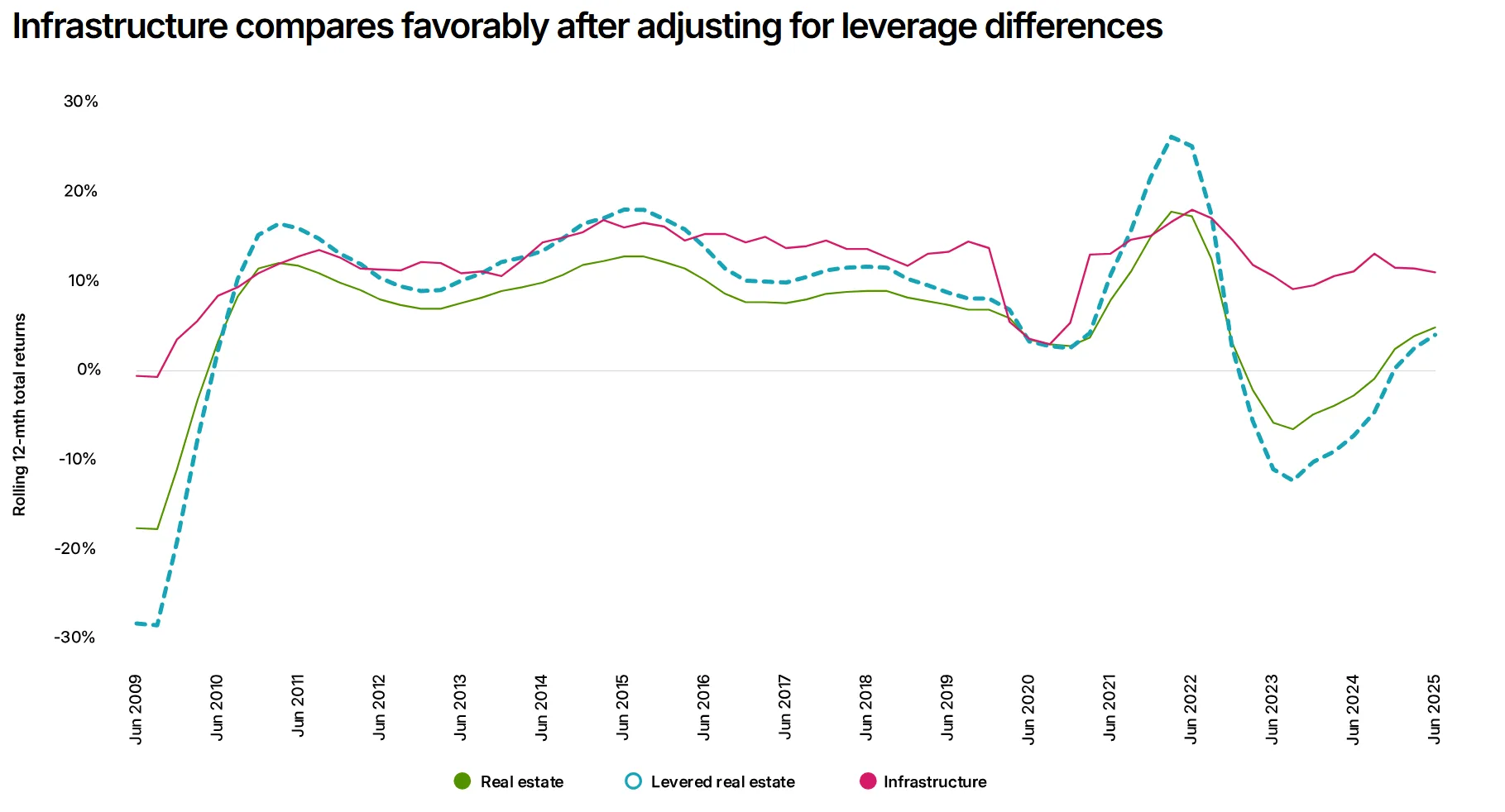

- Real assets allocations are shifting as private credit and infrastructure outcompete traditional real estate.

- Real estate debt strategies are yielding higher returns and attracting more capital than equity investments.

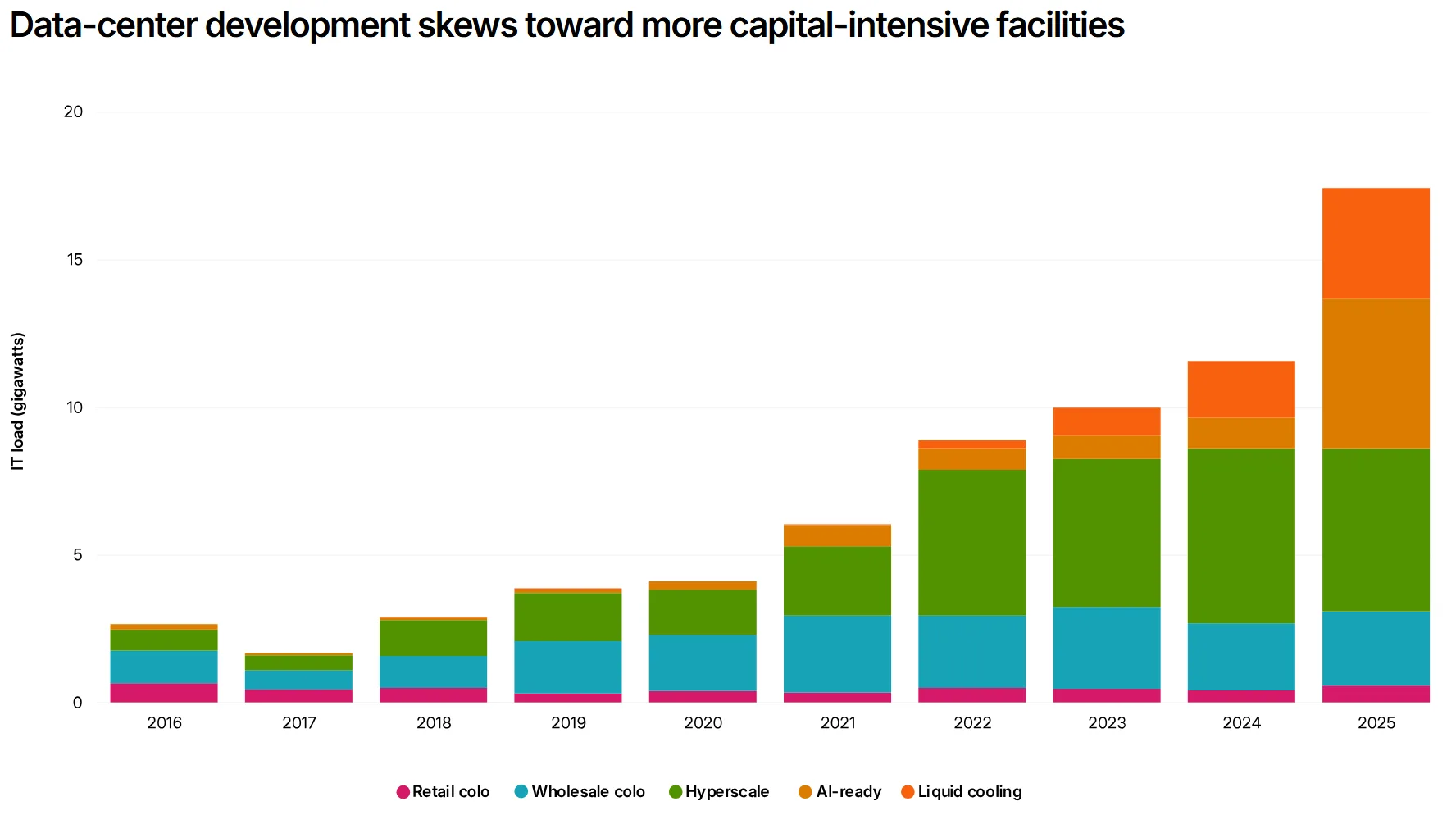

- Data centers face rising risk of obsolescence as technical requirements escalate, increasing investor caution.

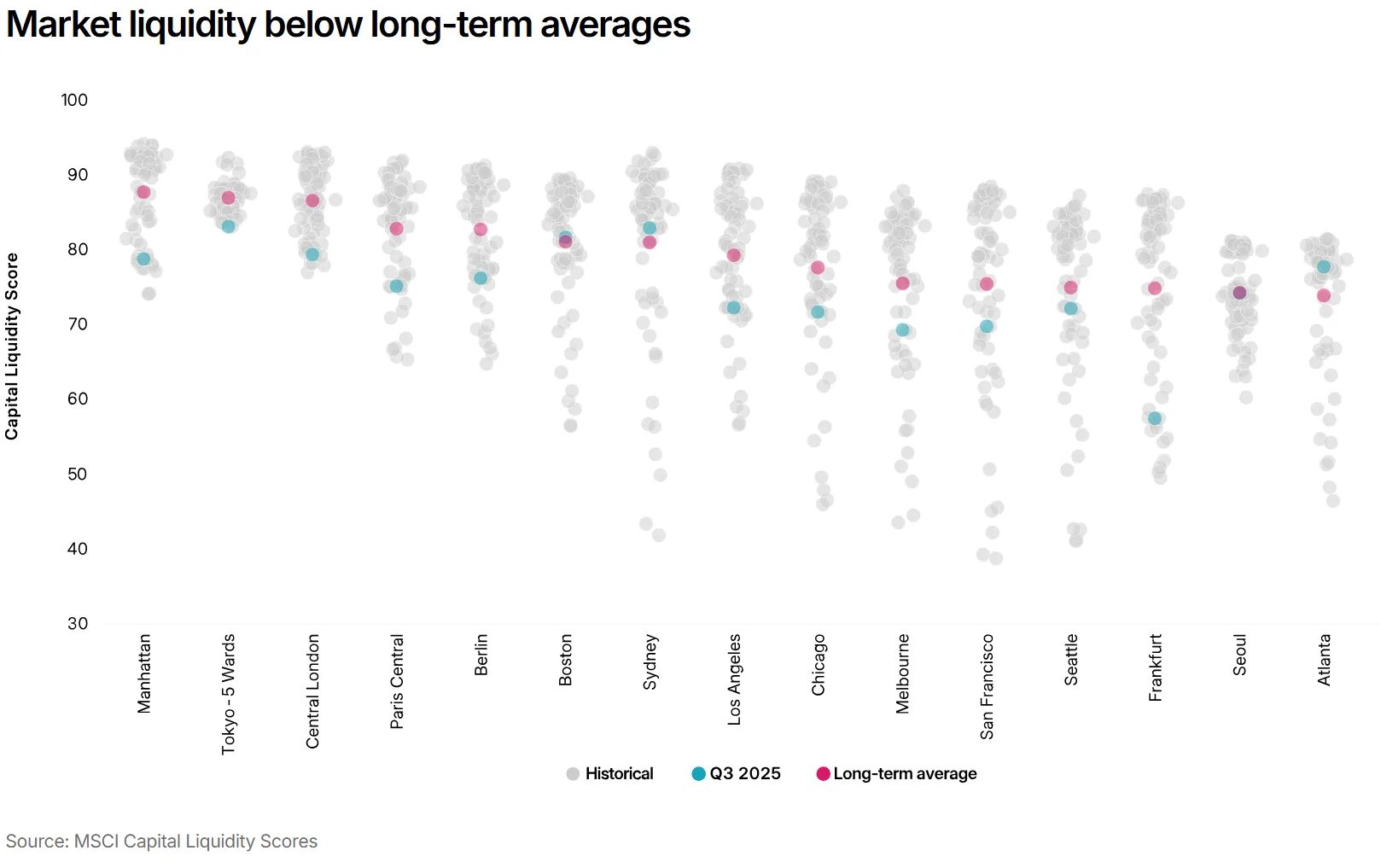

- Liquidity in global property markets remains below historic norms, with recovery expected to be gradual.

Real Assets Face Allocation Pressures

In 2025, institutional investors reduced real estate allocations in global real assets strategies — the first drop in over a decade, reports MSCI. Preference shifted toward private credit and infrastructure. About 60% of investors now view these alternatives as direct competition for capital, putting pressure on real estate’s role in diversified portfolios. As a result, there’s a growing need for more granular, data-driven asset selection focused on risk-adjusted returns within integrated real assets allocations.

Debt Outpaces Equity

Demand for real assets debt is rising, especially in the US. Real estate debt funds offer higher yields and better downside protection than equity investments. Debt funds have gained market share, fueled by growing dry powder. These vehicles now benefit from favorable deal terms and reduced competition from traditional lenders. The pivot away from equity is occurring as institutions actively rebalance their portfolios, reducing exposure to direct real estate in favor of more flexible credit strategies. This has inverted traditional CRE risk-return expectations and increased competition among all real assets segments.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Data Centers Bring New Risk

Within real assets, data centers are experiencing a rapid evolution toward high-power-density environments and AI-ready infrastructure. While demand remains strong, the sector now faces heightened risk of technical obsolescence. High development costs and the need to future-proof older facilities are making investors cautious. This mirrors past structural challenges in the office and retail sectors.

Liquidity Recovery Gradual

Global property market liquidity remains well below historic averages despite some rate cuts and stabilization. Ongoing uncertainty around inflation and central bank policy continues to restrict deal flow and cap new fundraising. A full recovery in real assets liquidity is expected to move slowly. It may become self-reinforcing as transactions increase and price discovery returns. Investors are advised to stay selective and focus on sector fundamentals, with competitive dynamics in real assets likely to persist into 2026.