- Trump’s federal return-to-office order and pro-CRE stance boosted demand for office space and signaled a market-friendly White House.

- Tariffs and trade policy triggered construction cost increases and delayed developments, despite strong deal flow in industrial and manufacturing sectors.

- A major tax overhaul made opportunity zones and LIHTC permanent, while expanding bonus depreciation to drive CRE investment.

- The White House launched a $500B AI infrastructure plan but undercut clean energy, complicating data center development and utility planning.

A Real Estate Developer Back in Office

President Trump wasted no time asserting his influence on commercial real estate, per Bisnow. Hours after his inauguration, he signed an executive order requiring federal workers to return to the office. This mandate gave an immediate boost to office demand and sent a clear signal: a real estate-focused administration was back in charge.

That message carried through 2025, as the administration’s policies reshaped CRE across multiple sectors.

Musk’s Disruption and the DOGE Fallout

Trump tapped Elon Musk to lead the newly created Department of Government Efficiency (DOGE), which aimed to slash federal spending. Musk began aggressively cutting federal office space, identifying 440 properties for potential sale and eliminating contracts and leases.

Though DOGE was disbanded in November and Musk stepped away in June, the GSA still shed 6M SF of space in 2025. The agency now leases 171M SF, with more cuts expected in 2026.

Despite Musk’s lofty $2T savings target, independent analysis showed cost reductions closer to $1.4B. The department also faced internal pushback and outside scrutiny as it revised or clarified earlier claims about canceled leases and downsizing efforts.

Tariffs Rattle Developers, Lift Costs

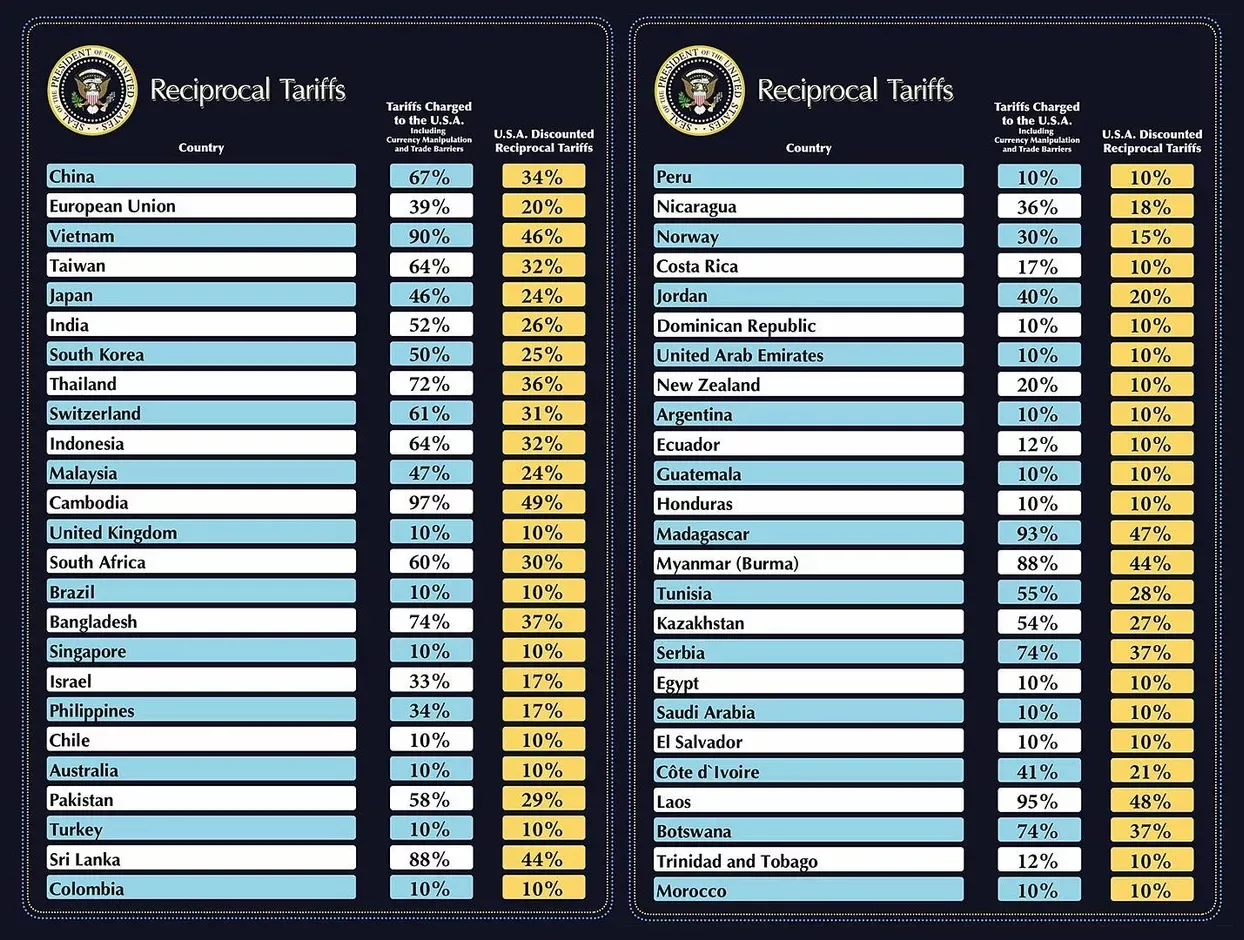

Investors had hoped Trump’s tough talk on tariffs was political posturing. That notion vanished on Feb. 2, when he imposed sweeping trade restrictions. Construction costs rose within days. By September, input prices were up 3.5%, adding to a 43% increase since early 2020.

Developers scrambled to adjust. Many delayed or canceled projects. Legal challenges reached the Supreme Court, but the White House signaled it would find other ways to enforce trade measures even if the court intervenes.

Still, CRE deal activity held up better than expected. Industrial sales slowed briefly after Trump’s “Liberation Day” tariff announcement, but brokers said the market recovered quickly.

A Massive Tax Overhaul with CRE Wins

In July, Trump signed the One Big Beautiful Bill, a sweeping tax package that expanded on the 2017 Tax Cuts and Jobs Act. The bill made opportunity zones and the Low-Income Housing Tax Credit permanent and updated the opportunity zone map to better target underserved areas.

The legislation also expanded bonus depreciation. That move allows companies to write off major capital expenses in a single year, spurring investment in manufacturing and heavy-asset properties. Gas stations and equipment-heavy assets saw surging interest in the second half of the year.

Critics called the bill a gift to corporations and warned it would add $3.4T to the deficit. But the real estate sector welcomed the clarity and incentives.

AI Investment Surges, Power Grid Strains

The White House announced the $500B Stargate venture in January, backed by top tech leaders. The initiative aims to build out US infrastructure for AI, including data centers and power supply.

By July, the administration published its AI Action Plan — nearly 100 proposals designed to fast-track permitting and override state restrictions. Another December order directed agencies to challenge state laws that might block AI development.

But energy issues threaten progress. Trump reversed many clean energy subsidies and encouraged coal-powered data centers. As a result, nearly 2,000 energy projects were canceled this year — 93% of them tied to renewables.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Fed Pressure and a Looming Power Shift

Trump began pressing the Federal Reserve to cut interest rates just weeks into his term. He clashed publicly with Chair Jerome Powell and even fired Fed Governor Lisa Cook in August. Cook refused to leave, and the Supreme Court will hear arguments in January.

The Fed delivered its first rate cut in September. December’s 9-3 vote reflected deep divisions among governors, with Trump appointee Stephen Miran pushing for sharper cuts.

Powell’s term ends in May. Trump has already selected a replacement and promised someone who favors “lower interest rates, by a lot.”

Immigration, Investment Visas, and 401(k) Reforms

Trump’s crackdown on immigration hit construction hard. By August, 35% of contractors said enforcement actions affected their labor supply. Meanwhile, the administration introduced the “gold card,” a new visa that grants permanent residency to wealthy investors who pay a $15K fee and donate $1M to the federal government.

The move may weaken demand for EB-5 visas, long used to fund US development.

In another significant change, Trump allowed 401(k) plans to invest in alternatives like real estate, private equity, and crypto. The change gives asset managers access to a $12T pool of retirement capital — potentially a powerful new funding source for CRE.

GSE Privatization: Still a Maybe

The White House continues to explore privatizing Fannie Mae and Freddie Mac. Though no formal plan has been released, the idea gained traction in 2025. Investors such as Pershing Square’s Bill Ackman pushed for gradual reform.

Bloomberg Intelligence cautions that any unwinding of federal oversight could take years. But the conversation signals growing interest in reshaping housing finance — and could impact liquidity in the mortgage market.

Looking Ahead to 2026

Trump’s second term has already made a mark on commercial real estate. His aggressive return-to-office mandate, reshuffling of federal agencies, and bold economic policies all contributed to a year of volatility and opportunity.

As 2026 approaches, developers and investors are bracing for more uncertainty — and more intervention from the White House. In this new political cycle, commercial real estate remains firmly tied to the pulse of Washington.