- Quick-service restaurants (QSRs) made up 20% of all new US retail leases over the past year, highlighting strong tenant demand.

- The top 50 QSR brands added 2,700+ net new locations in 2024, led by chains like Starbucks, Chipotle, and Wingstop.

- Consumer spending at restaurants hit $100B+ in July 2025, nearly 50% above pre-pandemic levels despite inflation.

- Investor interest in net-leased restaurant properties remains high due to strong visitation and reliable unit economics.

Restaurants Take The Lead In Retail Growth

Restaurants, bars, and coffee shops are playing a pivotal role in retail real estate’s post-pandemic recovery, reports Colliers. Over the past 12 months, these tenants accounted for roughly 20% of all new retail leasing. They have become a critical driver of foot traffic and absorption in shopping centers nationwide.

Even in the face of inflation, Americans are prioritizing dining out. Retail spending at restaurants and coffee shops exceeded $100B in July 2025, representing a nearly 50% jump from pre-pandemic levels.

Quick-Service Chains Dominate Expansion

Quick-service restaurants (QSRs) remain at the forefront of growth. In 2024, the top 50 QSRs opened 2,722 net new units, reflecting accelerated expansion compared to previous years. Chains leading the charge include:

- Starbucks

- Krispy Krunchy Chicken

- Jersey Mike’s

- Wingstop

- Chipotle

These brands are capturing consumer traffic through a mix of convenience, affordability, and digital ordering platforms, such as mobile apps and third-party delivery integrations.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

What’s Selling

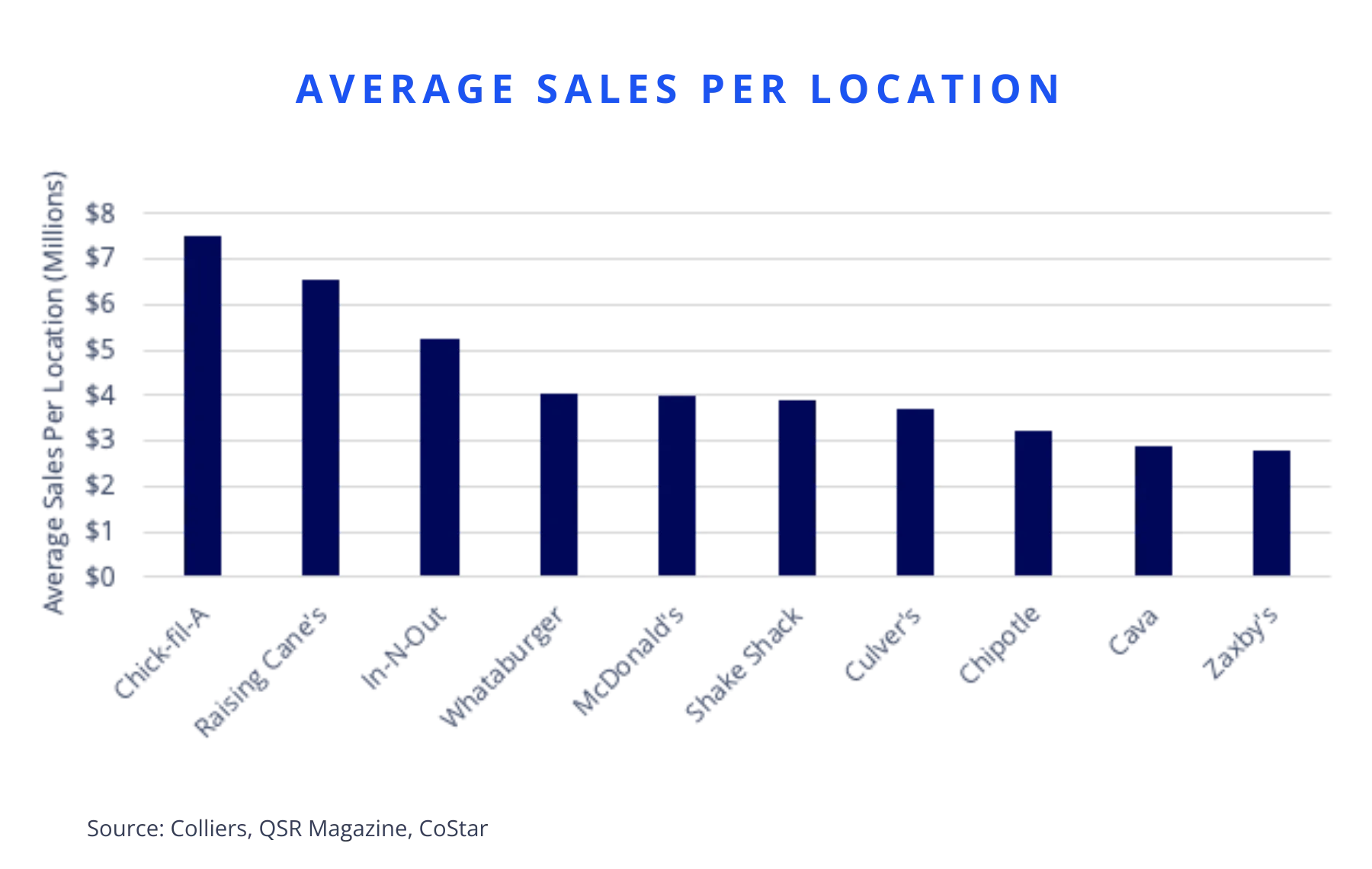

High-performing QSRs often revolve around two staples: chicken and burgers. Top performers by average sales per unit include:

- Chick-fil-A

- Raising Cane’s

- In-N-Out

- McDonald’s

- Shake Shack

Chains like McDonald’s, Taco Bell, Chick-fil-A, Wendy’s, and Burger King each serve over 1B visitors annually, with McDonald’s alone drawing more than 7B.

Among full-service operators, Chili’s, Olive Garden, Texas Roadhouse, and Applebee’s maintain strong visitation, though growth in this segment is more closely tied to local economies and discretionary spending.

Retail Strategies Are Being Rewritten

Food and beverage tenants are key traffic drivers, helping activate retail centers and improve performance for surrounding or neighboring tenants. For investors, restaurant chains with strong brand equity and consistent unit economics are attractive in the net-lease market, thanks to predictable cash flows and high consumer loyalty.

Looking ahead, the continued success of both fast-casual and experiential dining concepts will require a balanced tenant mix. Operators must also navigate rising cost pressures and adapt to shifting consumer preferences. Despite these challenges, the sector’s momentum remains strong.