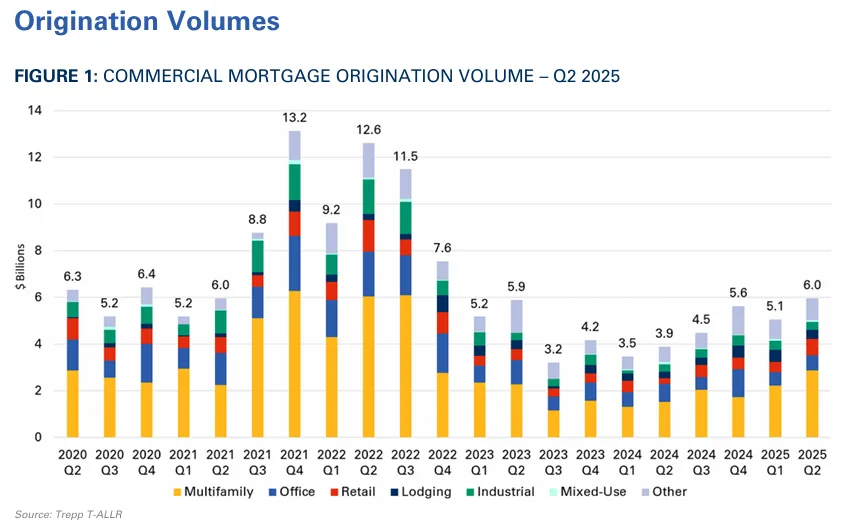

- Bank CRE originations hit $6B in Q2 2025, continuing momentum from late 2023, led by multifamily assets.

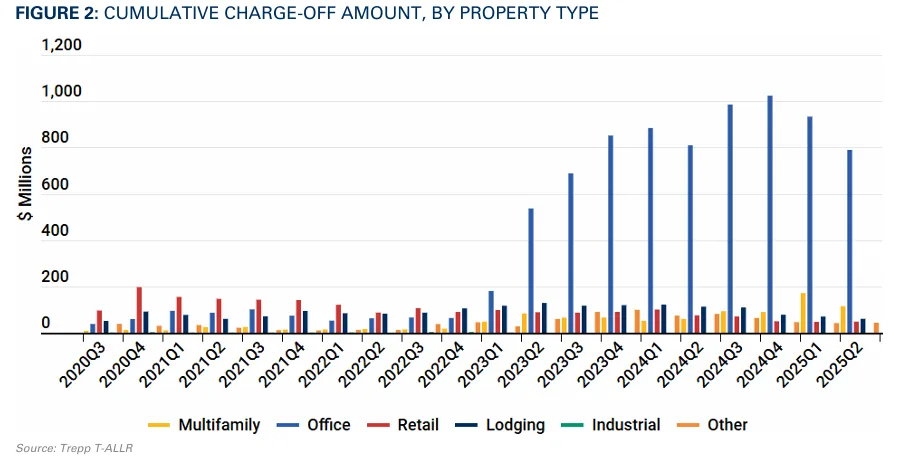

- Office loan charge-offs dropped for the second quarter, falling below $800M—hinting at stabilization in the sector.

- CRE delinquencies held steady at 1.94%, with office and multifamily improving; industrial and retail saw slight increases.

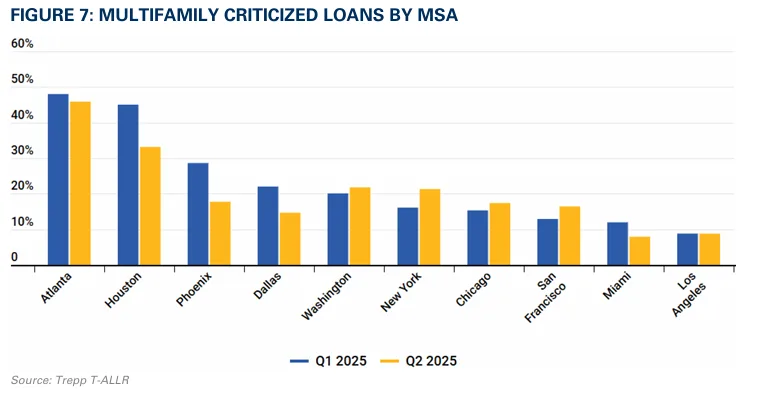

- Criticized loan rates improved in most major metros, though markets like Houston and Atlanta showed mixed trends.

CRE Lending Finds Its Footing

Q2 2025 saw continued growth in bank CRE loan originations, rising to $6B, on par with early-COVID volumes, according to Trepp.

Multifamily drove activity, with many loans structured on interest-only, floating-rate terms, as banks prepare for potential rate cuts. The market reflects cautious optimism amid conflicting macroeconomic signals.

Office Loan Distress Eases

Office charge-offs declined from $933M to under $800M, marking the second consecutive quarterly drop. While risk remains for aging and underperforming properties, this trend signals that the worst of the office downturn may be over.

Multifamily charge-offs also eased to $114M, while lodging sector rates remain elevated due to limited bank exposure and sector volatility.

Delinquencies Hold Steady

Overall CRE delinquencies remained flat at 1.94%, with serious delinquencies inching up to 1.70%.

- Office delinquencies dropped 20 bps to 6.13%—the third consecutive decline.

- Multifamily improved, falling to 1.40% from 1.58% last quarter.

- Industrial and retail rose by 28 and 32 basis points, respectively.

Criticized Loans Show Mixed Trends

Criticized loan rates, bank-internal indicators of credit risk, generally declined but varied by market.

- Office markets like New York, Washington, and Dallas improved, though levels remain high.

Houston and Atlanta worsened, impacted by tighter lending standards and maturing debt. - Multifamily loans in Houston saw a sharp 12% drop in criticized rates (to 33%). Other metros posted 2–11% declines, though New York, Chicago, and Washington saw slight increases.

Cautious Optimism Ahead

Q2 2025 marks a stabilizing period for bank CRE loans. Improvements in originations, declining office stress, and steady delinquency rates are encouraging signs. Yet risks remain, especially for older office assets and multifamily properties in oversupplied markets.

Expect performance to vary regionally as banks balance opportunity and risk amid uncertain monetary policy and economic signals.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes