- Commercial real estate dealmaking is rebounding after a slowdown sparked by President Trump’s April tariff announcement.rn

- Investors are cautiously returning to the market, as financing becomes more accessible and property owners grow more confident in valuations.rn

- Existing buildings are becoming more attractive amid rising construction costs tied to trade disputes, pushing focus toward acquisitions over new builds.

A Resilient Turnaround

The US commercial-property market is bouncing back, signaling the early stages of a property recovery, after President Trump’s early April tariff announcements briefly rattled investors and stalled financing activity. Deal pipelines that were temporarily frozen are moving again, with developers reviving paused projects, according to Bloomberg.

For example, a borrower working with Bravo Property Trust on a Texas apartment complex financing has resumed activity. “Now it’s off to the races again,” said Bravo CEO Aaron Krawitz.

Deals Resume, But With Caution

The earlier tariff shock disrupted momentum in a market that had only just begun to stabilize after years of rising interest rates and bank retrenchment. Josh Zegen of Madison Realty Capital described a return to activity, but noted that investor sentiment remains “a little more cautious, a little more uncertain.”

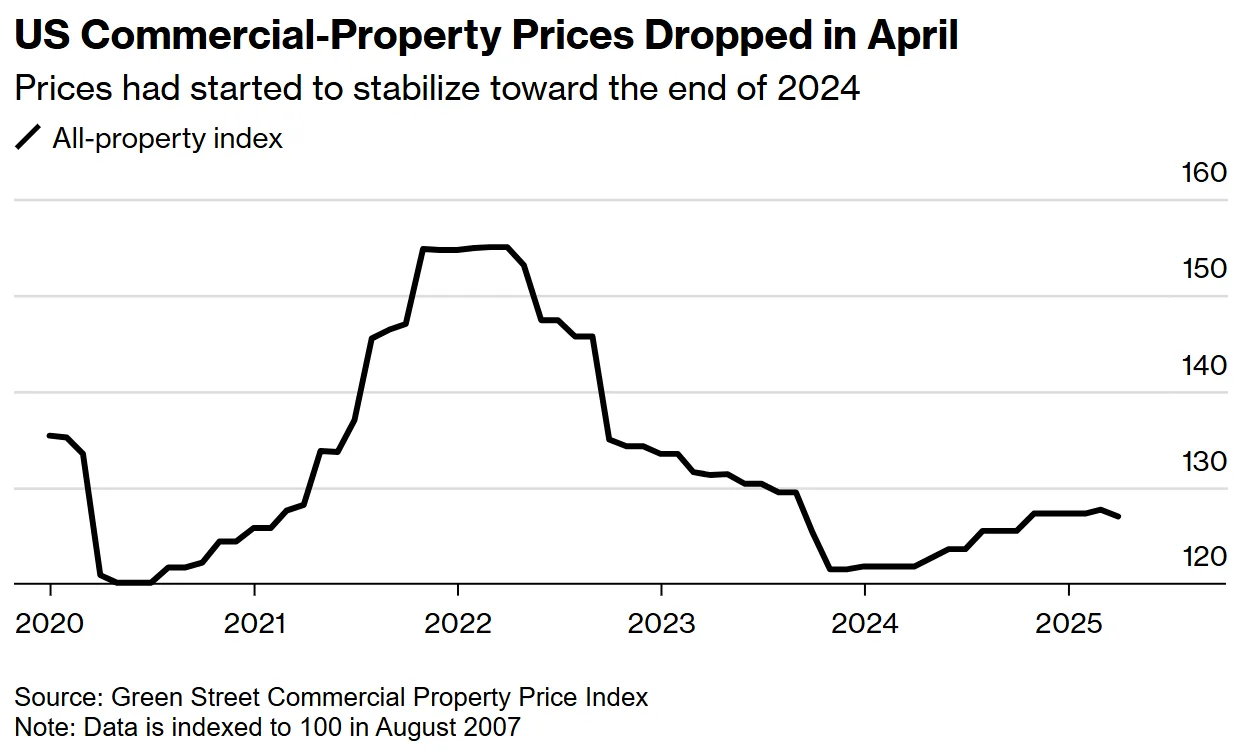

Property prices dipped 0.5% in April, according to Green Street, but by May, sentiment had begun improving. Blackstone’s global co-head of real estate, Nadeem Meghji, remains bullish, asserting that the “foundations for the real estate recovery remain intact.”

Credit Markets Fuel Recovery

Improved liquidity has played a key role in the rebound. Banks and alternative lenders have been gradually returning, helping fund deals and restore confidence. Eastdil Secured reports that Q1 activity was already gaining traction, and while the tariff news caused a brief pause, activity is now rebounding swiftly.

Just this week, the owner of Washington, DC’s Wharf development began marketing over $1B in commercial mortgage-backed securities.

Headwinds Persist—But So Do Opportunities

Challenges remain, including high interest rates, economic uncertainty, and tariff-driven cost pressures. Yet for some investors, these headwinds present opportunity. Higher construction costs may benefit owners of existing buildings by reducing new competition and supporting rent growth.

Developers in high-demand markets are also pushing forward. InterVest Capital Partners is seeking financing to convert Manhattan’s 111 wall street into more than 1,500 residential units.

Outlook

The commercial-property market appears to be building resilience after years of volatility. “The world didn’t end,” said Eastdil’s Brian Budnick. “It feels like people are building up a little bit of an immunity to those moments.”

While the path forward may be uneven, industry leaders agree: the property recovery is underway, even if shaped by caution and strategy.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes