- Private equity firms own over 2.2M US apartment units, about 10% of the total stock, with Blackstone leading at 230K+ units.

- Ownership is highly concentrated, with over half of units located in Texas, Florida, California, Georgia, and North Carolina.

- Acquisitions have surged since 2018, with 43% of units bought after 2021, raising concerns about affordability in major metros.

- Rising rents in high-ownership areas like Tampa-St. Petersburg have sparked debate over private equity’s role in housing costs.

Private Equity’s Apartment Empire

A new report from the PESP estimates that private equity firms now own more than 2.2M apartment units across 8,200 properties nationwide — including developments still under construction. That’s around 10% of the entire US apartment stock, a significant milestone in the financialization of housing, as reported by Multifamily Dive.

Blackstone Tops The List

Out of 121 private equity firms included in the PESP analysis, New York-based Blackstone leads the pack with over 230K apartment units, accounting for more than one-tenth of all private equity-owned units. Charleston-based Greystar follows with over 138K units, though it declined to comment on the report.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

High Concentration In Key States And Cities

More than 55% of PE-owned apartments are located in five states:

- Texas (440K+ units)

- Florida

- California

- Georgia

- North Carolina

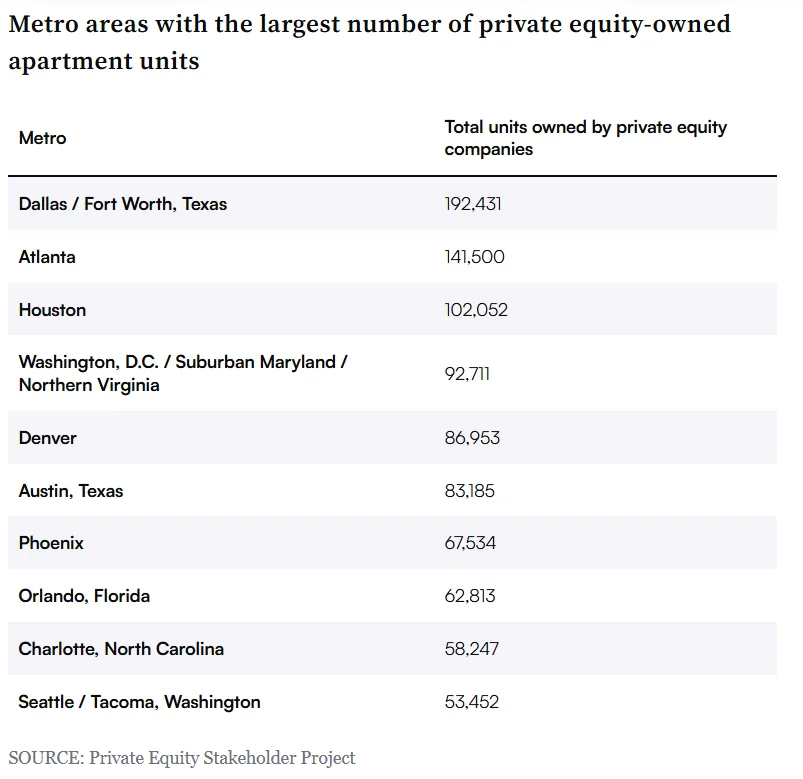

At the metro level, Dallas has the highest number of private equity-owned units — 192K across 591 properties. In markets like Atlanta, Denver, Austin, and Charlotte, private equity firms control over 25% of all apartment units.

A Recent Acquisition Surge

Private equity’s presence in multifamily real estate has ramped up quickly:

- 63% of units were acquired in or after 2018

- 43% of all units were purchased in or after 2021

- For Blackstone, 58% of its holdings were acquired post-2021

Cost-Burdened Renters In Key Markets

PESP draws a connection between rising private equity ownership and affordability pressures. In Tampa-St. Petersburg, where private equity owns nearly 25% of apartment units, the percentage of cost-burdened renters jumped from 52.6% in 2019 to 61% in 2023, while rents surged 49% — the steepest increase among the 25 largest US metro areas.

Blackstone Responds

Blackstone rejected claims that it’s contributing to rising rents, citing broader supply-demand imbalances. The firm stated it owns less than 1% of total US rental housing, with “virtually no ability to impact market rent trends.”

It also pointed to its $17B investment in housing through its affordable housing platform, April Housing, calling it the largest owner of Low-Income Housing Tax Credit (LIHTC) properties in the country.

Why It Matters

PE’s growing footprint in multifamily real estate is reshaping the rental landscape — especially in Sunbelt markets. While firms argue they’re improving and expanding housing stock, critics warn of a widening affordability gap.