- Dry powder for commercial real estate exceeds $350B globally. Blackstone leads with $177B ready to deploy.

- Investment momentum slowed in Q2 due to trade policy uncertainty, but a rebound is expected in the second half of 2025.

- Firms are shifting toward alternative sectors like data centers, student housing, and healthcare. Many funds face pressure to deploy capital soon.

Capital Ready to Move

CoStar reports that after years of record fundraising, private equity firms are regaining confidence. Despite recent slowdowns, they expect to ramp up real estate investment in late 2025. Blackstone, Apollo, Brookfield, and others are preparing to act on emerging opportunities.

Blackstone Leads the Pack

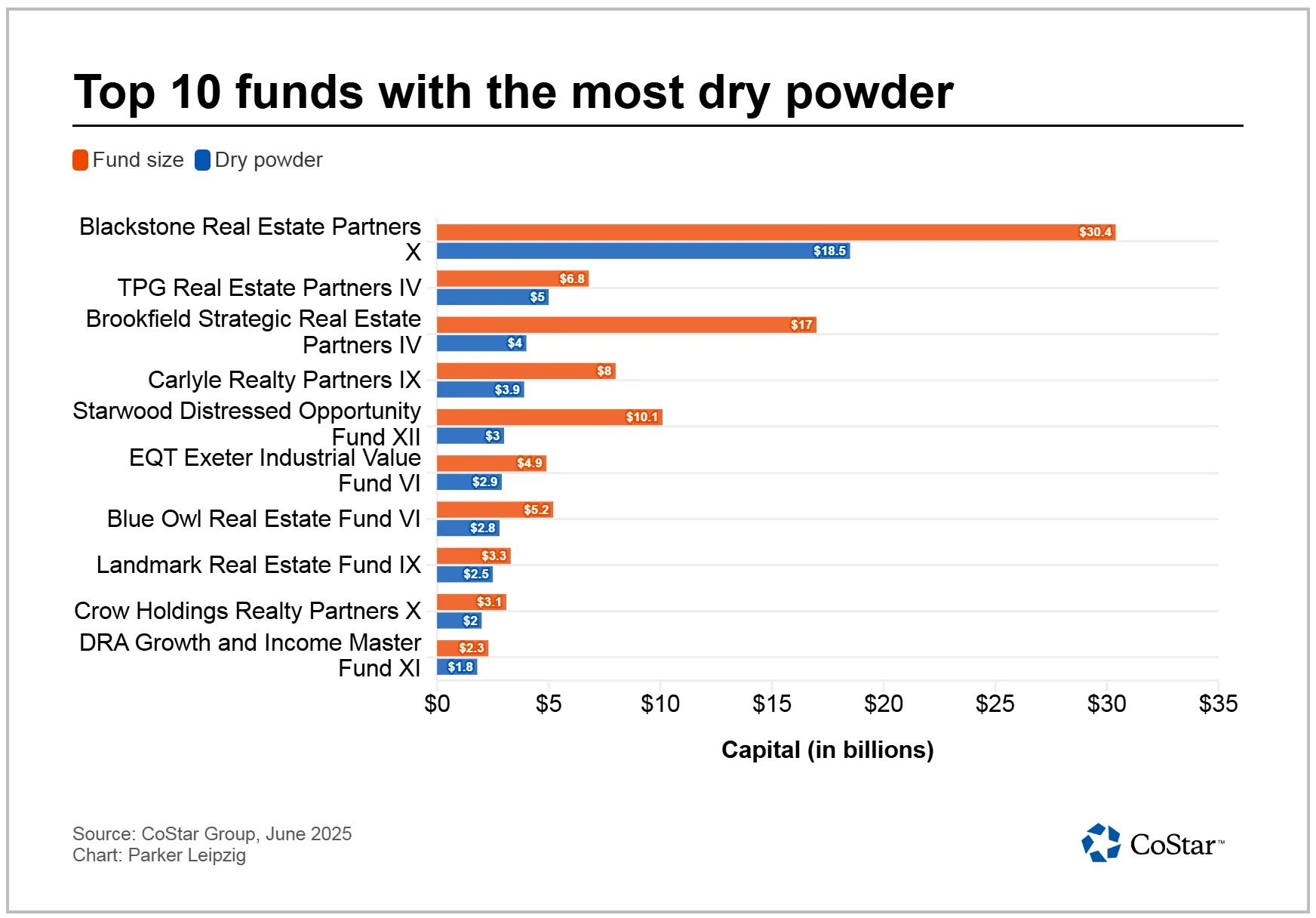

Blackstone holds the most capital among private equity firms. It has $177B globally, including $18.5B in its Real Estate Partners X fund. Recent acquisitions, like Retail Opportunity Investments for $4B, show its confidence in a recovering market.

Pressure to Spend

Much of the available capital was raised between 2020 and 2022. Funds typically have limited time to invest those dollars. Over $63B is still unspent by funds that are now approaching their investment deadlines.

Redemptions are also rising. Investor demand for returns is growing, and new fundraising has fallen behind. These trends are pushing firms to close more deals before the window narrows further.

Strategy Is Shifting

Private equity interest in industrial real estate remains strong, but many firms are now targeting new asset types. Data centers, student housing, and healthcare properties are in focus. These sectors offer steady demand and lower volatility.

“Alternative sectors performed well during the global financial crisis, COVID, and today’s high-rate environment,” said Harrison Street’s Geoff Regnery.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters

Investors see strong long-term drivers in these sectors. These include aging populations, increased college enrollment, and rising data use. According to PwC, US data center acquisitions jumped more than 60% in 2024.

Looking Ahead

If trade and interest rate uncertainty eases, deal volume could rise sharply. Firms sitting on capital want to move before their investment periods expire. With supply limited and fundamentals improving, the second half of 2025 may bring a wave of new investment.