- Congress is proposing changes to the Opportunity Zone program to drive investment into more distressed and rural communities.

- The House-passed tax bill includes reforms that would narrow zone eligibility and boost rural tax incentives.

- Critics warn that most OZ investments still favor gentrifying urban neighborhoods, not the areas that need them most.

- Proposed updates include stricter income requirements and eliminating adjacent high-income zones from eligibility.

Missed Targets

According to Bisnow, the Opportunity Zones program, created in 2017, offers tax breaks to investors who place capital in low-income areas. It has raised billions and fueled housing development in many places.

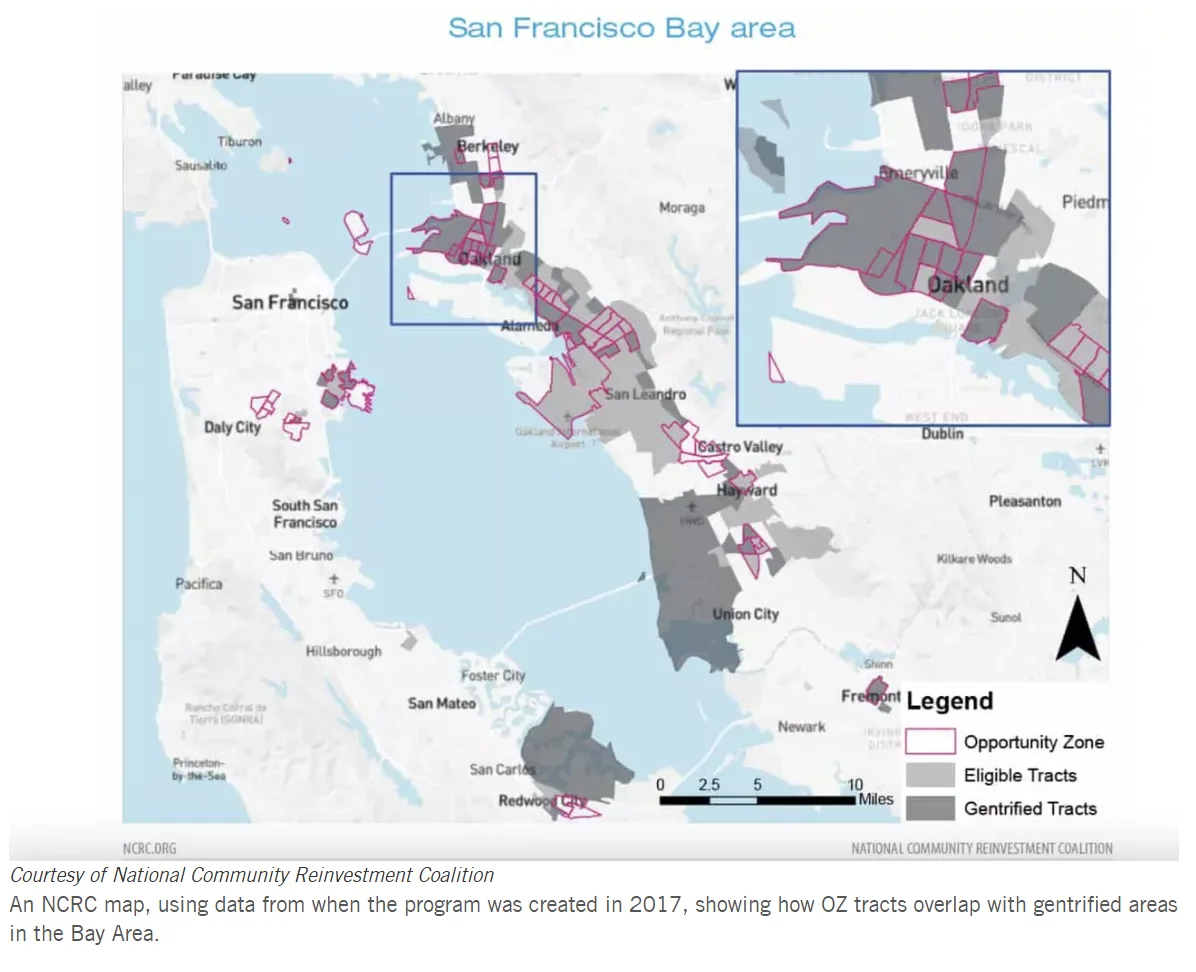

But research shows most investment has gone to urban zones already on the rise. Groups like the Urban Institute and NCRC found the majority of OZ funding flowed into wealthier areas or those already seeing growth.

What’s in the New Bill

The House-passed tax bill would tighten the program’s rules. It lowers the income threshold for eligible zones from 80% to 70% of the area’s median income. It also removes the rule that allowed nearby high-income zones to qualify.

A third of all new OZ designations would have to be in rural areas. These rural zones would also offer investors triple the current tax benefit.

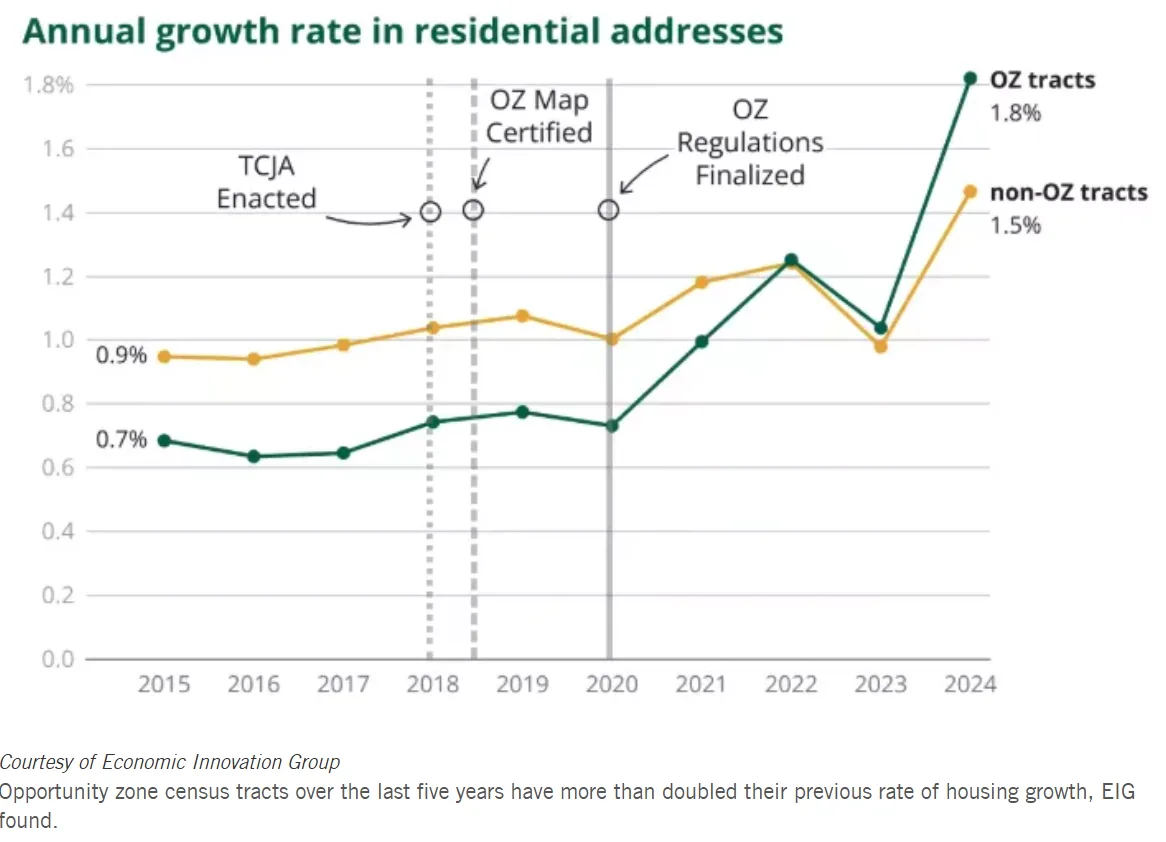

John Lettieri, CEO of the Economic Innovation Group, says these Opportunity Zone reforms could make a big difference. He points to data showing OZs helped add over 313,000 new housing units between 2019 and 2024.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Critics Still Skeptical

Some experts say the reforms don’t go far enough. Brett Theodos of the Urban Institute argues that OZs have failed to deliver clear benefits in deeply disinvested areas.

He says simply adjusting tax breaks won’t be enough to shift investor interest to rural markets. Many investors still chase high returns, which are often easier to find in fast-growing cities.

Jill Homan, who runs Javelin 19 Investments, agrees. She supports the new incentives for rural areas but believes deeper structural changes are needed. She says it’s not just about designating more rural zones, but making it easier to invest there.

Regional View: Appalachia

Donna Gambrell leads Appalachian Community Capital. Her group helped secure over $700M for 86 projects across six states. Even so, she says it’s tough to attract investors to the region.

She’s hopeful that the new Opportunity Zones legislation can help change that. “We need more tools to show why these areas are worth investing in,” she said.

Real Estate vs. Job Growth

While OZs were also meant to support small businesses, most of the money has gone into real estate. Lettieri says that needs to change. He wants reforms that make it easier to fund businesses that create local jobs.

Bruce Mitchell of NCRC sees potential in the changes. He supports lowering the income threshold and applying more scrutiny to zones that overlap with gentrified neighborhoods.

Why It Matters

The OZ program is set to expire next year. Lawmakers now have a rare chance to make it work better for the people and places it was meant to serve.

The Senate will take up the Opportunity Zones tax bill next. Supporters hope to send it to President Trump by July 4.

Whether these changes can truly shift investment toward struggling communities remains to be seen.