- Property prices, as measured by the Green Street Commercial Property Price Index, rose 2% in 2025

- The index edged down 0.1% in December but remains up 2.3% year-over-year

- Major CRE sectors such as industrial, office, and core sectors also posted 2% annual gains

- CRE price appreciation is likely to stay modest in 2026 barring a drop in interest rates

A Modest Year for Property Prices

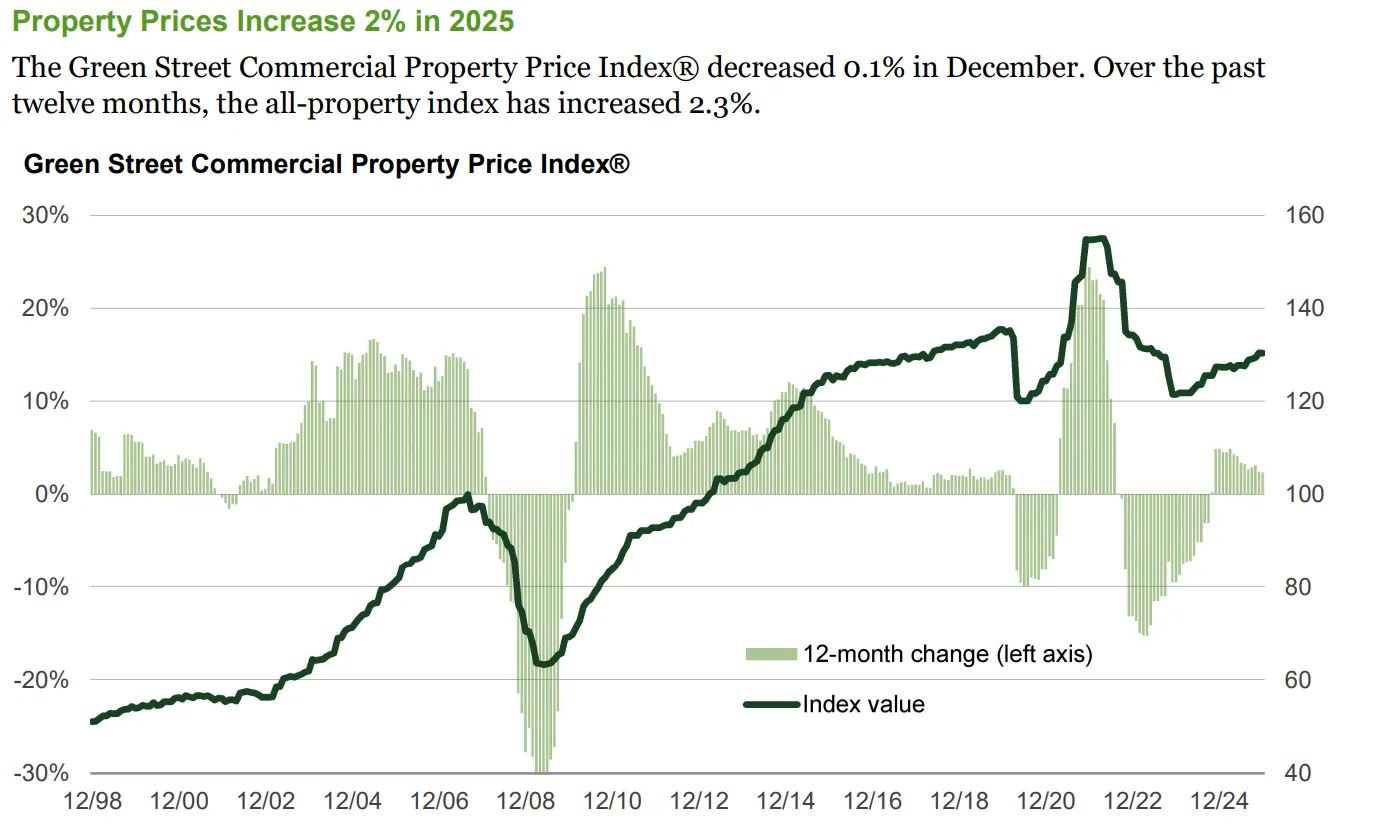

US commercial property prices posted incremental growth in 2025, according to the latest Green Street Commercial Property Price Index (CPPI). The all-property index increased 2% over the past twelve months, with values broadly holding steady across major asset classes.

The CPPI, which tracks institutional-quality CRE transactions nationwide, slipped 0.1% in December but maintains a 2.3% gain over the 12-month period. This trend reflects a relatively stable pricing environment compared to the sector’s steep declines since the 2022 market peak.

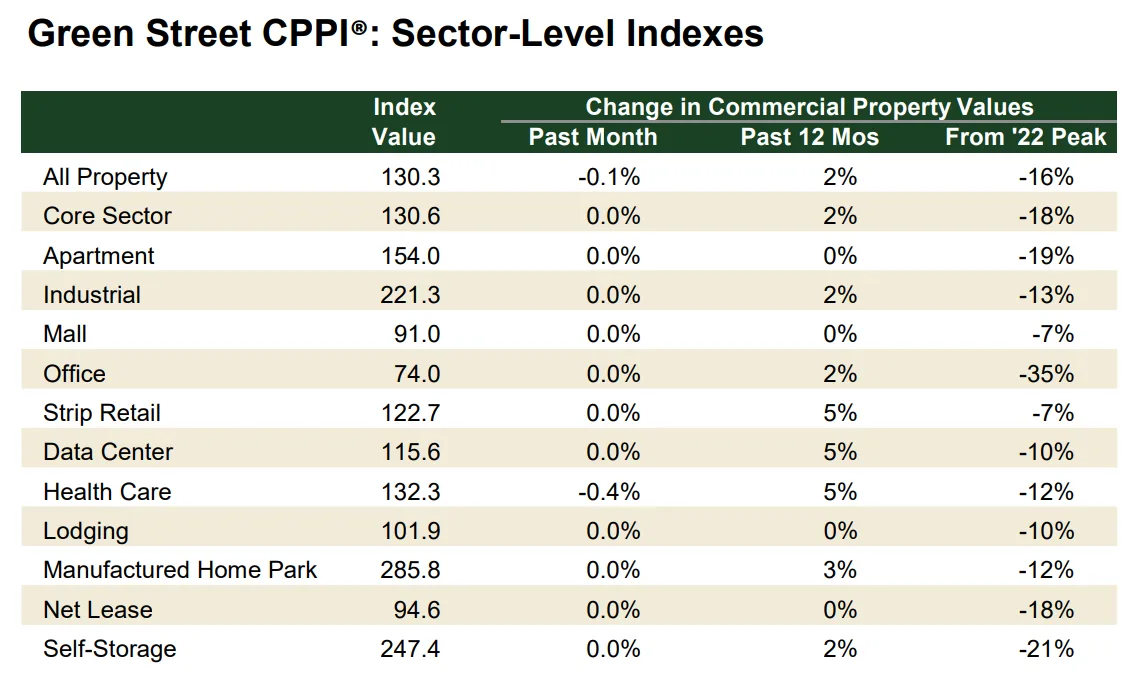

Index Breakdown by Sector

Core CRE sectors—including apartments, industrial, office, and retail—each reported a 2% rise for the year. Strip retail and data center values grew 5%, while healthcare, manufactured home parks, and self-storage saw gains between 2% and 5%. In contrast, some sectors like office (down 35% from the 2022 peak) and self-storage (down 21%) continue to bear the brunt of the earlier market correction despite recent stability.

- Core sector index: up 2% in 2025, but down 18% from the 2022 high

- Office sector: up 2% over the year, but still 35% below its 2022 level

- Data center and strip retail: leading the yearly gains at 5% each

CRE Price Outlook Tied to Rates

Peter Rothemund, Co-Head of Strategic Research at Green Street, notes that current property prices are in line with corporate bonds. As a result, significant price appreciation is unlikely in 2026 unless medium- and long-term interest rates decline, which would improve CRE pricing relative to other asset classes. Some of these dynamics have been playing out gradually over the past year, as price recovery has remained uneven amid lingering macroeconomic uncertainty.

The Green Street CPPI remains one of the sector’s most timely measures, capturing current transaction pricing with a focus on high-quality assets. Its latest readings suggest the CRE market is in a holding pattern, with sector performance aligning closely with broader macroeconomic conditions.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes