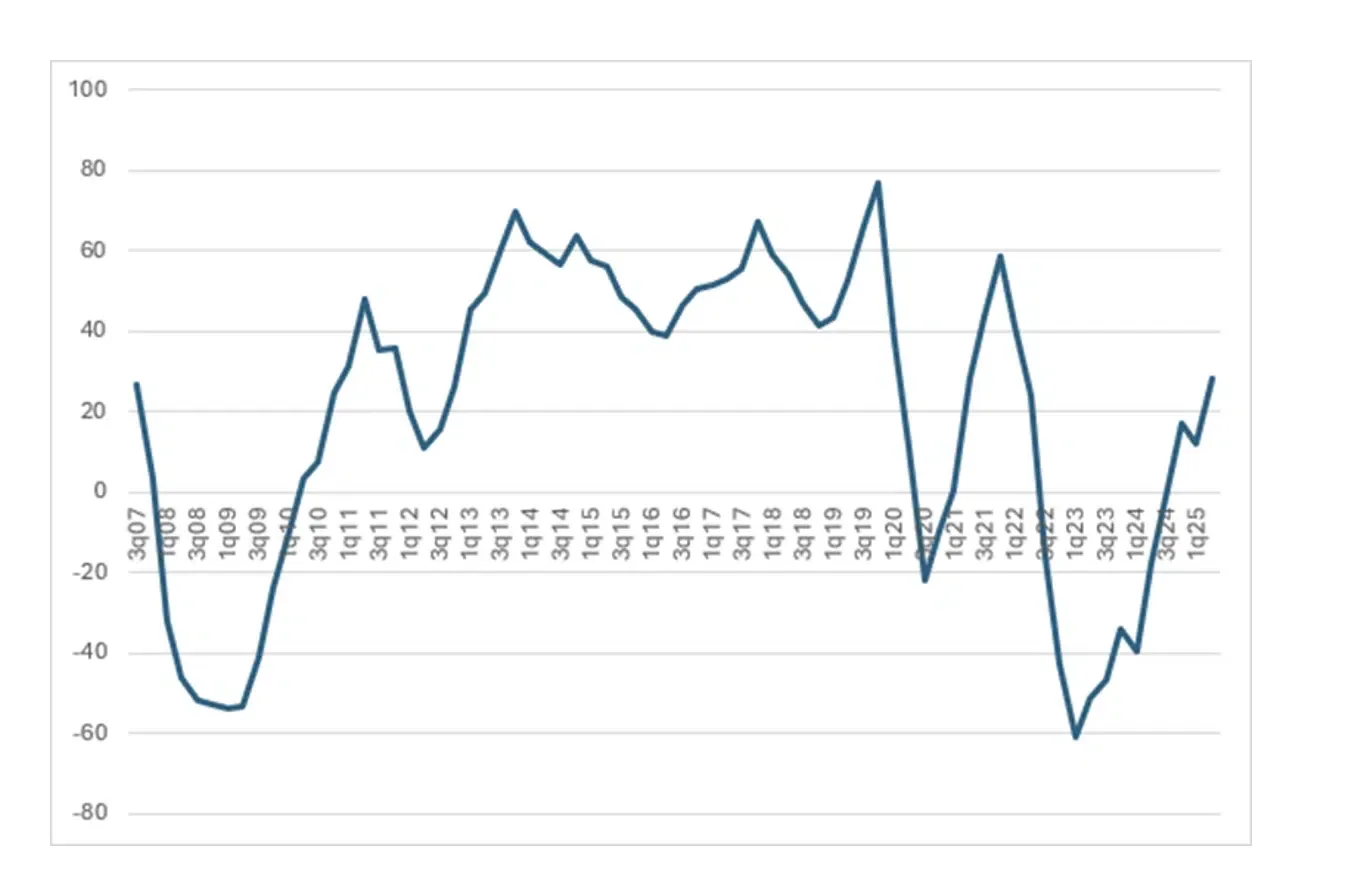

IREI reports that commercial real estate markets are showing consistent signs of stabilization, according to Madison International Realty’s latest reading of its proprietary Madison Real Estate Liquidity Index (MRELI). The index hit 35.6 in Q3 2025 — its highest point since Q1 2022 — reflecting improved conditions for entering and exiting real estate limited partnerships.

Still Room to Recover

Despite the upward trend, real estate capital markets have yet to fully normalize. According to Madison, index readings in the 40s and 50s typically signal robust market liquidity. Nevertheless, the index has surged nearly 80 points since early 2024, pointing to steady progress after years of volatility driven by the pandemic and subsequent rate hikes.

What’s Driving the Improvement

MRELI’s Q3 gain was attributed to strong loan origination activity in both the US and Europe, along with improving public markets and a recent uptick in CMBS issuance, which has helped restore some investor confidence in liquidity channels. Liquidity also benefited from the Fed’s recent rate cut, which has supported renewed private equity interest.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Cautious Optimism Ahead

“After the worst period of illiquidity since the global financial crisis, commercial real estate markets appear to have turned a corner,” said Christopher Muoio, managing director at Madison International Realty. Still, he noted that some metrics — such as dry powder and fundraise timelines — remain muted, suggesting the rebound is uneven.

Why It Matters

As a secondaries specialist and liquidity solutions provider, Madison uses the MRELI to track investor sentiment, deal flow, capital markets activity, and overall ease of access in commercial real estate. Continued recovery in these metrics could signal broader health in the investment landscape heading into 2026.

Looking Ahead

While external risks remain — including global trade tensions and shifting monetary policy — the path toward more normalized liquidity appears intact. Madison expects cautious momentum to continue into 2026 as capital formation regains strength and investor confidence improves.