- MM and CRE CLOs have become major private credit financing vehicles, with MM CLO volumes peaking at $50 billion in 2024 and CRE CLOs at $37 billion in 2021.

- Despite structural similarities, MM CLOs offer broader collateral diversity and serve smaller, non-rated companies, while CRE CLOs are backed by transitional commercial properties.

- While MM CLOs show more diversification and higher recovery rates, CRE CLOs have recently experienced higher default rates amid refinancing and interest rate stress.

A Decade of Growth for Private Credit CLOs

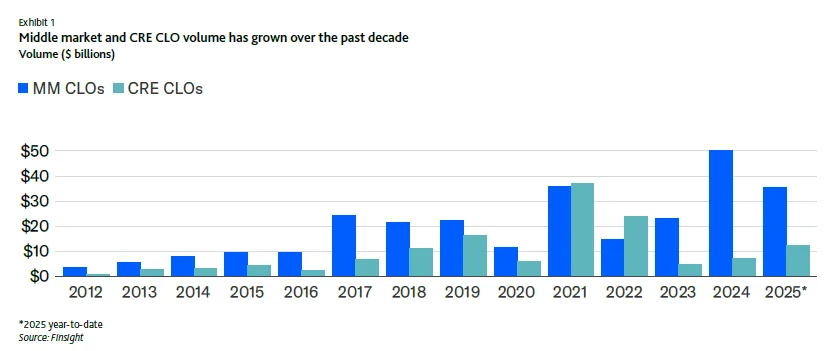

Collateralized loan obligations are no longer the exclusive domain of large syndicated loans or conduit commercial mortgage-backed securities. Over the past decade, CLOs backed by private middle-market corporate loans and transitional real estate have surged. MM CLOs peaked in 2024 at $50 billion in volume, while CRE CLOs hit a high of $37 billion in 2021—both a significant leap from under $10 billion in 2016.

Both CLO types fund direct lending businesses, a model that continues to expand amid investor appetite for yield and lenders’ pursuit of alternative capital sources. Despite macroeconomic turbulence, including COVID-era shocks and inflation-driven default cycles, the CLO structure continues to prove resilient and adaptable for these private credit vehicles.

Not All CLOs Are Built the Same

Though MM and CRE CLOs share similar structural features—such as revolving loan pools, tranching, and payment diversion triggers—the collateral held within each is vastly different.

MM CLOs pool together senior secured loans made to middle-market businesses, usually with up to $200 million in EBITDA. These loans support working capital, M&A activity, or refinancing efforts. The average MM CLO portfolio holds loans to 100–150 obligors spanning a broad range of industries, making them highly diversified.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

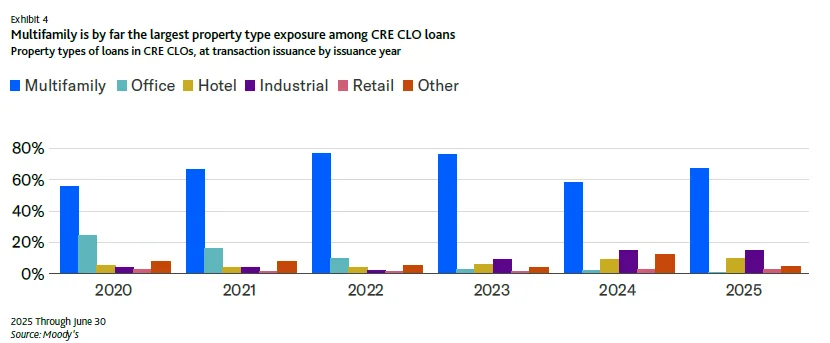

By contrast, CRE CLOs are backed by floating-rate loans secured by transitional commercial properties, like multifamily buildings undergoing lease-up or office properties in redevelopment. These portfolios are smaller and less diversified, with 20–25 borrowers on average, and heavily weighted toward multifamily real estate—often exceeding 50% of collateral.

Credit Quality and Risk Diverge

The Moody’s analysis reveals key differences in credit profiles. MM CLOs tend to carry an average weighted average rating factor (WARF) of 3700–3800, translating to a B3 rating equivalent. CRE CLOs carry higher WARFs of about 4800, or a Caa1 equivalent, reflecting their higher risk profile.

Recovery assumptions also differ. MM CLO recoveries are based on credit estimate models, while CRE CLO recoveries depend on real estate property types—with multifamily loans recovering more than hotel or land loans. Over the past few years, defaulted holdings in CRE CLOs have surpassed those in MM CLOs, reflecting growing stress in the transitional CRE market amid rising interest rates and refinancing hurdles.

Structures Built for Protection

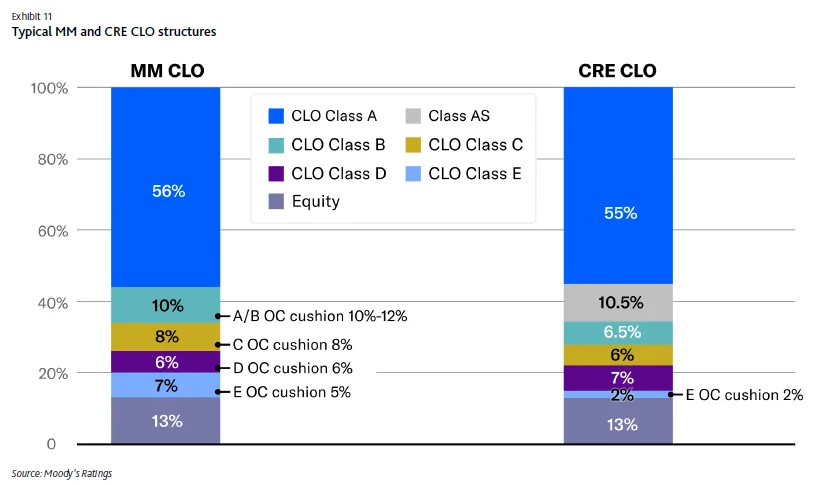

Despite these differences, MM and CRE CLOs feature similar structures. Each includes overcollateralization and interest coverage tests that trigger payment diversions when performance deteriorates. Senior bonds in both structures—typically rated Aaa—enjoy substantial credit enhancement: 42%-45% for MM CLOs and 43%-48% for CRE CLOs, exceeding the protection found in broadly syndicated CLOs or conduit CMBS.

Other shared features include:

- Floating-rate coupons, with quarterly payments for MM CLOs and monthly for CRE CLOs.

- Ramp-up and reinvestment periods, generally 6–9 months and 2–5 years, respectively.

- Excess spread, providing additional buffer to absorb losses.

Looking Ahead: Challenges and Opportunities

While MM CLOs have historically shown greater diversification and stronger performance, both structures face ongoing challenges. MM borrowers—often smaller firms—can be more susceptible to economic downturns. CRE CLO borrowers depend heavily on executing business plans to improve property performance, which can be hampered by market volatility.

Nonetheless, private credit CLOs remain a cornerstone in financing direct lending and transitional real estate strategies. The structural protections built into both MM and CRE CLOs continue to attract investors seeking higher-yielding, asset-backed exposure in a complex credit environment.

As the boundaries between traditional and private lending blur—with banks increasingly funding private credit entities—the importance of understanding the nuances in CLO structures and collateral has never been greater.