- The US real estate cycle is still in its early phase, offering investors time to enter before pricing rebounds.

- Limited capital and cautious buyers are slowing activity, but reducing competition for high-quality assets.

- Structural trends in living, logistics, data infrastructure, and credit continue to support strong investment cases.

Slow Pace Creates Opportunity

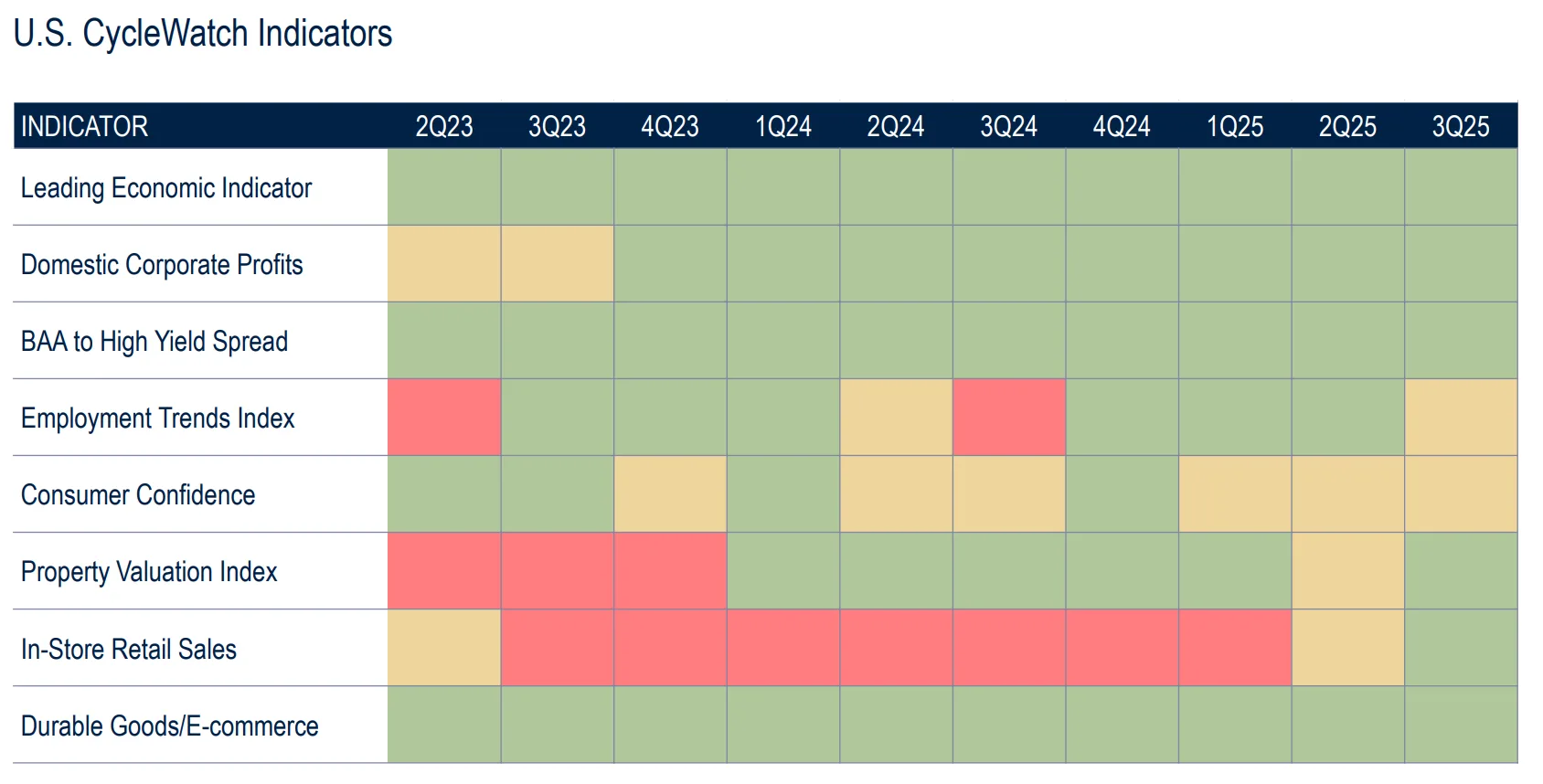

According to PGIM, the US commercial real estate market continues to recover, though at a measured pace. Economic indicators like job growth, corporate profits, and consumer sentiment remain solid. However, capital flows remain slow. High borrowing costs and cautious investors are holding back deal volume across property types.

This delay is opening space for well-positioned investors. With little distress and limited competition, buyers can find quality assets at fair prices, especially in sectors with strong fundamentals.

Fair Prices, Shifting Capital

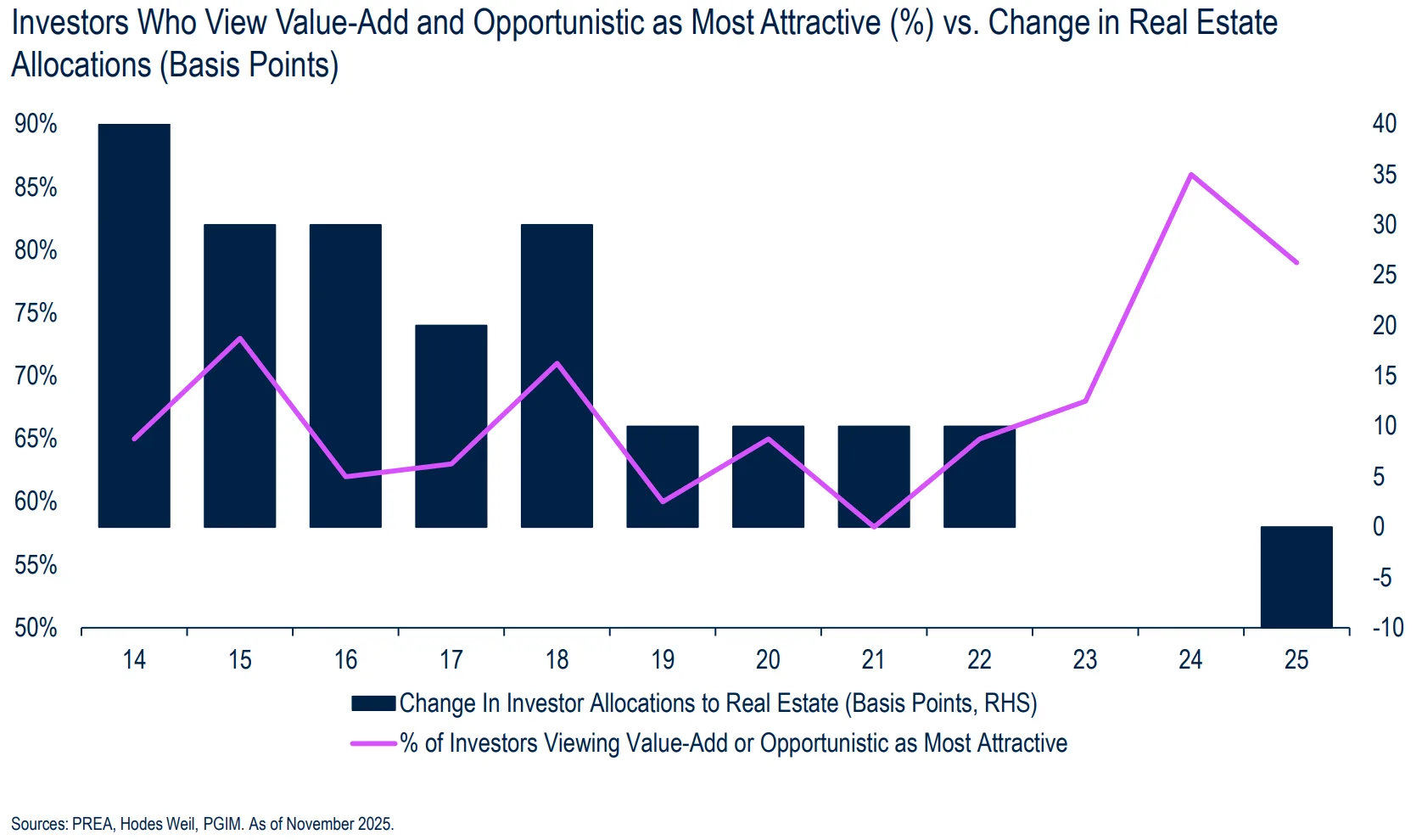

Property values have leveled off. Yields now align with historical averages, which points to fair pricing. While income-focused investors may hold back, long-term players see room for solid returns. At the same time, many institutions have reached their real estate allocation limits. Because of that, capital is moving away from core strategies and toward value-add, opportunistic, and credit plays.

Where Investors See Value

Living assets continue to attract interest. Demand for senior housing and build-to-rent homes remains strong, supported by aging demographics and low homeownership affordability. Occupancies are rising, and rents are expected to grow next year.

Logistics properties, especially those near population centers or trade routes, remain in demand. Supply is slowing, which supports rent growth in the most desirable locations.

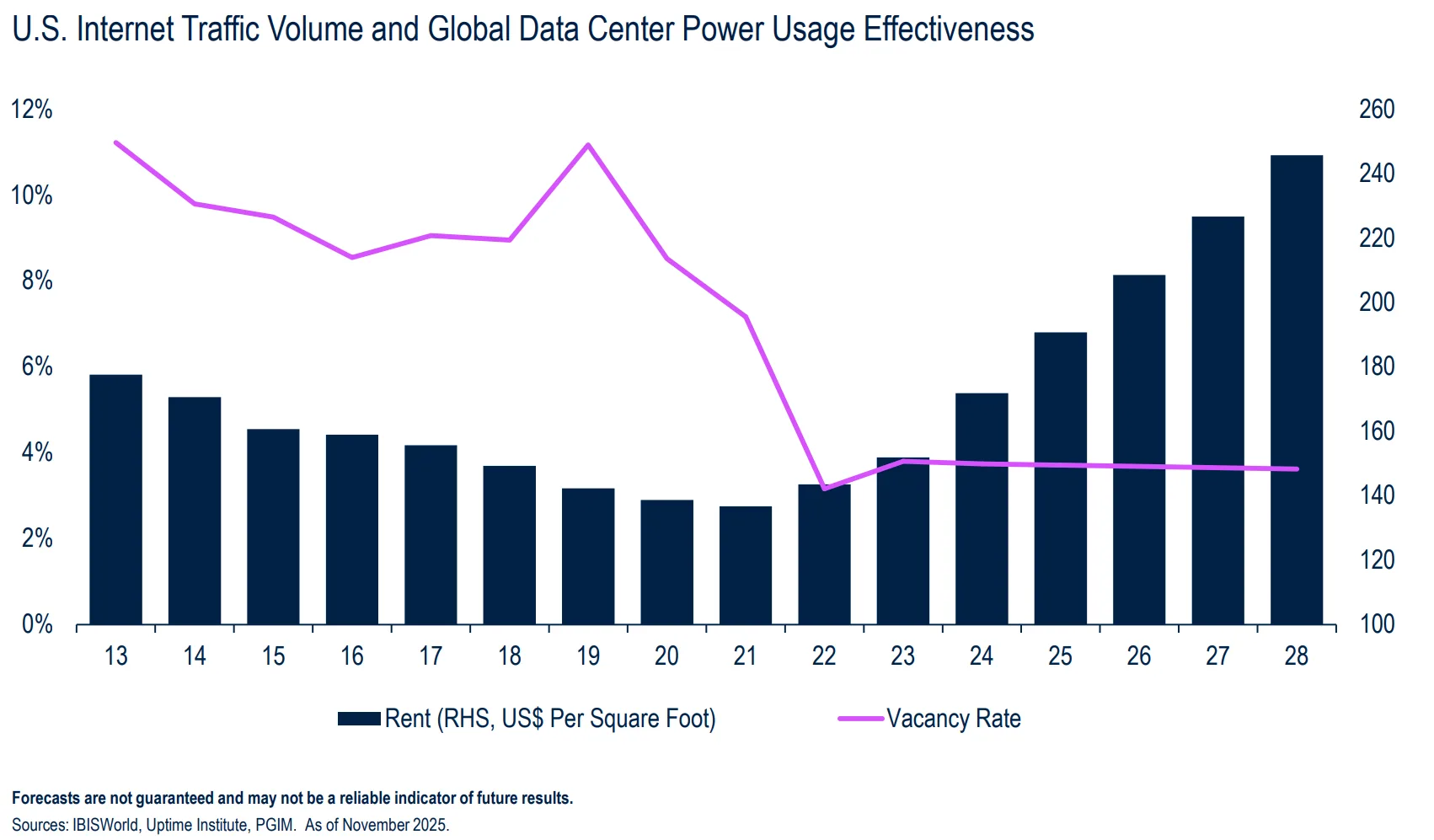

Data centers show strong performance as digital infrastructure grows. Tenant demand is keeping up with supply, and rental rates continue to climb in key markets.

Credit strategies offer attractive yields. With banks pulling back from lending and oversight rules evolving—including recent changes to HUD’s enforcement approach—non-bank lenders are stepping in to fill financing gaps. Bridge loans, stretched senior structures, and transitional debt provide flexible options for both borrowers and investors.

Outlook for 2026

Real estate markets are still in the early recovery phase, and that’s likely to continue through next year. Investors with a selective, long-term view can take advantage of this period. Sectors backed by durable demand—like housing, logistics, and data—offer some of the most compelling opportunities. With less competition and improving fundamentals, 2026 may favor those who act with focus and discipline.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes