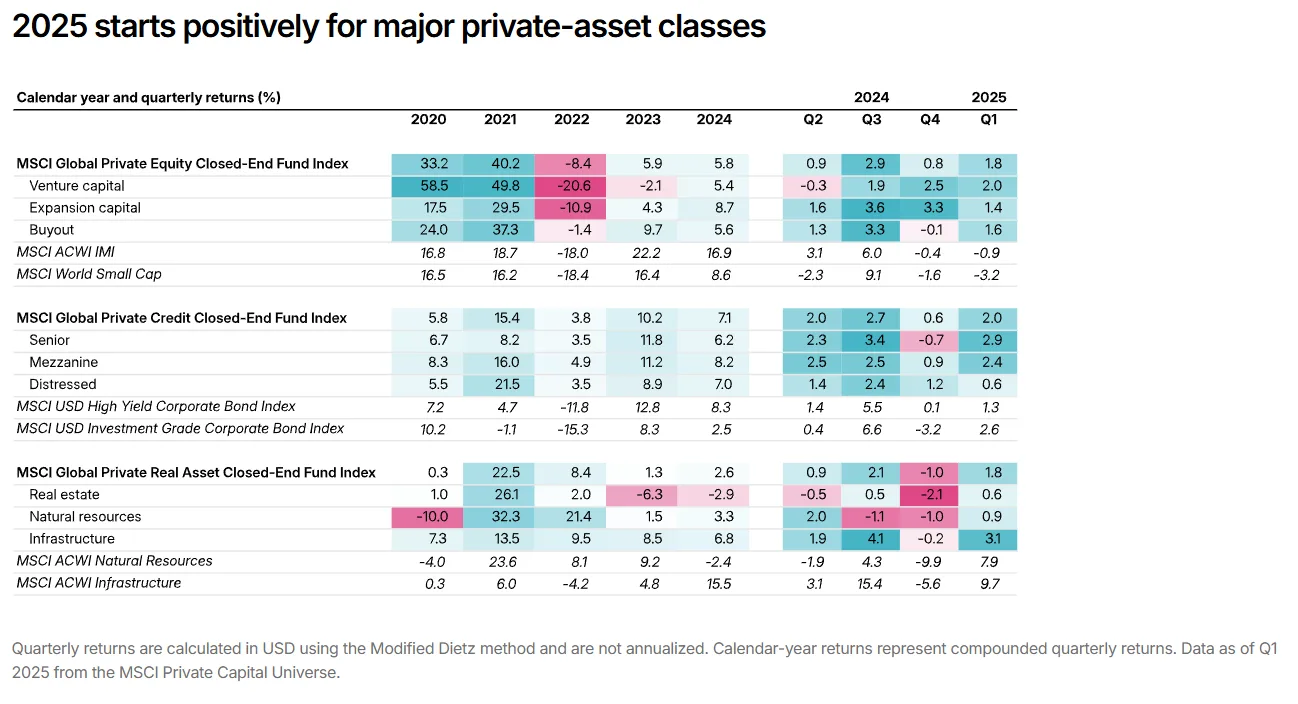

- Private credit led the pack in Q1 2025 with a 2.0% return, outperforming both private equity and real assets.

- Private equity followed closely, posting a 1.8% return, with venture capital outperforming its peers at 2.0%.

- Real assets rebounded from late-2024 declines, returning 1.8%, thanks to a 3.1% gain in infrastructure and a modest 0.6% uptick in real estate.

Private Markets Off To A Positive Start

Private markets saw a strong start to 2025, according to MSCI’s latest Private Capital Universe update. All three major strategies—private credit, private equity, and real assets—posted improved performance compared to the final quarter of 2024.

Credit Outperforms In

Private credit was the top performer in Q1, delivering a 2.0% return globally. Gains were driven by strong returns in senior lending (2.9%) and mezzanine debt (2.4%), aligning with the solid performance of public bond indexes during the same period.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Equity Holds Steady

Despite ongoing macroeconomic uncertainty, private equity returned 1.8% in Q1. Venture capital stood out with a 2.0% gain. All three subcategories delivered positive results—a stark contrast to public small-cap stocks, with the MSCI ACWI Small Cap Index down 3.2% in the same period.

Real Assets Rebound

Closed-end real asset funds also showed signs of recovery, posting a 1.8% return after ending 2024 on a down note. Infrastructure led the sector with a 3.1% gain, while real estate inched into positive territory, returning 0.6% after several quarters of decline amid elevated interest rates.

Why It Matters

The across-the-board positive performance underscores investor resilience and the appeal of private market strategies in a shifting macro landscape. With public markets facing volatility, private capital continues to offer diversification and relative stability to institutional portfolios.

What’s Next

If current momentum holds, 2025 could mark a turnaround year for the market, particularly in real assets and venture capital. Investors will be closely watching Q2 results for signs of sustained recovery and continued alpha generation across strategies.