- Private real estate, tracked by the NCREIF-ODCE Index, has delivered four straight quarters of positive returns, pointing to a cyclical turning point.

- Lending standards for commercial real estate acquisitions are easing, showing growing confidence among banks and institutional lenders.

- Transaction volume is up for the fifth straight quarter year-over-year, reflecting renewed investor appetite and improving market liquidity.

Private Real Estate Is Gaining Ground

According to a report from Cohen & Steers, after a prolonged downturn that began in late 2022, private real estate appears to be turning a corner. In recent months, investors have seen steady improvements in returns, lending conditions, and deal volumes. These are all critical indicators that the worst may be over.

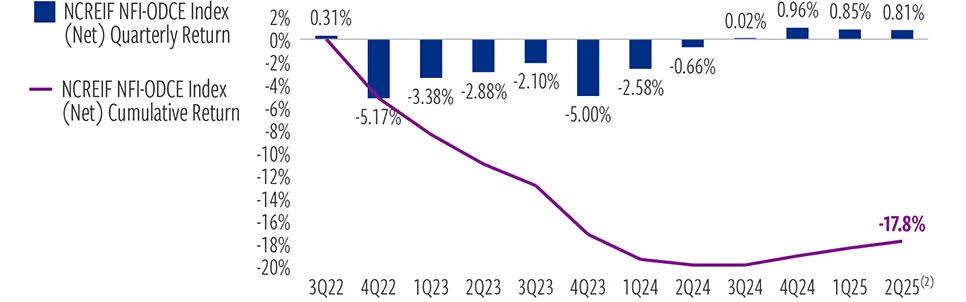

Four Consecutive Quarters of Positive Returns

The strongest signal of recovery is consistent improvement in performance. The NCREIF NFI-ODCE Index, a key benchmark for institutional-quality real estate, has now posted four consecutive quarters of positive returns.

This trend suggests more than a short-term rebound. According to Cohen & Steers, the index likely bottomed in Q2 2024. Once returns turn positive, history shows they typically stay that way through the early stages of a recovery.

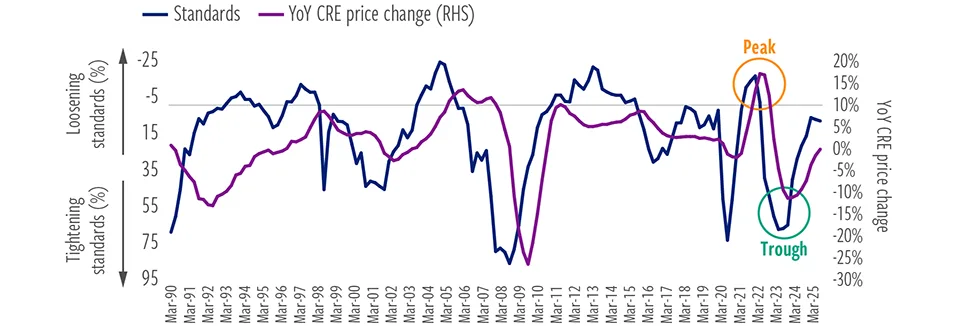

Lending Standards Are Loosening

The lending environment is also improving. Recent data from the Senior Loan Officer Opinion Survey shows that only 9% of lenders are tightening standards—a sharp drop from prior quarters.

Banks and other lenders are now more willing to finance acquisitions. This reflects stronger confidence in real estate values and cash flows. At the same time, speculative construction remains limited. Lenders are still requiring higher equity commitments and strong pre-leasing, which is helping control supply.

This creates a supportive backdrop for existing properties, with more available capital and less competition from new developments.

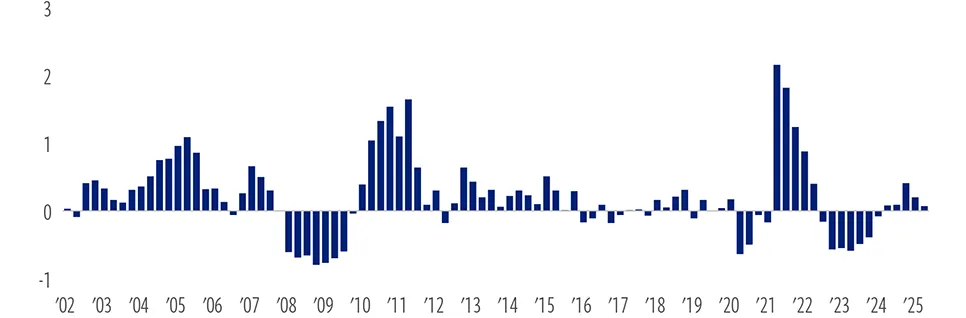

Transaction Volumes Are Rebounding

Finally, investor activity is picking up. US commercial real estate transaction volume has increased year-over-year for five straight quarters. This marks the most sustained growth since the downturn began.

More investors are coming off the sidelines. They are encouraged by clearer interest rate direction, improved valuations, and better fundamentals in select sectors. As a result, capital is returning to the market.

Why It Matters

Taken together, these three trends—stronger returns, easier financing, and rising activity—indicate that private real estate has likely bottomed. For investors waiting for clear signals, the market is showing increasing signs of stability.

What’s Next

While some macro risks remain, the private real estate sector is entering a more favorable phase. With fundamentals stabilizing and capital returning, the months ahead may offer attractive opportunities for investors ready to reenter the market.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes