- Private investors are leading a rebound in the single-tenant net lease retail sector, with transaction volume up 18% year-over-year through Q3 2025.

- Individual asset investments increased 15% year-over-year, while entity-level deals dropped sharply by 98%, largely due to fewer mergers.

- Cap rate spreads widened between top-tier and lower-tier tenants, and longer lease terms continued to command premium pricing.

- The average cap rate held at 6.5%, the highest level in over a decade, but remained stable despite broader market volatility.

A Rebound Year For STNL Retail

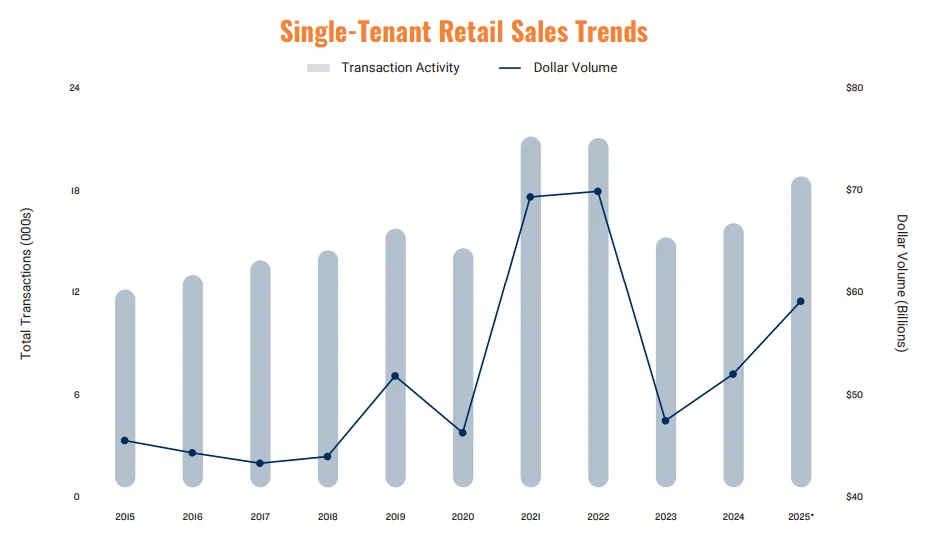

After sluggish activity in 2023 and 2024, the US STNL retail market experienced a notable resurgence in 2025, reports Marcus&Millichap. Transactions rose 18% and dollar volume 14% in 2025, showing improved alignment between single-tenant retail buyers and sellers.

Volume remained below the 2021 peak but exceeded all prior years, signaling a structural recovery in investor confidence.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

The Private Investor Revival

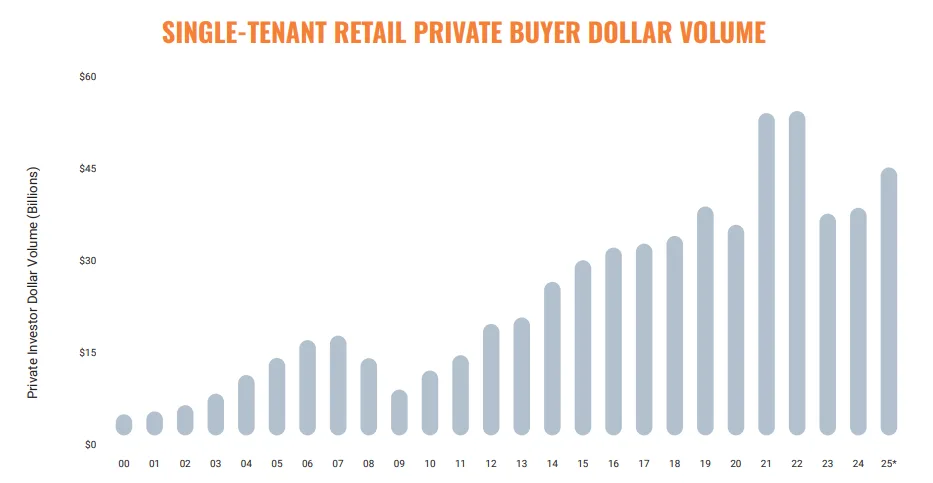

Private capital played a pivotal role in 2025’s comeback. Private investors accounted for 71% of all transaction volume, significantly outweighing REITs (10%), institutions (9%), and foreign buyers (4%).

Buyer volume in 2025 was 17% below the 2022 peak but still surpassed all years prior to 2021.

Cap Rates: Risk VS. Reward

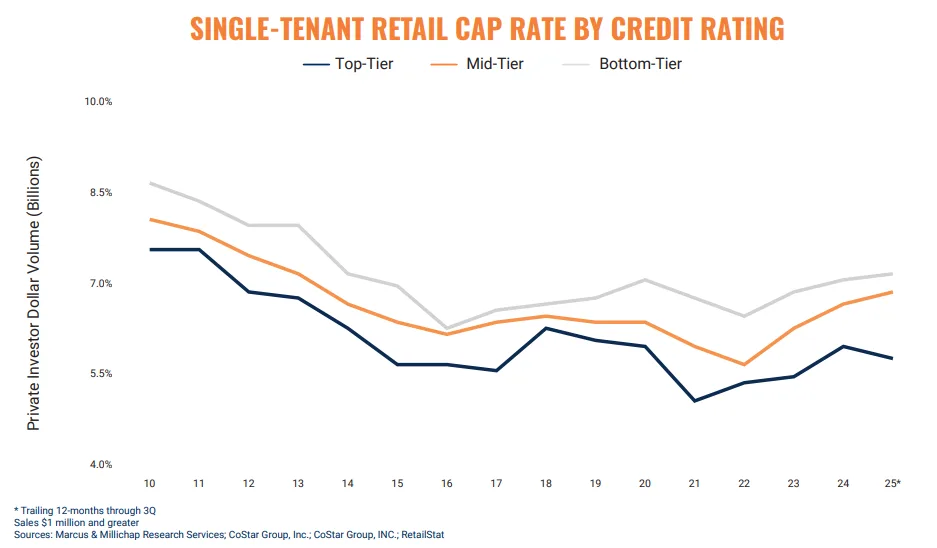

A critical theme in 2025 was risk-based pricing. The cap rate spread between top-tier and lower-tier tenants expanded to 140 basis points, up from the historical 100 basis point average. This reflects investor demand for stronger credit tenants amid uncertainty.

- Top-tier tenants: Cap rates decreased in 2025.

- Mid-tier tenants: Cap rates inched closer to bottom-tier levels.

- Bottom-tier tenants: Continued to yield the highest cap rates.

Lease Term Impacts Cap Rates

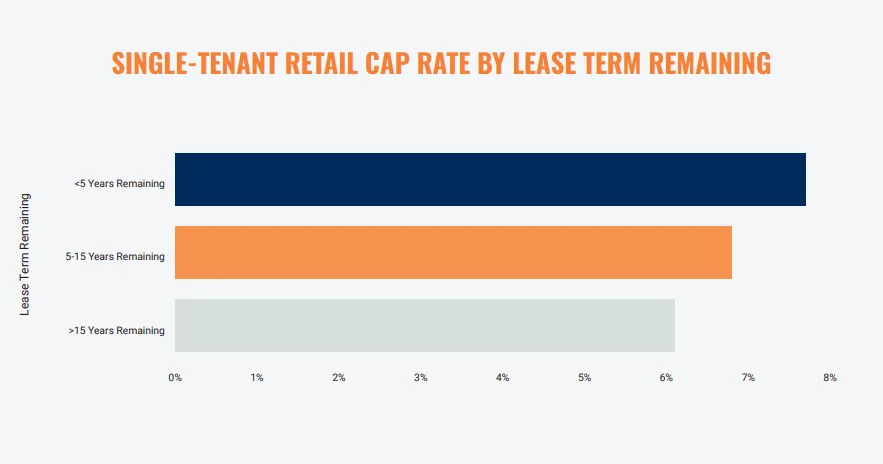

Lease length remained a key valuation metric:

- <5 years remaining: Avg. cap rate of 7.7%

- 5–15 years remaining: 6.8%

- >15 years remaining: 6.1%

Shorter lease terms demanded higher yields to offset rollover risk.

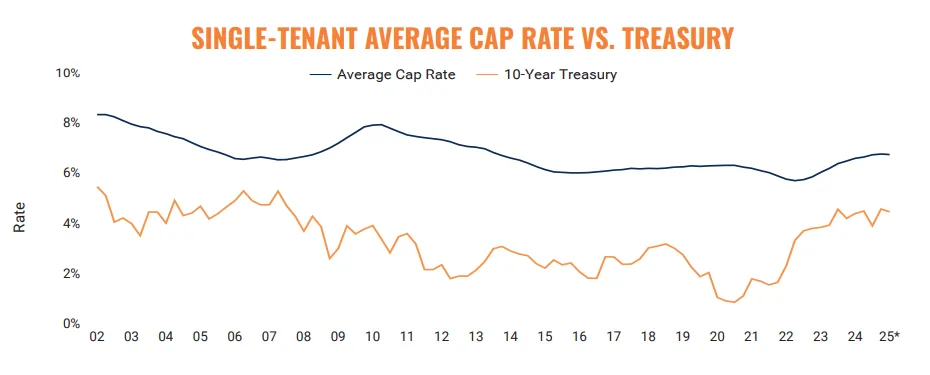

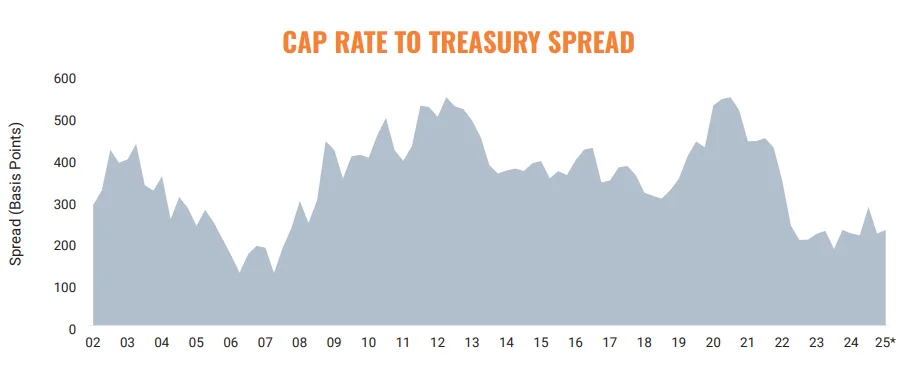

Historical Yield Spread: A Tailwind?

As of September 2025, the cap rate spread over the 10-Year Treasury widened to 240 basis points, up from a recent low of 200 in 2022. This enhanced yield premium could continue supporting deal activity into 2026.

What’s Next

Despite subdued portfolio and entity deals, a private capital rebound and better pricing alignment point to a positive outlook for STNL retail. According to Marcus & Millichap, investor appetite is expected to remain strong, especially for properties with long lease terms and creditworthy tenants, which continue to drive pricing premiums.