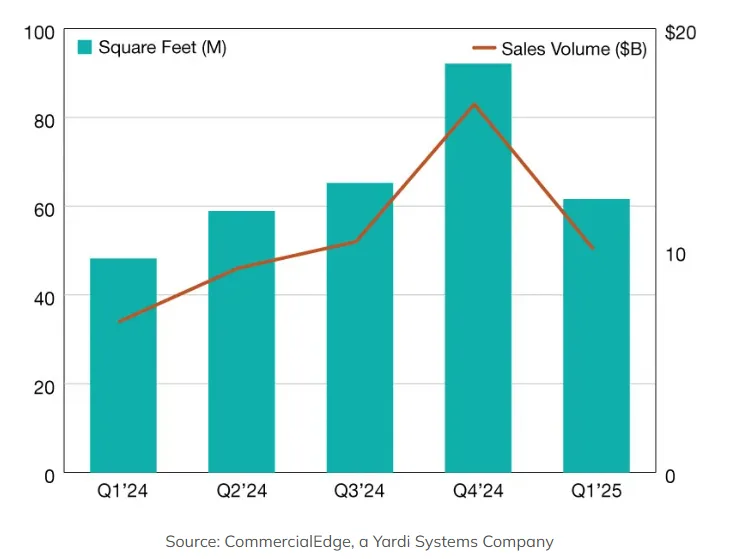

- Q1 2025 office sales hit $10.1B, up 48.5% year-over-year, with 61.6M square feet traded.

- Average price rose to $181.46/SF, a 13.7% increase from Q4 2024.

- Early Q2 deals average $536.74/SF, signaling strong investor demand despite sector challenges.

Office Investment Gaining Ground

CommercialEdge’s latest data shows renewed strength in the office investment market, with Q1 2025 closing on $10.1B in sales across 486 transactions and 61.6M SF of office space, per Commercial Search.

This represents a substantial rebound from Q1 2024, which recorded $6.8B in sales.

While the number of deals remained nearly identical to the previous year (485 vs. 486), the higher transaction value and square footage suggest a broader market rebound driven by investor confidence and better-aligned valuations.

Pricing on the Rise

The average sale price PSF in Q1 2025 rose to $181.46, reflecting a 13.7% jump from the $159.56 recorded at the end of Q4 2024. For context, office assets in all of 2024 traded at an average of $179.91 PSF, with 2,382 transactions totaling $43B.

So far in Q2, pricing momentum appears to be accelerating further. CommercialEdge recorded nine transactions totaling 1M SF, with an average price of $536.74 PSF—a sharp increase from $158.78 PSF in Q2 2024.

A Promising Start to 2025

While the office sector continues to grapple with hybrid work shifts and evolving space demand, early 2025 performance signals renewed investor appetite, particularly for high-quality or well-located assets.

If current trends continue, the office sector could be on track to outperform 2024 totals, offering signs of recalibration and growth in a market still finding its post-pandemic footing.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes